Topicus: Constellation Software 2.0

Confederate Colonel John Pemberton founded Coca-Cola in 1886. In 1919, he took it public. For the next fifty years, the stock compounded at 26%. Coca-Cola had become a cultural icon and analysts began to doubt whether it could continue growing.

In 1938 Fortune Magazine wrote:

Several times every year a weighty and serious investor looks long and with profound respect at Coca-Cola's record, but comes regretfully to the conclusion that he is looking too late. The specters of saturation and competition rise before him.

With hindsight, it’s laughable to think 1938 was “too late.” A fresh dollar invested in 1938 would have grown to $625 by 1993, according to Warren Buffett.

Today, the questions surrounding Constellation Software resemble those asked about Coca-Cola in 1938. Though Coca-Cola was obviously a buy in 1938, it may be the exception that proves the rule. Few stocks compound for centuries on end.

Constellation IPO’d in 2006 at CAD $18 per share and now trades for CAD $1,900 and the company’s finely-tuned acquisition engine is widely known. But, will it be able to make enough acquisitions to move the needle on its $40 billion market cap? If only investors had a way to go back in time and invest in Constellation as a young company...

Actually, that opportunity very nearly exists today. In January 2021 Constellation Software spun out Topicus. With a CAD $3.5 billion market cap, Topicus resembles a 2012-vintage Constellation Software.

Topicus’s plan is to run Constellation’s playbook on the European VMS market. In many ways, this market is more attractive than Constellation’s North American market. The European market is more fragmented because there are so many countries with different regulations and languages. This makes for more acquisition opportunities. Further, European companies tend to be family-owned. Usually, closely-held companies prefer to sell to a buy-and-hold acquirer like Topcius rather than a private equity chop shop. Finally, private equity is less prevalent in continental Europe and not as well capitalized as in North America.

Topicus = “Old” Topics + TSS

Topicus is the combination of Constellation’s TSS and what I’ll call “Old” Topicus. Constellation retained an ownership stake in Topicus, will manage the company’s capital allocation, and majority control its board of directors. Topicus will inherit Constellation’s hard-won wisdom on acquisitions and operations. TSS will likewise inherit Topicus’s organic-growth know-how.

TSS

TSS’s history dates to 1998 when Rinse Strikwerda took his Dutch IT company public, netting $100 million. Strikwerda formed a family office and put his daughter and her husband in charge. One of their first investments was an acquisition of Total Specific Solutions (TSS).

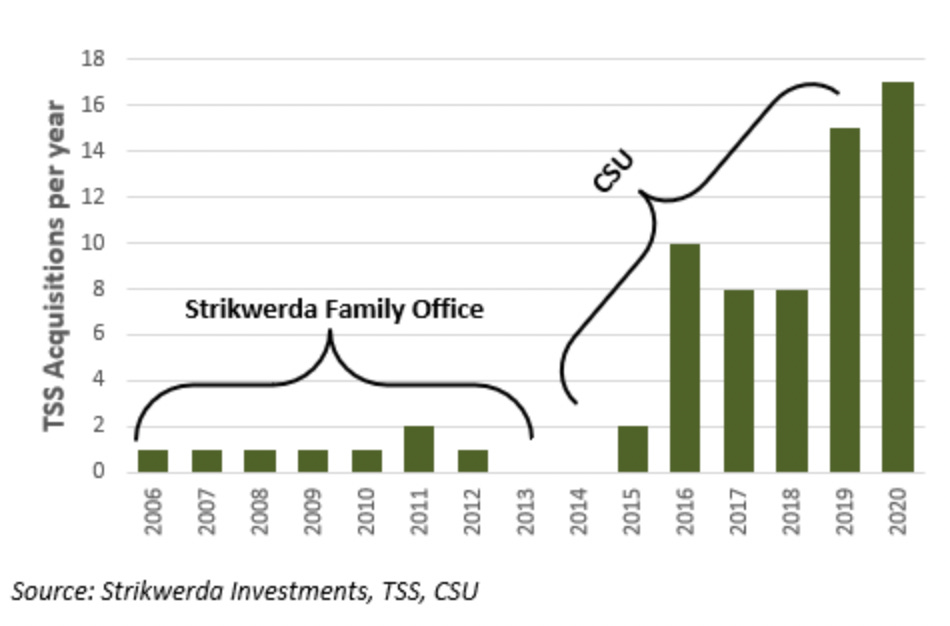

Strikwerda used TSS to roll-up Dutch VMS businesses. Between 2006 and 2012 they made eight acquisitions, becoming the largest VMS company in the Benelux region (Belgium, Netherlands, and Luxembourg).

