T. Rowe Price: Compounding Machine on Sale

T. Rowe Price is a long term compounder currently selling at a discounted valuation. The company went public in 1986 and has been a 100-bagger since its IPO; generating outstanding shareholder returns of 18% compounded annually since 1986 and trouncing any relevant benchmark. Today the stock is down 40% from its recent highs and selling for less than 10x earnings, a greater than 50% discount to its historical (and fair) valuation.

Background

Anyone interested in the stock market is probably familiar with T. Rowe Price. The company provides global investment management services primarily through actively managed mutual funds and other products for clients across the globe. T. Rowe is one of the largest investment management businesses in the world with a wide variety of products.

As of the end of Q1 the company had more than 1.55 trillion dollars in assets under management (AUM) and has a presence in 16 countries around the globe. Roughly $900B of assets are deployed in public equity strategies and $175B are in fixed income products. The remaining $500B of assets are held in multi-asset strategies such as target-date retirement funds, managed volatility, and other strategies holding both equity and debt securities. In 2021 the company acquired Oak Hill Advisors, who manages about $57B, to expand into alternative assets such as structured credit and high-yield loans.

Business Drivers

Much like Diamond Hill, which we’ve written about in the past, long-term results are driven by assets under management and fee levels. In turn, assets under management are driven by market price appreciation and net client inflows or outflows. Over the past 10 years AUM has compounded 12% annually.

Source: 2022 Investor Day

Most of the increase in AUM has been thanks to market price appreciation, while net client inflows have been slightly positive over the past decade.

Fee rates vary by product and have compressed modestly over the years thanks to share-gains from low-cost passive investing strategies. T. Rowe’s average fee rate is around 45 basis points across all products, with actively managed mutual funds charging higher rates and target date and fixed income products charging far lower fee rates. Fee compression has only modestly offset growth in AUM over the last ten years and it appears that fee rates have reached somewhat of an equilibrium across the industry, though they could always march lower.

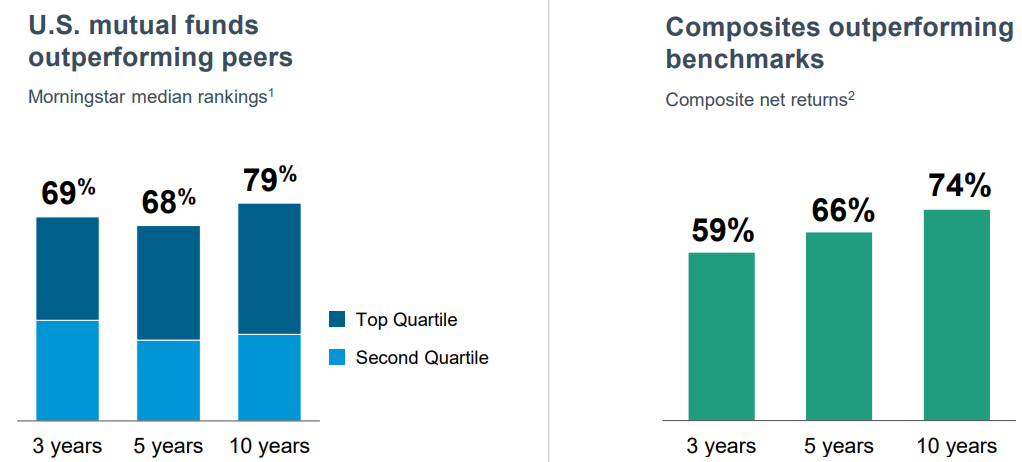

Given the recent pressures from passive investing products, investment performance is as important as ever in retaining and attracting new capital. T. Rowe has an outstanding record in this respect.

Over 10 years, 75-80% of T. Rowe’s products are outperforming their benchmarks, an excellent record for a company of this size.

