REITs had a rough 2022 and many have had an even worse five year stretch. It has been a particularly tough stretch for lodging REITs. It’s hard to imagine a worse operating environment for those who own and operate hotels than the last three years.

The pandemic decimated demand for multiple years and now interest rates have risen at the fastest pace since the 1980s which puts pressure on REITs from multiple angles. Owning real estate involves employing high degrees of leverage so when interest rates rise the cost of doing business goes up because financing is so much more expensive. On top of that, many investors look to REITs to generate yield and when safer fixed income sources become more attractive investors flee REITs, making interest rate increases a double whammy for the stocks. Given this backdrop, who in their right mind would want to own a REIT? Naturally when a segment of the market is this out of favor I can’t help but look deeper.

Here I’ll focus on Park Hotels, the owner of upscale and luxury hotels across the U.S. Park’s stock is about 60% down from its all-time high and currently trades for a dramatic discount to its underlying asset value and replacement cost while offering a potentially highly attractive forward yield; is the price worth the risk?

Background

Park Hotels was spun out of Hilton when Hilton Worldwide separated the franchisor (now just Hilton) from its real estate company (Park Hotels) and its time share company (Hilton Grand Vacations) in 2017. We love Hilton’s business and owned the stock for a period after the pandemic hit in 2020. You can read more about Hilton in our 2020 write-up.

Park owns a little over 50 hotels across the United States and focuses on upper-upscale and luxury properties in prime markets from New York to Florida to California to Hawaii.

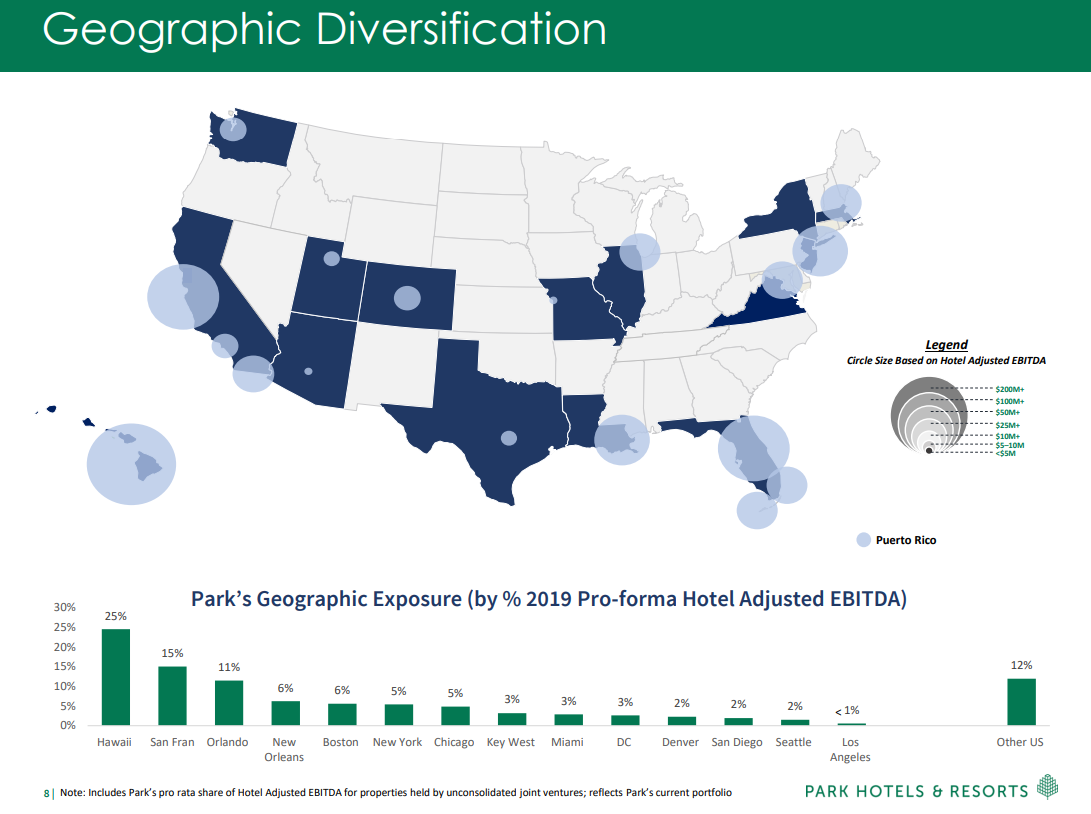

Below is a breakdown of the geographic exposure for its properties. The outsized exposure to San Francisco and Hawaii has been particularly troublesome over the past few years given the pandemic. More on that later.

