Many shall be restored that now are fallen and many shall fall that now are in honor.

– Horace, Ars Poetica (epigraph to Ben Graham’s Security Analysis)

Dollar General, one of the market’s COVID darlings, has fallen from grace. The stock is down over 50% from its all time high, its largest drawdown ever, and currently trades at its March 2020 COVID lows.

I wrote about Dollar General in April 2021 and called it a “beast.” They’d grown same-store sales for 31 consecutive years while increasing store sales at a 9.0% CAGR. Since then it’s been tougher going.

DG’s performance in COVID was so extraordinary that it proved too tough to lap. Same-store sales declined 2.8% in 2021 after surging 16.3% in 2020. Comparable sales returned to growth in 2022, increasing 4.3%, but have flatlined since then. Year-to-date they’re down 0.1%.

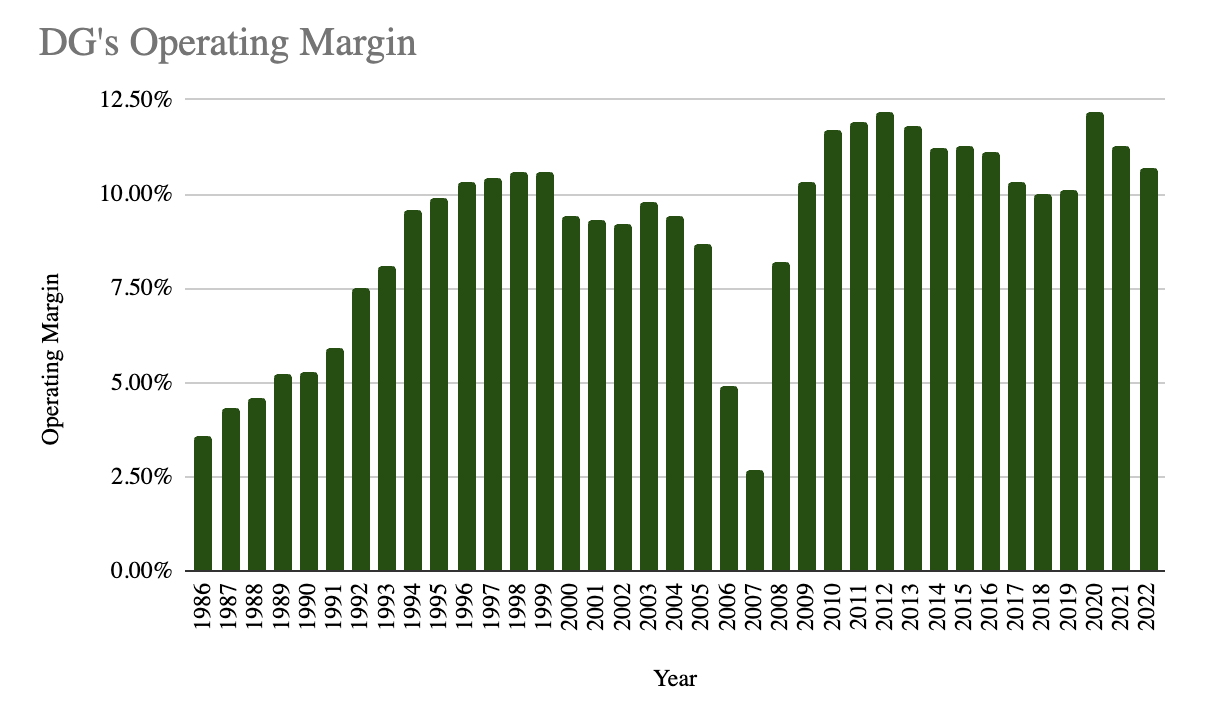

More worrying are DG’s margins, which have deteriorated faster than its sales. Slow sales and continued inflationary pressured have caused DG’s cost structure to deleverage.

Historically, DG has operated with about 9% operating margins. Operating leverage drove margins north of 10% during COVID, but leverage bites both ways. A shift in mix, higher shrinkage, growing occupancy and labor costs, higher interest expenses, markdowns, and an ailing end customer have driven significant deleveraging that’s pushed operating margins to 7%.

In my 2021 article I wrote, “The million-dollar question is, will the future look like the past?” Today that question is more important than ever. If DG’s margins revert to their pre-pandemic average then the stock looks strikingly cheap – 11x normalized earnings, which I’ll explain later. The market seems to have little faith though. DG’s stock is priced like its margins will be permanently lower.

