Semler Scientific: An Emerging Monopoly?

Semler Scientific is a ~$600M small cap business focused on helping healthcare providers diagnose and treat chronic diseases. To date, the business has one product in market and three other “shots on goal” that represent additional growth opportunities.

The company received FDA approval for its product, QuantaFlo, in 2015. In 2017 the business began generating cash from operations and is growing at a 40% clip via a unique distribution model and a differentiated product protected by patent through 2027, and is subsequently developing a potential standards of care moat.

Overview

Founded by Dr. Herbert Semler and run by CEO Dr. Douglas Murphy-Chutorian, Semler is a cross between a medical device and software-as-a-service (SaaS) business. The company’s only current product, QuantaFlo, is used to diagnose peripheral arterial disease (PAD) which is a circulatory condition in which narrowed arteries reduce blood flow to ones limbs. The disease is a sign of fatty deposits in the arteries and is often a preamble to serious health complications.

Patients diagnosed with PAD have a greater than 20% event rate of cardiovascular death, heart attack, stroke, or cardiovascular hospitalization within 12 months. People with PAD are four times more likely to die of a heart attack and three times more likely to die of a stroke. Basically PAD is a big red flag and needs to be treated and diagnosed as early as possible to avoid these outcomes.

Unfortunately, PAD is a grossly underdiagnosed disorder. It’s estimated that roughly 90% of people with PAD don’t display noticeable symptoms, leading to an estimated 75% of cases going undiagnosed. The result is in an unnecessarily tragic burden on people with PAD and a big financial cost to the healthcare system in general.

Source: November Semler Investor Relations Presentation

QuantaFlo

Semler estimates that nearly 20 million Americans suffer from PAD in the U.S. alone. Prior to QuantaFlo, the standard way of testing for PAD was with the ankle brachial index (ABI) method. In the ABI method, a technician measures blood pressure in both arms and legs with blood pressure cuffs along with a handheld Doppler device. The technician then calculates blood flow differential between the extremities to determine if the patient likely has PAD. These tests usually take about 15 minutes and must be done by a trained technician and as such, tests are usually done in specialized vascular labs. ABI testing equipment typically costs around $6K, but can run much higher. That ABI tests are impractical to conduct in standard primary care offices contributes to the under-diagnosis problem.

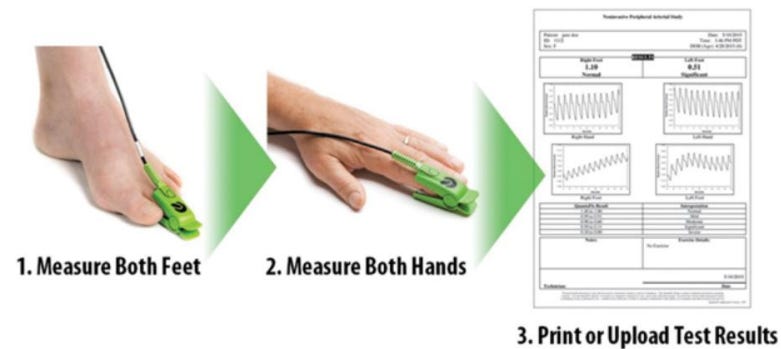

Semler’s solution to diagnosing PAD was to develop QuantaFlo, which is a simple four minute in-office blood flow test. The device clips on to a finger and toe on each extremity and measures blood flow using infrared light. A blood flow waveform is then instantly constructed by their proprietary software and analyzed in the cloud to assess whether the patient has PAD.

Source: November Semler Investor Presentation

The test is as accurate or better than traditional methods and vastly easier to conduct and analyze and therefore more practical to administer. QuantaFlo is offered as a cost-effective subscription service instead of one-time purchase of equipment. Semler offers both recurring subscriptions and pay-per-test options. In this way, Semler is much more of a SaaS business than a medical device manufacturer.

Rather than going door-to-door and selling to doctors’ offices and hospitals across the country, Semler made a savvy move when deciding how to bring the product to market.

Distribution Strategy

In a typical medical device product launch, droves of sales reps hit the ground running and try to drum up business one healthcare provider at a time. This approach takes a lot of time, effort, and money, but it’s usually the only option as medical device businesses need to go to where the customers are.

While doctors and medical practitioners are the users of QuantaFlo, they are not the primary customers. Semler’s main customers are actually large insurance companies and risk assessment groups. The reason is simple, QuantaFlo benefits insurance groups the most and therefore they’re the most likely to pay for the product. Identifying PAD earlier and in more patient’s results in lower adverse outcomes and subsequently lower costs to insurance providers who have to pay for those adverse outcomes. QuantaFlo’s ease of use makes testing for PAD more widely available and therefore has the potential to greatly reduce costs for insurance carriers. According to a recent interview with Yen Liow, insurance companies realize 100-150x return on their investment in the first year when they implement QuantaFlo.