Since the spinoff the company has added modest exposure outside of Hilton, but Hilton properties still represent about 90% of the revenue base, with Marriot and Hyatt representing the remaining 10%.

Park earns revenue from renting rooms (63%), selling food & beverages (27%), and other ancillary hotel services (10%). The customer revenue mix has historically been split relatively evenly between leisure travelers (35%), group, like conferences or events (31%), and business transient (29%). The recovery since the onset of Covid has varied widely between these segments, as you might imagine.

In recent years the management team has been focused on simplifying the portfolio into core properties, recycling capital from asset disposals to renovate existing properties and generate a lift in room rates and profitability, and opportunistically allocating capital between acquisitions and shareholder capital returns.

Competitive Dynamics

Historically I have not been all that excited about REITs for a couple of reasons; capital allocation and lack of competitive differentiation. Much like pipelines, REITs have historically paid out the majority of net income as dividends (as is required by the REIT structure) but then turned around and issued shares (sometimes at prices that don’t make sense for continuing shareholders) to fund growth. A REIT may yield 6%, which looks great to income investors on the surface, but if they issue 3% more shares every year to fund growth, existing shareholders suffer from dilution and a dropping stock price. In this example effectively the REIT would only yield a much more pedestrian 3% thanks to this continuous dilution.

Additionally, I struggle to find a differentiator in most REITs as many are competing in hot markets or sectors with abundantly growing supply. This was especially true when interest rates were near zero and anyone could fund a multi-million dollar real estate deal.

Park appears to have a more compelling long-term competitive position than your average REIT.

Irreplaceable Assets, Limited Supply Growth

Park is focused on solely owning high-end properties in premier markets across the U.S. In these markets, and for these types of properties, there is very limited supply of new hotels coming online for the foreseeable future.

Park estimates annual supply growth at just 1.5% across its markets. This is down from an already low 2% pre-pandemic. The pandemic wiped out a portion of the supply of hotels and delayed the construction of others. Even before considering the impacts of Covid, it’s simply difficult to secure real estate and extremely expensive to build out large luxury hotels in major metro cities in the U.S.

Additionally, rising construction and labor costs are further slowing supply growth and making replacement costs rise appreciably.

Each of these dynamics point to meaningful barriers to entry in Park’s markets. It appears Park owns a collection of irreplaceable assets (or at least very hard and expensive to recreate) with increasing demand in the face of limited supply. This enduring competitive advantage should ultimately result in pricing power for hotels across its portfolio.

Additionally, Park’s focus on the luxury segment is intriguing. While hotels are inherently cyclical and subject to competition, the higher end segment is less susceptible to constant competition than your average hotel. Guests who are looking to stay at upscale hotels associated with dominant brands in premier cities are likely to be much less price sensitive than a median-income family going on a weekend road trip that makes their lodging decision largely based on whatever hotel is offering the best deal that day.

If you believe in the long-term growth of travel in the United States, particularly in major cities, it’s hard to see supply growth keeping up with demand growth in the coming years.

Current Headwinds and Risks

Now that I’ve got the compelling aspects of Park Hotels’ business out of the way, let’s look at the risks. After all, the stock isn’t 60% off its previous high for no reason.

There are three factors currently working against Park Hotels, most of which appear nearing resolution. Investors are concerned about:

Continued overhang from Covid travel demand reduction, particularly in San Francisco and Hawaii.

Uncertainty about the resolution of 2023 debt maturities. Until a few weeks ago, Park had two looming maturities this year; a $900M revolver which recently got pushed out until 2027 and a $725M commercial mortgage backed security (CMBS) against a San Francisco property that matures at the end of 2023. It’s the CMBS that appears to be troubling analysts most and for good reason given its size and the state of the credit markets.