Sales Trends

There are very few businesses which benefited from COVID that have not faced a day of reckoning. Only AutoZone, O’Reilly, and Tractor Supply come to mind for retailers. Dollar General was a COVID winner but was never not going to sustain its pandemic-era sales pace.

The chart above shows the DG’s same-store sales trends back to 1990. There’s only two years, 2021 and 2023, of negative same-store sales. That’s an extraordinary record.

One reason I suspect DG’s stock is down so much is that the market had DG pegged as a counter-cyclical. Historically, that’s been the case. Sales spiked in the early ‘90s, 2001, 2008, and 2020. The investors who bought DG thinking the stock would offer a safe place to wait out macroeconomic uncertainty are capitulating now.

Still, it’s fair to wonder why DG isn’t thriving right now.

I suspect one reason for DG’s current sales malaise is a continued “after shock” of 2020’s unprecedented boom. DG’s sales spike in 2020 was significantly larger than any before, both in absolute terms and relative to the prior years’ trend. 2020’s same-store sales grew 16.3% after averaging 3.3% the three years prior. In 2008 sales grew 9.0% after averaging 2.5% in the years prior.

In the pandemic city people (like me) fled to the countryside and shopped at DG. Now those people are back in the office or out traveling. Habits and schedules are slowly but surely reverting to their pre-pandemic state which is a headwind for Dollar General.

Digging deeper, it’s clear that DG’s core customers are struggling. Dollar General’s core customers are rural blue collar workers making $40,000 per household. They’re the most vulnerable to inflation.

DG’s sales mix shows this. Sales of consumables, which make up 80% of DG’s sales, rose 6% year-over-year in the most recent quarter. Sales of non-consumables fell 4%. On balance sales rose 4%, mostly due to new stores. Traffic declined but was offset by a larger average transaction size, the result of higher prices.

While DG’s sales trends look worse compared against Dollar Tree, which operates the Dollar Tree and Family Dollar banners. Dollar Tree’s comparable sales rose 7.8% and Family Dollar’s rose 5.8%. Dollar Tree’s results were driven by higher traffic more than higher prices.

What’s going on? Is Dollar Tree outcompeting Dollar General?

To understand the difference between them, it’s first important to understand that Dollar General and Dollar Tree are not perfectly comparable. Dollar General skews rural while Dollar Tree and Family Dollar skew urban. They’re catering to different customers and inflation is hitting them differently.

Dollar General and Dollar Tree also differ by mix. Dollar General’s mix is 80/20 consumable/non-consumable while Dollar Tree’s is 50/50. Like Dollar General, Dollar Tree saw its mix shift towards non-discretionary consumables. Consumable sales rose 11.7% versus 2.7% for non consumables.

More importantly, Dollar Tree is in the midst of a multi-year turnaround. Paul Hilal’s Mantle Ridge took an activist stake and has been agitating for change. Hilal used to work for Bill Ackman’s Pershing Square and worked on the firm’s first investment in Canadian Pacific.

Hilal thinks that Dollar Tree was woefully mismanaged and has lots of low-hanging fruit for improvement. In response, last year Dollar Tree “broke the buck” and began selling items for $1.25. Starboard Value had been pushing Dollar Tree to do this for years to no avail.

Dollar Tree had never sold an item for more than $1 before 2022. Inflation began to severely limit the SKUs it could offer. When a SKU could not be made small enough to be sold for a dollar, Dollar Tree would drop the product, even if it was a top seller. Now Dollar Tree is adding back products like ice, which always sold well. Higher price points allow Dollar Tree to sell larger 7 lb bags of ice, something people actually want, for $2, along with family-size portions of food.

I suspect that the rollout of Dollar Tree’s higher price points is driving its outperformance over Dollar General more than anything. The key question long-term investors need to ask is whether Dollar Tree is suddenly more competitive than Dollar General. While Dollar Tree is clearly closing the gap, Dollar General has a multi-decade lead in merchandising, procurement, and distribution.

Retail is tricky because consumers have no switching costs. They’ll go wherever they find value and convenience. Dollar General has to re-earn its customer’s loyalty every single day.

While Dollar General sells commoditized goods – goods you can find a million other places – its competitive advantage is the convenience that it offers. 75% of Americans live less than 5 miles away from one of Dollar General’s 20,000 stores. 80% of stores are in towns of 20,000 or fewer. Dollar General targets areas where there are no low-cost alternatives, like Walmart, within 15-20 miles. What Dollar General is really selling is time – the convenience of avoiding that 30-40 mile round trip drive.