Source: 2022 Investor Day

The beautiful part of this model is if the business can continue to stay roughly flat in terms of client inflows, it captures the tailwind of rising equity markets over long periods of time. Projecting AUM growth over time in a business like this is reasonably predictable, it’s over shorter time horizons when things get tricky.

Recent Challenges

Though T. Rowe has delivered solid returns for investors over long periods of time, short term equity fluctuations can be extreme. Performance in the company’s flagship growth fund (T. Rowe Price New Horizons) has been poor in 2022 as technology stocks have swooned. The strategy is down roughly 40% this year and has apparently been the leading contributor to the stock selling off. This short term performance hiccup has caused net client outflows to start the year, a double whammy that has further spooked the company’s investors.

Periods of underperformance in key strategies should come as no surprise to the long term investor. In fact, for investors who plan to stick with an approach over long time periods (including our own) there is a 100% that the strategy will go through periods of underperformance and occasionally perform substantially below expectations. This is patently unavoidable, yet it seems investors are still surprised when they encounter such a period. For a business with the reputation, global reach, and historical track record of T. Rowe Price, periods like this should be treated as an opportunity, not a red flag.

Competitive Advantages

While active managers such as T. Rowe Price have faced pressure from low cost index fund offerings, they still benefit from a tremendous business model.

Investment managers tend to have a very sticky revenue base. Much like switching checking accounts, it is onerous to move investment accounts between managers. Switching costs become infinitely higher when it comes to target date retirement products that are offered to large corporations. Barring horrific underperformance over sustained time periods, clients are unlikely to abandon T. Rowe’s strategies en masse. Despite the underperformance and resulting outflows in the equity strategies this year the company has seen net inflows in all other areas of its business.

Basically, if you believe that there will always be a role for active investors in financial markets, it’s hard to imagine T. Rowe Price’s book of business diminishing materially. I don’t foresee a world where all investing is done on a passive basis by computers with no price discovery being performed by active managers. As long as humans are involved in markets there will remain opportunities for insightful investors to exploit the emotionality of others. Clients will in turn be there to provide active managers with capital in an effort to both outperform and to insulate themselves from their own emotions when it comes to their long term investing approach.

I realize I am incredibly biased when coming to this conclusion considering I own an active investing firm and spend virtually all of my time thinking about these things. But hey, just because I am biased doesn’t mean I’m wrong.

T. Rowe Price also enjoys incredible scale in its industry. The business has the number 3 position in target-date funds behind Fidelity and Vanguard, and has immense distribution reach across its products and asset classes. A recent Barron’s article highlighting the stock described T. Rowe Price as a “best of breed” active manager, and we agree. It isn’t as if the firm has its entire future staked on one strategy (such as Cathie Wood’s Ark investment funds). With more than 1.5 trillion dollars under management and entrenched client relationships, T. Rowe Price has built a powerful franchise over the past four decades.

In addition to a sticky and enduring revenue base T. Rowe enjoys a capital light business model. Other than office space and some technology investments, there are scant capital expenditure requirements when it comes to managing an investment firm. Most of the firm’s expenses are tied up in its people. This leads to an incredibly scalable business model. It is no surprise that T. Rowe enjoys consistently high returns on capital of 20-30% year after year.

Without the need to heavily reinvest in the company to grow profits, and aided by the long-term tailwind of rising equity prices, T. Rowe Price is able to grow at above average rates while returning virtually all of its earnings to shareholders.

Capital Allocation

Thanks to the capital light nature of the business, over the last decade the board has returned 101% of earnings to shareholders via regular dividends, special dividends, and share repurchases.

Source: 2022 Investor Day

As we’ve learned with AutoZone, Dominos, and others, when you pair even modest growth with a robust capital return program, the results can be exceptional and persistent returns for investors.

Valuation and Forward Returns

It’s not overly complicated to assess how T. Rowe’s business may perform in the years ahead, as it’s a relatively simple company with a few important drivers.