Ongoing recessionary concerns given the historically cyclical nature of the travel industry. Of course, this is not unique to Park Hotels but nonetheless it’s likely weighing on the stock.

Let’s quickly look at each of these issues.

Covid Overhang

Obviously travel was obliterated for a few years after the pandemic hit and it has come back in fits and starts over the last 18 months. Park generated almost no revenue in 2020 and in 2021 things came back about halfway. Park’s exposure to Hawaii and San Francisco were particularly challenging for different reasons. Additionally, decreased business travel has weighed on results since 2020 and has only recently started to normalize.

San Francisco had particularly onerous lockdown measures and was much slower to reopen the city than almost anywhere else in the U.S. As such, usage of Park’s San Francisco properties greatly lagged those of its hotels in Florida and other cities that were quicker to return to normal activity levels. Around 15% of Parks business is in San Francisco, so the slow reopening and sluggish subsequent recovery have had a disproportionate impact on the company’s financials.

Hawaii – Parks largest market at nearly 25% of revenue – was slow to recover due to Japans persistent nation-wide travel restrictions. Historically, Japanese tourists have accounted for 20% of the total demand for Park’s two Hawaii properties. Additionally, ADRs associated with Japanese travelers to Hawaii have typically come at a 20% premium to domestic travelers. The pent up demand from domestic travelers has recently mitigated the lack of travel from Japan, and the return of Japanese travelers in 2023 represents material upside going forward.

Finally, business transient travel has been slow to recover given the increase in remote work since 2020. At long last things appear to be getting back to normal in this segment. Pre-pandemic work patterns began normalizing this fall, and in September business transient and group demand was nearing 80% of 2019’s levels.

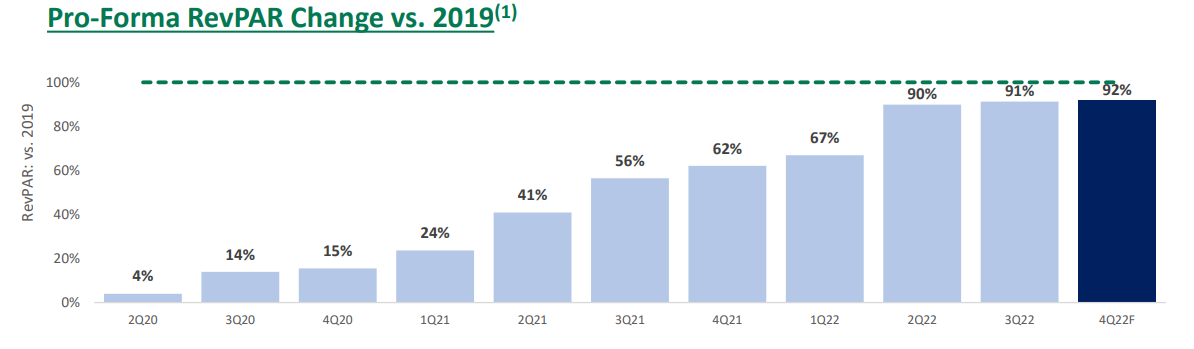

These headwinds have worked together to produce a slower than desired recovery in Parks business. Nonetheless, in the back half of 2022 the business has almost returned to 2019’s levels. RevPAR in the fourth quarter was likely about 92% of 2019’s after adjusting for acquisitions and dispositions in the portfolio.

In many markets, occupancy, average daily rates (ADRs), and RevPAR are already above 2019’s levels. It seems inevitable that, like most of the rest of the world, Parks business is destined to return to pre-pandemic performance and beyond before too long.