The distribution model works like this: Semler markets the product to insurance carriers and risk assessment groups (like home health providers) who will save money by identifying PAD as early as possible. These large healthcare groups pay Semler for a subscription to QuantaFlo. Then, the insurance groups actually pay doctors to implement QuantaFlo testing. This typically takes the form of a pay-per-test arrangement, and the insurance carriers or risk assessment groups pay doctors a modest amount every time they use QuantaFlo.

Ingeniously, instead of hiring boatloads of sales reps, Semler is utilizing the heft of big health insurance groups to push their product. Their largest customers literally pay doctors to use QuantaFlo while paying Semler for the subscription; talk about efficient marketing! This has resulted in a very uncharacteristic result compared to a typical early-stage medical device or SaaS business: profitability.

Normally, when SaaS companies are scaling, they offer big discounts or payment deferrals in order to get their software in the hands of customers. This results in reported GAAP losses because product discounts show up as a marketing expense which take time to recoup through annual recurring software revenue and upselling. In many cases, this model makes sense because long term customer values are so high in sticky, recurring software business models.

In medical device, there are often significant upfront preproduction and manufacturing costs before a product hits the market. In Semler’s case, they contract out the manufacturing process and therefore have virtually no capex. Further, since their product is largely software, its cost of revenue is almost nothing.

Lastly, as mentioned above, both SaaS and medical device businesses generally need to employ tons of sales people to get their product in the hands of customers as quickly as possible. Again Semler has avoided this via their superior sales model.

Even though up front losses make sense as long term investments for many SaaS or medical device businesses, Semler has found a way around them and is scaling rapidly while maintaining profitability, which is even better. Here’s what early results have looked like.

Fundamentals

QuantaFlo was approved in 2015 and started generating real revenue around 2017. Since 2017, revenues have grown at a 44% compounded annual rate. Similarly, operating cash flow has compounded at 39%. Gross margins have expanded from an outstanding 80% to an almost laughable 91%. Operating margins currently stand at 44% and returns on capital are near 50%.

Since 2017 the business has retained roughly 100% of earnings and earned ~35% incremental returns on retained capital. In other words, intrinsic value has compounded at a mid-to-high 30% range annually over the past five years.

source: November Investor Presentation

Additionally, the business has no debt, a net cash balance sheet, and heavy insider ownership. Director William Chang owns 19% of the business and CEO. Dr. Douglas Murphy-Chutorian owns 12%. Also, Yen Liow, one of our favorite investors, recently purchased about 2% of the business through his hedge fund Aravt Global.

Growth

While QuantaFlo serves a niche market, it appears they have a long growth runway thanks to their small base. While disclosures are scant regarding market size of PAD testing, I gather that the business has less than 5% of their current addressable market.

The company estimates that there are more than 400,000 physicians and other potential customers in the U.S. alone that could implement QuantaFlo. At a ~$6,000 annual subscription price (best estimates I can find on annual price for QuantaFlo) I get a ~$2.4B potential market. I’m not so concerned about getting this correct to the dollar because Semler generated ~$55M of revenue over the past 12 months, or about 2% of the estimated market size. You could cut the addressable market down drastically and the company still has a long growth runway.

In a rare comment on growth potential, management stated during the June 2020 earnings call that they were very early or in the “first inning” of their growth runway with QuantaFlo. I would agree.

Additionally, the business recently announced that they are exploring several new product categories. In 2020 Semler entered into a marketing and distribution agreement with a private company to serve as the exclusive distributor of a new product. The business recently added its first few customers and will begin to disclose details as they become material.

Semler also made minority investments in two other private companies that are working on new product launches.

I’m not considering any value from these three other potential product categories as I don’t know enough to make any sort of assessment. At a minimum I assume they will not be hugely value destructive given the small dollar investments on a relative basis and the management team’s success with the QuantaFlo product and business model. Heavy shareholder alignment among the management team helps ease any concerns here as well.

So far, the numbers look great and the potential is large, but there are a few important questions.

Risks & Business Model Durability

Frankly I’m not so concerned about the upside with Semler. The historical numbers jump off the page and if they can continue, the business will do well. Semler is in replication mode with QuantaFlo, has an advantaged distribution model, an excellent value proposition to customers, and outstanding unit economics. If they can continue with the growth algorithm of partnering with insurance plans to get QuantaFlo in the hands of doctors and generate similar returns on capital, the business could continue growing handsomely annually for many years, creating a tremendous amount of shareholder value. The real question is – how durable is this position?