In All I Want To Know Is Where I'm Going To Die So I'll Never Go There author Peter Bevelin quotes Buffett saying:

One of the best moats in many respects is to be a low cost producer. Being a low cost producer of something that is essential to people is going to be a very good business. It is like comparing a copper producer whose costs are $2.50/lb with a copper producer whose cost are $1.00/lb. Those are two different kinds of business. One is going to go broke a $1.50/lb and the other is going to be doing fine.

Buffett is saying that a company’s moat can be its cost structure. Buffett said this in 2009 but Andrew Carnegie knew it in 1865. Carnegie’s philosophy was "watch the costs, and the profits will take care of themselves" and he famously knew his costs “to the penny.”

To gauge DG’s competitiveness, I look at its overhead (SG&A) relative to its sales and selling square footage.

Despite a tough couple of quarters, Dollar General is still more productive (sales/SQFT) and more efficient (SG&A/SQFT) than its competitors. DG bests Dollar Tree on a sales per square foot and bests everyone on an SG&A per square foot basis. This efficiency helps to drive Dollar General’s industry-leading operating margins.

I worry more about DG’s competition with Walmart than with Dollar Tree. DG’s customers have to choose between a 20-30 minute drive to a Walmart, where they can get everything, or a 5 minute drive to Dollar General where they can get the essentials.

Dollar General needs to keep its prices low enough so that this convenience is affordable enough to drive traffic. If groceries at Walmart or Aldi become cheap enough, strained consumers will drive out of their way to save. The Motley Fool recently found that a $40 basket of goods is about 10% more expensive at DG than Walmart.

Margin Trends

Dollar General, in the most recent quarter, reported -0.1% same store sales but -25% earnings per share. This was more operating leverage than anyone expected and is the main reason the stock fell so much.

Historically DG has operated with 31% gross margins and 9% operating margins. I’ve laid out the last ten years below along with the last twelve months and the most recent quarter.

There’s no single issue responsible for DG’s margin compression. It’s been a death by a thousand cuts.

First, the whole industry’s mix has shifted toward non-discretionary consumables and away from non-consumables. Non-consumables carry higher gross margins, so the net effect is negative.

The bigger issue is that Dollar General will now have to discount its growing inventory of non-consumables in order to keep its stores fresh and get its working capital back. DG expects this to be a $95 million headwind the rest of this year. On the bright side it should produce a large working capital inflow. The sale should also drive traffic and consumable sales.

Next on the list are occupancy and labor. Inflation isn’t just squeezing DG’s core customer’s, it’s squeezing DG itself. Dollar General leases virtually all of its real estate which means costs go up when inflation runs hot. Similarly, Dollar General’s labor costs have risen. DG thinks it's done with major wage increases but it still needs to add labor hours to stores.

One reason places like Dollar General struggle with high turnover is because lately they’re been understaffed. The laborers that are there can’t keep up with the amount of work they’re expected to do and find it too stressful relative to the pay. Adding labor hours will alleviate the strain on existing employees and to keep stores cleaner, better organized, and better stocked. More labor will lead to a better customer experience, which is key to earning repeat business.

DG’s interest expense has risen substantially. It’s up 50% year to date and up 100% since the early 2022. It’s partially because of rates and partially because of increased debt.

Dollar General’s leverage remains safe for now, but the company has suspended buybacks to focus on more important capital allocation priorities. Despite the headwinds, DG continues to invest in its store initiatives. This is its best use of capital because it protects and expands its moat.

Finally, Dollar General and the entire retail industry have been reeling from excessive shrinkage. Almost every retailer called it out this quarter and it seems few know what to do about it. Locking merchandise behind doors is a surefire way to reduce sales. DG thinks shrinkage is the result of a difficult macro environment and its own elevated inventory levels. If that’s the case then clearing out its inventory this fall and winter should help. DG expects an additional $100M headwind from shrinkage through the end of the year, which is substantial.

Looking Ahead

Dollar General is struggling, but it's nothing that cannot be fixed. DG’s problems are largely ones affecting the entire industry.

DG guided for more pain ahead, but it felt like a “kitchen sink” quarter. DG’s CEO, Jeff Owen, took over last November and has been on the job for less than a year. This feels like his reset quarter where he gets everything out and level sets expectations low enough to clear.