Debt Maturities

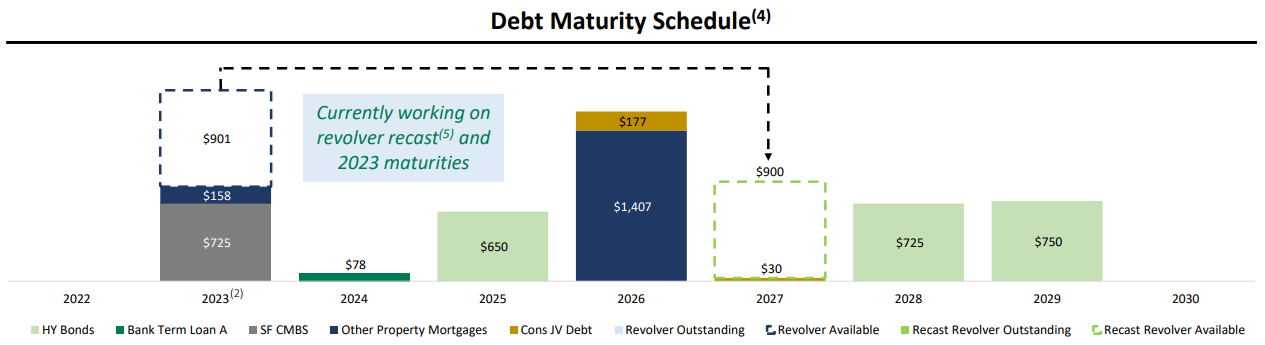

The market hates uncertainty. This is doubly true for uncertainty around debt maturities or anything else that can impact short term liquidity. As of Q3, Park had about $1.8B of debt maturing in 2023, which represented the majority of the liquidity the business had on hand.

Of the $1.8B, $900M was the revolver which on December 2nd was recast and pushed out to 2027. This wasn’t surprising as the revolver had been held with Wells Fargo since 2016 and banks are happy to continue rolling over revolvers as long as the underlying business is healthy, which Park now is.

A relatively modest amount of other mortgages are maturing this year across the portfolio, and Park intends to pay the $160M amount with cash on hand. This just leaves the $725M San Francisco CMBS to deal with.

Management outlined the plan for each maturity during the November earnings call:

“We are currently working with our banking partners to extend our revolver, which we expect to finalize within the next couple of weeks, while evaluating several opportunities to address our $725 million CMBS loan, which matures late next year.

With respect to additional near-term maturities, we have 2 small mortgage loans coming due next year, totaling just over $100 million, and we expect to pay off those balances with available cash on hand as we continue to move towards a more unsecured capital structure.”

Later in the call the CFO discussed options specifically for the CMBS:

“So I would say that as we look at the markets, whether it's bank, financing, or call it, CMBS, anything that's kind of in that kind of high single-digit debt yields, you're probably looking at, call it, 350 to 400 (bps) over SOFR…we're looking at more sale, probably a mortgage type of situation with an unencumbered assets like the Bonnet Creek Complex as a solution. Clearly, we'll continue to monitor the bond market as well. Obviously, not pricing what we would be looking to do now. But if things kind of calm down and normalize a little bit, maybe you can see that as an opportunity, but I think more focused on kind of a mortgage route going forward with the pricing I just discussed.”

It sounds like the most likely outcome is that the company takes out a new mortgage on an unencumbered property and uses the proceeds to pay off the SF CMBS. Makes total sense. It’ll add some incremental interest burden as the existing CMBS is around 4% and the debt markets are now pricing at around 8%. This means refinancing the $725M at an incremental 4% might add $30M of interest expense for the business going forward.

Analysts on the call kept pressing management on the CMBS and they clearly became agitated. When asked again about if they would have to sell properties at distressed prices to repay the CMBS, CEO Tom Baltimore reminded the analyst that managing the capital structure and the asset portfolio is what they are paid to do, and they’ve proven to be fairly skilled at it in the past. He not so subtly reminded the analyst that there were a lot of other questions in queue so stop asking about the CMBS.

“it's a fair question, but let me also just say, we've got a number of people in the queue here, and we want to try to give answers to as many questions as we can. And I know we're stacked up with a lot of other companies reporting today. Respectfully, no team has sold and moved more assets than we have since the spin. We're up to 38 assets now and $2 billion international, 14 of those as you know, South Africa, Brazil, Germany, 7 in the U.K., a joint venture in Dublin. I mean we've seen it all and done it all… And I think we've shown a real skill in being able to sell and also do it efficiently and at pricing that makes sense. We're not a distressed seller. We're doing this thoughtfully and prudently, and we set a goal of $200 million to $300 million. We've already exceeded that. We've raised it now to $500 million, and we're confident we'll be able to deliver that and continue to use those proceeds to certainly delever and reinvest back into the portfolio.”