As outlined above, T. Rowe’s intrinsic value is going to compound roughly in line with AUM. Most of the gains in AUM are likely going to come from market price appreciation and retained dividends. Historically, T. Rowe has captured about 75% of the S&P 500’s annual return because its asset mix is not strictly equities.

I have no idea what the stock market will do over the next year or two. I have a better idea of what returns might look like over the very long term. In a scenario where stock market returns revert materially lower over the next ten years compared to the last ten years (which seems likely given the outstanding performance in recent years) T. Rowe Price investors should still do well.

Let’s say the stock market returns 7% annually over the next decade, about half the returns from the last decade including the recent downturn. AUM at T. Rowe should rise 5-6% annually thanks to price appreciation and retained income. The stock currently yields 4% and management has repurchased roughly 1% of shares annually over the long term. This relatively conservative scenario takes per share business returns to low double-digits annually over the coming years. Even if the stock market goes nowhere the current 10%+ free cash flow yield provides a reasonable floor for investors.

Also worth mentioning is a recent split T. Rowe conducted in their business. In early 2022 they split a number of funds out into a separate investment management entity. This move is somewhat common among active managers as it unlocks modest capacity in strategies that are constrained or closed to new capital. Most of the funds being separated are small and mid-cap funds, and the hope is that there will be less overlap in terms of the fund’s holdings because they’re run by different managers. This should result in a lower probability that T. Rowe could move the market in certain smaller stocks because of an upgrade or a downgrade causing all of the company’s managers to move in lockstep. It also helps enable the company to take new capital in these strategies because of eased capacity limits for how much of an individual stock the firm can trade. I don’t see this as a big positive or negative, but it’s worth nothing. It’s probably a modest positive overall but doesn’t materially change the trajectory of the company.

So, respectable growth seems likely; what are investors paying for that prospective growth? It turns out, not much.

The stock is likely to outperform the business thanks to a cheap current valuation. Presently T. Rowe trades for around 10x earnings, and even lower on a multiple of free cash flow. Over the last decade the company has traded at a high-teens average multiple of earnings, and a median of 15x earnings. I don’t have any reason to believe historical valuation levels are unreasonable.

A 15-20x multiple implies roughly 3-5% terminal growth; lower than what I’d expect thanks to the growth the business should realize from market price appreciation alone. Should the company re-rate to 15x earnings over the next 5-10 years it would add 4-8% annually to stock returns. Combined with the business return of 10-12%, it’s not hard to envision 15-20% annual returns for equity holders over the next 5-10 years.

Finally, the business is very conservatively capitalized with a cash balance of close to $5B and zero debt. Cash accounts for almost 15% of the company’s market cap and management has consistently returned capital to shareholders. We love businesses that are drowning in cash, a box T. Rowe certainly checks. If excess capital from the balance sheet is released to shareholders returns could be even more favorable.

Summary

T. Rowe Price is a simple business that enjoys one of the strongest franchises in the active investment management industry. The company has compounded at a high-teens rate for decades and is poised to continue to deliver above-average returns thanks to a capital-light business model, solid management, and an advantaged competitive position.

A pervasive shift to passive investing and continued fee compression are risks, but not ones that strikes me as existential for the business. The recent price appears to incorporate a continued gloomy outlook that is incompatible with the company’s fundamentals as I see them.

Recent short-term weakness in its core strategies appears to have created an opportunity for long term investors to buy shares at a heavily discounted valuation. Rebounding equity markets and a generous capital return program are long-term tailwinds for patient investors that aren’t afraid to stomach some volatility inherent in owning the stock of an investment management company during a bear market.

If you would like to invest with Eagle Point Capital or connect with us, please email info@eaglepointcap.com. Thank you for reading!

Disclosure: The author, Eagle Point Capital, or their affiliates may own the securities discussed. This blog is for informational purposes only. Nothing should be construed as investment advice. Please read our Terms and Conditions for further details.