I think about this in a few parts. First, is QuantaFlo protected from competitors? So far, QuantaFlo is the only technology of its kind on the market, and is protected via patent through 2027. One might assume traditional ABI testing equipment makers may attempt to copy QuantaFlo, but I’m not sure that’s realistic. In addition to being patent protected, QuantaFlo is a totally different type of product than ABI equipment, as its value is largely in the software that analyzes the test results in the cloud and spits out a result in minutes. Not to mention the actual blood flow sensors are a totally different technology than ABI equipment. It’s not practical for most businesses to just completely switch their business model from traditional medical device to a software/subscription business.

That said, I’m sure competitors will enter; that’s what 90% gross margins and recurring revenue in a multi-billion dollar market will do. I found a press release from 2019 on a product called FlowMet-R that appears to serve a similar function (noninvasive blood flow monitoring) via laser sensors. There is no mention of software or subscriptions attached to the product and the business was acquired by Medtronic in 2020. I can’t find much else on the business. At the very least, Semler has a multi-year head start and patent protection for another five years. It certainly appears that for now, Semler largely has a monopoly on its PAD testing methods and associated software. So the next question is, can the market share gains continue?

An important nuance here is that in the healthcare space, competitive advantages often arise from a standard of care perspective rather than strictly a technological one. In other words, once a healthcare method is adopted, it takes a lot to unseat it. It requires a product that is disruptive to the traditional ones -like QuantaFlo compared to ABI testing – to unseat a commonly accepted practice. It’s not worth the training and implementation costs to switch to a product that’s the same or marginally better. In this sense, I would be more worried about some revolutionary method disrupting QuantaFlo before they capture meaningful share instead of competitors copying Semler. This is probably a risk I’d be willing to shoulder as I’m not sure how much easier PAD testing can get than sub-five minutes and a couple of finger sensors. Maybe an all-in-one blood test is the thing to worry about, but that’s outside my scope of knowledge and seems implausible in the near-term?

Next, I wonder if the value to insurers is large enough to allow for continued 30%+ annual revenue growth. I have not yet been able to independently validate the 100-150x first-year returns that customers are realizing from QuantaFlo, though I have an upcoming call with the company and a question in to Yen Liow about this. I don’t have any reason to doubt this claim, however, and the product appears to offer an excellent value proposition to customers and indeed saves lives and money for minimal costs.

Additionally, the test is clearly superior by orders of magnitudes, and more widely adoptable, compared to the clunky traditional ABI methods. However, it’s not as if PAD is a big enough market to warrant an overnight 100% adoption from all insurance groups and home health providers. The business will need to continue to market the product to insurance customers to drive adoption across physicians because the insurance companies frankly have bigger fish to fry if left to their own accord. Nonetheless, if the value proposition is indeed there, as it appears to be, growth should continue.

Valuation & Returns

Semler’s stock price has been under pressure for the last several months, dropping more than 45% from an October 2021 high of $150 to today’s ~$80/share. Most of this is thanks to a) a revenue miss in November causing the stock to drop 23% and b) a fairly high starting valuation, leaving little room for short-term error. Also, the business is under-followed and is a small cap stock which generally trade at meaningful discounts to businesses of similar quality but larger size.

As a result, the stocks valuation has compressed from ~45x free cash flow to around 30x LTM free cash flow. The business is priced at less than 25x next years’ free cash flow, which is a very undemanding valuation should the business continue to deliver anywhere near the growth over the next five years that it delivered over the past five.

Consider a scenario where the business continues to grow at 30% rates through 2027 (its patent year). This does not seem unreasonable given the business is in replication mode with a proven value proposition and an advantaged distribution model. In this case, even with multiple compression down to 15x out-year earnings (implying GDP-like terminal growth) the market cap would still compound at 15% per annum. It doesn’t seem likely that growth slows dramatically by 2027 considering 30% annual growth through 2027 still only leaves Semler with ~10% of the estimated market size and ascribes no value to the other three business ventures. Further, even mature businesses of this apparent quality rarely trade for market-average multiples. You don’t need a complex financial model to contemplate the potential value that can be created from Semler’s apparent long runway of attractive compounding combined with a reasonable starting valuation.

Another reference point in businesses like Semler is the “Rule of 40” which is often used to evaluate SaaS businesses. The Rule of 40 is a popular metric among SaaS investors and executives. The rule states that the company’s growth rate when added to its free cash flow margin should be over 40 to be considered a healthy SaaS business. Semler has an extremely healthy score of around 75. Not surprisingly, businesses that are able to sustain high Rule of 40 scores are consistently rewarded with handsome valuations.

Source: McKinsey & Company

Should Semler eventually trade in-line with high quality Rule of 40 companies, the company’s valuation would be materially higher than today.