Impending debt maturities are a real issue that investors need to understand. To me, the $725M doesn’t seem like a deal breaker especially given they just renewed the revolver. Frankly the team could just repay the CMBS with the revolver and still retain ample liquidity to reinvest in the business.

Recessionary Concerns

I really don’t have unique insights as the whether the U.S. will experience a deep, shallow, or no recession in 2023, or any other year for that matter. It doesn’t mean much to me either way. Recessions will come and go and our focus is owning businesses that will be stronger and deliver superior returns through any economic cycle.

Also, no two recessions are the same. Historically travel has suffered during economic contractions, but who is to say that will hold true if we have a recession this year? Based on everything I’m reading from travel companies, demand is exceptionally strong and consumers have only begun to scratch the travel itch that developed during the pandemic. People, especially high-income consumers that use Park’s properties, may continue traveling right on through an economic contraction, should one arise.

We prefer non-cyclical businesses to cyclical businesses. The majority of what we own should not be influenced by broader macroeconomic and extrinsic factors. That said we’ll always have some cyclical companies in the portfolio, though I wouldn’t make a bold bet with my entire portfolio on the outcome of travel during a recession.

Long term investors should be aware that buying a company like Park means grappling with some inherent cyclicality, and it’s important to take that into account with the price paid. Said differently, it isn’t a good approach to pay a peak multiple on peak earnings for a cyclical business. Speaking of the price of the stock…

Valuation & Forward Returns

Because Park is only now ramping up towards pre-pandemic operating levels, valuing the company requires a healthy dose of normalization.

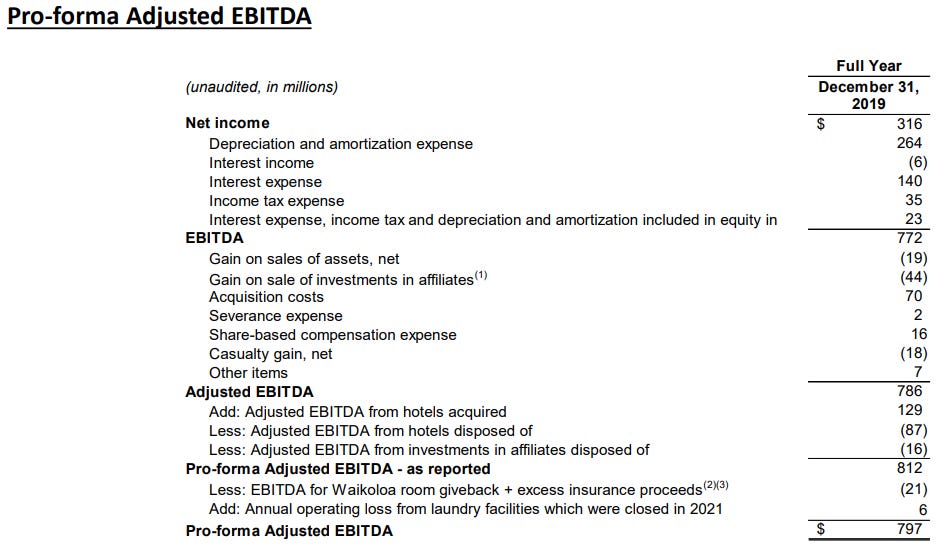

In 2019 the business generated about $910M in EBITDA, but this needs to be adjusted down because the company has been disposing of non-core properties over the past several years. (Disclaimer: I hate that management talks in EBITDA terms, but it’s industry standard for REITs so I’ll begrudgingly go with it for now). Fortunately the company gives us a good starting point and bridges 2019 to 2022 EBITDA and accounts for changes to the asset portfolio.

When the gap finally closes - which I expect to happen in 2023 given they’re ~90% of the way there as of Q3 – Park should generate around $800M in EBITDA. The business is currently renovating a handful of properties which should produce an incremental $25M of EBITDA, which offsets most of the impact of higher rates. I don’t care about EBITDA, though, what matters is distributable cash flow.

Park needs to spend about 6% of revenue on capex annually which is around $200M. After backing out interest and capex, it’s reasonable to expect around $350M of pretax distributable cash flow (REITs only pay nominal taxes given the structure) before considering any growth above 2019’s levels, which seems likely.