Looking ahead, I see no reason to believe that Dollar General’s business model is broken. Sure, they need to fix a few things, but that’s how retail goes. Much of the volatility we’re seeing in the business today feels like lingering aftershocks from COVID. The pandemix upended DG’s economics and consumers so severely that there was bound to be pain as things normalized. So long as DG continues to offer consumers value and convenience, I’m convinced they’ll have a bright future. The most important thing is that DG maintains its low-cost advantage.

Forward Returns

You pay a very high price in the stock market for a cheery consensus.

– Warren Buffett

One way to value Dollar General is to assume that over, say, five years they’ll be able to right the ship and get margins back into their historical range. If that’s the case, Dollar General looks cheap on a normalized basis. Below I’ve shown my assumptions, which include a 9.2% operating margin (DG’s 10-year average), current interest expense, and how that affects their pre-tax (EBT) margin.

Normalized this way, DG trades for 8x pre-tax earnings and 11x net income. A quick glance at DG’s Value Line charts suggest it has never been this cheap, going all the way back to its IPO in 2008.

If you wanted to be more conservative you could assume operating margins normalize lower. At 8.4%, DG’s 3-year pre-COVID average, the stock trades about a turn higher. Still not bad. The point is to be roughly right – if DG’s normalized margins are higher, it’s worth substantially more.

DG usually trades for a mid-teens multiple. Value Line reports their 10-year median PE at 16.6. This is probably appropriate given the runway for profitable growth and no nonsense capital allocation.

Last week Dan laid out our framework for analyzing how a business generates and uses cash. Below is mine for DG for the last decade. Note that the point of our framework is to force us to think about where the money comes from and where it goes. It’s not a one-size-fits-all formula.

DG is able to grow while returning 100% of net income as dividends and stock buybacks while maintaining a reasonable amount of debt. The only way businesses can do this is by earning high returns on their equity, which DG does (~40%).

Forward returns are largely a function of its same store sales growth, store count growth (NUG), yield, and change in multiple. There’s also a case to be made for margin expansion, which I’ve baked into the analysis below by using an 11x PE (based on normalized margins) as the starting multiple.

In the five years pre-pandemic DG averaged 2.7% same-store sales growth, which I’ve assumed they return to. New units should grow at a 4-5.0% rate, give or take a little in any given year. DG thinks it has room to build almost 10,000 new DG stores in the US in addition to their Popshelf concept. DG is also beginning to build Dollar General stores in Mexico which could dramatically expand the company’s addressable market and growth runway.

Historically DG has returned virtually 100% of its net income to shareholders. I expect this to continue, but it may take a year or two to ramp back up. Finally, assuming that DG does sort its margins out the stock should re-rate to closer to its long-term average PE multiple of 16.6. If it re-rates over five years that would add 8.6% to annual returns.

All in all this analysis suggests that the stock is priced to produce low 20% returns over the next five years. There’s a lot of assumptions in there but even getting half of that prospective return would be attractive. Even if the businesses doesn’t re-rate, investors should earn the sum of earnings yield and growth, which should total about 13%. I can’t imagine DG’s margins normalizing and the stock doesn’t re-rate, however, so a 9% operating margin is the key assumption everything hinges on.

Dollar General today looks like a classic time arbitrage opportunity. Two years ago it was a COVID darling considered impervious to the business cycle. Now it’s being left for dead. The next year or two may not be pretty, but that’s why the stock is available at a bargain price today.

Do you have a “stranded” 401k from a past job that is neglected and unmanaged? These accounts are often an excellent fit for Eagle Point Capital’s long-term investment approach. Eagle Point manages separately manage accounts for retail investors. If you would like to invest with Eagle Point Capital or connect with us, please email info@eaglepointcap.com.

Disclosure: The author, Eagle Point Capital, or their affiliates may own the securities discussed. This blog is for informational purposes only. Nothing should be construed as investment advice. Please read our Terms and Conditions for further details.

I go into DG frequently and avoid Crazy-Mart like the plague. I’m not seeing how the DG customer will be going to WMT more frequently now than she was in the past. The argument that a DG shopper transforms into a WMT shopper when money becomes extremely tight doesn’t hold water for me---money is always extremely tight for the DG shopper.

I think there’s a habitual component to DG shopping or maybe people are too lazy to drive all the way to Crazy-Mart. Plus, People in the DG stores seem to know each other-- the clerk is carrying on various conversations and calling customers by name. And, the basket size is so much smaller at DG that WMT doesn’t seem to be a substitute. Finally, when money gets tighter, some CVS, WAG, KR shoppers may head over to DG.

Basically, DG just seems to be going through a COVID hangover...