Summary

Semler is a unique business and in many ways unlike typical businesses that I study. I’m no expert in the medical device or healthcare space, but Semler’s value proposition, subscription model, and competitive position aren’t overly complicated to grasp. It appears that there is a real chance Semler is an emerging monopoly as they’re disrupting the standard of care in a niche-but-plenty-large-enough market. On top of that, the business is reasonably priced thanks to near term modest financial misses and under the radar coverage, despite the competitive position and long-term outlook seemingly intact.

I’ve just wrapped up an initial dive into Semler, so if any readers have insights into the main questions I’ve raised, specifically:

a) Standard of care-based moats for medical testing businesses like Semler;

b) The size of the PAD testing market;

c) The apparently high return on investment insurers are realizing from QuantaFlo;

d) Anything else related to the business that may be helpful;

Please feel free to reach out.

If you would like to invest with Eagle Point Capital or connect with us, please email info@eaglepointcap.com. Thank you for reading!

Disclosure: The author, Eagle Point Capital, or their affiliates may own the securities discussed. This blog is for informational purposes only. Nothing should be construed as investment advice. Please read our Terms and Conditions for further details.

Bob - thanks for the comments, very good points. I mostly agree with what you've said.

I too was skeptical of the technology moat, usually technology does not represent a lasting competitive advantage, and I don’t think this case is much different. After speaking with the CEO, I do think it is a stronger interim advantage than I initially suspected, as there are significant trade secrets and IP in building software that analyzes PAD in under 5 minutes. The trick with having the software cloud-based is they have a big data advantage that they can provide back to the insurance companies. Normally when a test is run in a doctor’s office the results go into a patients file and are not aggregated for insurers. QuantaFlo can easily aggregate all of the PAD testing data and provide valuable insights to insurance plans which isn’t an option for most types of healthcare testing. I didn’t fully appreciate that aspect until talking with the management team. This isn’t a benefit that has to be exclusive to Semler, but nonetheless it’s a great selling point.

The key metrics for the software kind of speak for themselves as the company has no churn once QuantaFlo is implemented and the subscription pays for itself every year if only a few patients are diagnosed with PAD per subscription per year.

I mentioned FlowMet as a possible competitor in the article, and think there is bound to be more like it in the coming years. It does appear Semler has a sizeable head start and a superior distribution model, but we’ll see if they end up executing. Also, with less than 5% of the market it’s not as if a few competitors mean the death of QuantaFlo. Either way I do expect any technological edge to wear off over time as it always does, which is why I don’t see technology as their moat. The question is really if they can achieve a widespread standard of care (they’ve apparently already achieved it in areas).

Semler is attempting to dig a standards-based moat which, if successful, can be incredibly valuable. The technology and associated patent gives them the opportunity and runway to dig a standards-based moat, but it does not guarantee they’ll be successful. Time will tell if they’re able to execute, and investors have to weigh the upside of achieving a standard of care in a large part of the PAD testing market against possible risks of competition.

On capital allocation, I would prefer if they could plow 100% of FCF back into high-return projects, but that would also come with major risks that subsequent products are not as successful or high potential as QuantaFlo. I think they’re trying to strike a balance here, they’ve invested in growing the salesforce and also have a number of other products they’re working on bringing to market via the same distribution model. A blessing and a curse of QuantaFlo is that it simply doesn't need that much capital to continue to grow. More so than incremental capital, QuantaFlo just needs time to keep slicing through the layers of bureaucracy at big insurance companies to gain adoption.

Beyond that if they cannot find productive uses for excess cash and they believe a dollar retained will not be as valuable as a dollar distributed, they should return that capital to shareholders. Always a balance between reinvesting in sensible projects versus putting capital at risk just for the sake of reinvesting. No one is perfect but I suspect management is not being foolish with capital allocation given their high levels of ownership, particularly the CEO.

The jury is still out on Semler to me, though I think the company has put itself in a reasonable position to create a lot of value over the coming years if they can continue replicating what has worked over the past several years. Should be a fun one to watch unfold.

So Aravt blew up and has to dispose of its Semler 2% ownership. 3 days later the company announces $20m buyback. Why is a company, so early in its growth phase, announcing possible buybacks? Can it not do anything better with this cash? Reinvest in exciting projects that will stave off the patent cliff in 2027? Source: https://www.wsj.com/articles/aravt-global-shutting-down-as-hedge-funds-get-hit-by-unraveling-of-growth-trade-11646908200

Also, "its value is largely in the software that analyzes the test results in the cloud". This seems so fluffy and vague. Why does it have to do the computation in the cloud? A couple of finger sensors and an algorithm is zero moat to Medtronic and their army of sales reps:

https://www.medtronic.com/us-en/healthcare-professionals/products/cardiovascular/intraprocedural-monitoring/flowmet.html

I like Semler's innovative distribution and subscription model via the insurers but this moat is too shallow for me.