Historically, RevPAR has grown at a mid-single-digit clip. In the years leading up to the spin RevPAR was growing 5% on average (see below). After the spin and before the pandemic RevPAR was growing 2-3%.

With 2019’s operating metrics within reach and the travel market seemingly holding strong, I wouldn’t be surprised if the business grows at an above-trend rate for several years. Additionally, management took $85M of expenses out of the business permanently during the Covid restructuring period. Operating leverage on a high fixed cost business like owning hotels means earnings are likely to grow faster than revenue.

If Park delivers 2019-level performance this year and generates $300M - $350M of distributable cash flow, the stock will yield 10 – 12% from present prices. It doesn’t seem likely to trade there for long, and if it does, investors can collect a fat and growing yield.

It would not surprise me if Park was producing $400M - $500M in distributable cash flow within five years, which would represent just ~5% annual growth in earnings over 2019’s levels. In this scenario and with the current $3B market cap, Park would be producing around 15% of the current market cap in distributable cash flow each year.

If earnings materialize even close to these levels, I don’t see how Park’s stock doesn’t re-rate substantially in the coming years. Unless the business experiences some major distress that I’m not accounting for, investors are unlikely to allow the stock to trade at a 10%+ dividend yield for long.

Investors generally demand a couple percent premium in yield from REITs compared to U.S. treasuries. Right now the 10-yr trades around 3.5%. If rates stay around these levels that means investors seem likely to demand a 5-6% yield, over the long run, for a REIT like Park Hotels. To illustrate the potential returns, if Park can generate $450M in distributable cash over the next few years and trades at a 6% yield, the market cap would be around $7.5B, or 2.5x recent prices. This is on top of investors collecting a 10-15% current yield. You don’t need a degree in higher mathematics to grasp the upside in a situation like that, which is why an investment in Park is more about becoming comfortable with the downside and risks that I listed above.

On the asset side, the market is placing a steep discount on both NAV and replacement cost. During a Q3 presentation management estimated that the stock was trading at a 54% discount to consensus NAV and a 69% discount to replacement cost. Even if they’re off by 50% it’s still quite cheap.

This dynamic only serves to reinforce the constrained supply growth in Park’s markets. No publicly traded REIT is going to build a new hotel only to have the public markets mark it down by 50-70% when it enters the portfolio. The forces of capitalism are likely to work in Park’s favor for some time and keep new supply at bay, fostering pricing power and risings ADR’s.

Whether you look at it from an asset or an earnings point of view, the market is not giving Park much credit.

Management agrees the stock is cheap, and it’s almost obnoxious how frequently they point this out. To give them credit, they have put their money where their mouth is and repurchased almost $300M of stock over the past few years, a very rare move for a REIT.

Summary

Park Hotels is not some epic capital-light compounder. Historical returns on capital aren’t nearly as high as I’d prefer, they are not going to light the world on fire with growth, it’s bound to be somewhat cyclical, and there is a little hair on it as is almost always true with something trading for a high normalized earnings yield. That said, it’s still has some intrigue as an investment.

The business appears to possess a reasonably strong and enduring competitive position given the supply/demand imbalance in the markets where it competes. It also serves a desirable higher-end consumer segment. The business is tantalizingly cheap and not much needs to go right for the stock to do quite well.

An investment in Park is pretty simple; if you believe the business will soon return to, or above, 2019’s performance, and believe management will take care of the San Francisco CMBS maturity in short order, the stock is likely to deliver outsized returns.

If you would like to invest with Eagle Point Capital or connect with us, please email info@eaglepointcap.com. You can also find more information on our website. We recommend starting with our Fundamentals. Thank you for reading!

Disclosure: The author, Eagle Point Capital, or their affiliates may own the securities discussed. This blog is for informational purposes only. Nothing should be construed as investment advice. Please read our Terms and Conditions for further details.

Thanks for sharing! I'm curious if Park Hotels could ultimately be a target of a take private transaction given the factors you mentioned. In particular, the points around the assets trading at less than replacement costs, an out of favor asset class, and the fact that many of these assets are irreplaceable in terms of their location, etc. all sounds a lot like what Brookfield Asset Management looks for in terms of real estate investments.