In 2013, Constellation bought two-thirds of TSS. Strikwerda retained the remainder and Robin van Poelje (Strikwerda’s son-in-law) remained CEO.

TSS had everything Constellation looks for in an acquisition:

Dominant market positions;

A focus on customized software, which is particularly sticky;

A decentralized organization structure; and

Managers that think in generations, not years.

To the last point, Tjitske Strikwerda’s (Rinse Strikwerda’s daughter) once said:

“We don’t think in terms of five years, we think in terms of generations… Our focus is on building companies that are able to reinvest their cash flow in new growth opportunities and thus achieve a leadership position in their market segment. We call them compounders. Building such a compounder is difficult, it is time consuming. But we have plenty of time.“

TSS didn’t make any acquisitions during their first two years under Constellation. In 2015, Constellation had finished laying its foundation and acquisitions took off. The chart below shows how Constellation’s capital, contacts, and know-how supercharged TSS’s acquisitions engine. Since then, TSS has grown faster than Constellation as a whole.

Old Topicus

Old Topicus dates to 2001 when three partners formed the company to own Dutch VMS businesses. Like Constellation and TSS, Old Topicus owned companies with dominant market positions, sold customized software, used a decentralized structure, and invested for the long run.

Here’s how dominant some of Topicus’s products are:

75% of primary schools in the Netherlands use its ParnasSys software; and

80% of mortgages in the Netherlands are either originated, serviced, or advised by Topicus-owned Findesk or FORCE.

In 2020, Constellation announced that they would acquire Old Topicus, merge it with their TSS unit, and spin-off the combined entity as (New) Topicus.

Unlike Constellation and TSS, Topicus focuses on organic growth rather than acquisitions. They’re more of a spawner, like Amazon and Alibaba than an acquirer like Constellation or Berkshire Hathaway.

Spawners build businesses instead of buying them. A preference for building over buying is so embedded in Topicus’s DNA that employees once built themselves their own in-house brewery. As a result, Topicus spends more on R&D than M&A.

Topicus’s strategy is to hire smart people and give them autonomy to explore new ideas. Cells of 7-10 employees take responsibility for projects. They prioritize hiring smart, entrepreneurial employees with strong tech skills. They target niches with high administrative burdens. They grow alongside their clients and follow them across borders. For instance, a large Dutch client is currently deploying their software in Belgium and soon in Spain and Germany.

When employees have a business idea, Topicus allocates resources to incubate it. When the projects succeed, Topicus allows employees to retain an ownership stake in them. Some of Topicus’s most dominant businesses came from employee projects.

The CEO of Old Topicus, Daan Dijkhuizen, will be the CEO of New Topicus. That could shift capital allocation away from M&A and towards organic growth. Then again, Topicus uses a decentralized structure and doesn’t try to extract synergies. They encourage but don’t require, sharing best practices. Constellation has struggled to generate organic growth lately, so Topicus may bring fresh ideas to the table. TSS plus Old Topicus could be a case of “one plus one equals three.”

TSS appeared to struggle for the first two years under Constellation. Then, growth exploded. Investors should be careful not to jump to any conclusions about the combined entity too quickly.

New Topicus

New Topicus has an unusual structure.

To start, it owns European businesses but trades on the Toronto Venture Exchange. The company’s stock trades in Canadian Dollars, but reports financials in Euros. I imagine a number of its shareholders are Americans thinking in US Dollars. The Toronto Venture Exchange is dominated by junior miners and other small commodity-focused upstarts, so Topicus seems out of place. Sometimes situations like these lead to a stock being overlooked by its logical investor base. So far, Topicus’s valuation and stock performance don’t indicate this is an issue.

Second, Topicus’s ownership is split between three groups:

Constellation Software owns 30.35% of the economics and controls 50.1% of the votes through a single super-voting share. They can appoint six of ten directors.

The Joday Group (Strikwerka’s family office) owns 30.30% and can appoint two directors.

Ijjsel (owner of Old Topicus) owns 9.00% and can appoint two directors.

The public owns the remaining 30.35% share.

The structure is a bit convoluted because some parties own convertible preferred shares and exchangeable units. Fortunately, Topicus has already announced that on February 1, 2022, all preferred shares will convert, one for one, into subordinate voting shares. At the same time, all exchangeable units will convert into ordinary shares, one for one. That will simplify the capital structure.

The structure came about because Old Topicus insisted on preserving its identity. In May 2020 Constellation wrote:

“The plan to create a publicly listed operating group made up of Topicus and TSS was a key part of our discussions with the Topicus founders. They didn’t want their legacy disappearing into the craw of an omnivorous conglomerate. While they knew that Topicus would have autonomy within Constellation, they also wanted identity. The public listing is expected to afford our Netherlands-based businesses a platform from which to celebrate their culture and achievements.”

Old Topicus’s emphasis on preserving their legacy and identity highlights the different mindset on continental Europe as compared to North America. This could give Topicus an edge when it competes head-to-head with private equity.

In the current structure, preferred dividends eat up the majority of Topicus’s free cash flow. Initially, Topicus will have to focus on organic growth since it will not have enough retained earnings to consider acquisitions. This was probably done intentionally to give Topicus a chance to settle into its new structure. When the preferreds are converted next winter, Topicus will begin to accumulate retained earnings it can redeploy into acquisitions.

Valuation

Note: All figures in millions of Euros except per-share amounts.

Topicus earned 103 million in free cash flow (FCF) in 2019. In 2020, FCF grew 26% to 130. Future growth rates will be a function of organic growth and acquisitions. Given that Constellation maintains voting control over Topicus, I’d expect Topicus’s capital allocation to be as thoughtful as Constellation’s.

Constellation has grown at a mid-teens to mid-twenties rate from acquisitions and a mid-single-digit rate organically. Combined, the company compounded at an off-the-charts rate for over a decade. If Topicus can manage even half of Constellation’s growth rate, shareholders will be pleased. There’s reason to think Topicus will at least be in that ballpark.

First, Topicus will benefit from Constellation’s know-how and hard-won lessons. Recently, Mark Leonard admitted he made a mistake when he held Constellation’s hurdle rates for large acquisitions too firm. Unwilling to pay up for large VMS businesses, Constellation was priced out of the market by private equity. Topicus, like Constellation, will likely underwrite large acquisitions to a slightly lower hurdle, increasing the odds they’ll win the bidding war. The idea is for a higher reinvestment rate to compensate for a lower hurdle rate.

Second, for reasons already discussed, the European VMS market may be more attractive than the North American market Constellation operates in.

Last, Topicus is a lot smaller than Constellation — about one-tenth the size. Small acquisitions are always easier than big ones. Unfortunately, small ones no longer move the needle for Constellation. But they will move the needle at Topicus.

Today investors are paying nearly 60 times free cash flow for Topicus. Though that’s an above-average multiple, Topicus is an above-average business. The base rate of success for paying that much for a business isn’t good. However, I suspect that paying that price 10 years ago for Constellation would have worked out. Investors buying today need to have an extremely long time horizon (decades, not years) and lots of confidence in their thesis. I’d prefer a less demanding valuation that doesn’t require such a rosy forecast to succeed.

Risks

Recently, an analyst asked Topicus’s CEO if Topicus will compound faster than Constellation. He said he hopes to, but that it isn’t preordained. Though Topicus is smaller, Constellation has more resources. They have a head office solely focused on capital allocation, and an entire team sourcing deals.

Sometimes, the playbook that works in one geography doesn’t translate well to another. Liberty Latin America (LILAK) was pitched as John Malone’s successful North American cable playbook applied to Latin America. After five years, LILAK has lost two-thirds of its value. Fortunately, Topicus and Constellation are decentralized and therefore highly flexible. There is not top-down big-picture strategy like there was at LILAK. Topicus should be able to adapt if they begin to get negative feedback. Further, while I’m no expert on LILAK, I think that they’ve struggled against a headwind of cord cutting. Topcius shouldn’t be as affected by technologic change.

If you would like to invest with Eagle Point Capital or connect with us, please email info@eaglepointcap.com. Thank you for reading!

Disclosure: The author, Eagle Point Capital, or their affiliates may own the securities discussed. This blog is for informational purposes only. Nothing should be construed as investment advice. Please read our Terms and Conditions for further details.

Good stuff. You may enjoy this podcast that I did about Constellation with MBI. We don't cover Topicus that much, but a lot of stuff applies to it since it's the same model and culture even after the partial spin:

https://www.libertyrpf.com/p/going-deep-on-constellation-software

Cheers 💚 🥃

Quick Q - where did you locate the number of acquisitions they do in a year? they don't seem to talk about that number in the Quarterly or annual reports. I think I once read Mark Leonard saying they don't like revealing that but your report has the number count. thanks!