This month we read:

Influence: The Psychology of Persuasion by Robert Cialdini

The Demon of Unrest: A Saga of Hubris, Heartbreak, and Heroism at the Dawn of the Civil War by Erik Larson

Fabric of Success: The Golden Threads Running Through the Tapestry of Every Great Business by James Emanuel

Hillbilly Elegy: A Memoir of a Family and Culture in Crisis by J.D. Vance

Influence: The Psychology of Persuasion by Robert Cialdini

Influence is one of the few books that Munger consistently recommends and references throughout Berkshire meetings, and it doesn’t disappoint. My favorite human psychology book to date was Thinking, Fast and Slow by Daniel Kahneman, and I put Influence right on the same footing. It may even be more practical and applicable to every day life as it was written with the intention of helping us avoid psychological traps we all encounter.

Cialdini, a leading pioneer in uncovering human psychological biases, distills the major areas where we can be tricked by car salesmen, business counterparts, politicians, or anyone else, into seven key principles. The seven tendencies to maintain high alert for are:

Reciprocation Tendency

We have an immensely strong tendency to reciprocate, often unconsciously, to those who have done even a small favor for us. Even an act as small as leaving a pen for someone can trigger a subconscious “personal debt” that will be repaid at a later date when that person seeks a favor. Often the reciprocation far exceeds the initial small favor, so it is an asymmetric (in the wrong direction) dynamic for the one being deceived. It’s why Sam Walton wouldn’t let his buyers accept so much as a box of cookies from any supplier.

Liking Tendency

It’s not rocket science to claim we are more willing to do a favor for someone we like or love. Still, we need to be on the lookout for how powerful this can be. Cialdini uses the example of Tupperware parties to illustrate the point. When a friend joins a direct selling company and invites friends over, it’s almost a certainty they’ll buy at least something that the host is selling; they are friends after all.

The Halo Effect is a sub-category of the liking tendency. When someone is good looking, successful in another endeavor, or famous, people tend to blindly accept what they say or do even if it has no relation to other areas they’ve proven to be competent.

Social Proof Tendency

Humans are inherently heard animals, and never is this more evident than when examining the concept of social proof. If our friends, colleagues, or anyone like us accept something we tend to accept it also. Countless businesses are built on the social proof concept, most notably businesses that rely on brand power. If others are wearing a certain brand, it must be good, and we have to have it, too. If everyone is buying Tesla stock, regardless of valuation, it must be a good idea and so people will imitate the behavior. Needless to say, this can have sinister ramifications.

Authority Bias

We tend to accept the opinions of those in a position of authority regardless of whether or not they have any expertise on a subject. We believe politicians or our bosses even when we have no basis for doing so. Make sure to take extra care to think critically for yourself before taking at face value anything someone in a position of power says, especially if it’s going to impact you in a big way.

Scarcity Bias

Retailers make a living on the scarcity principle. We all know that we often value something more when we know it is in short supply, high demand, or both. Take a second to step back and assess whether you really want that new TV just because the salesman told you it was the last model they have and they may not get any in for a while. Often, our automatic instincts kick in and make us believe we have to have something that appears scarce and if it was in abundant supply we would not think twice about passing it up.

Commitment and Consistency Tendency

Once we’ve committed to something, especially publicly, it becomes very hard to change our stance. We look for reinforcing data points and discard and disconfirming evidence that runs counter to the decision we’ve already made. We stick to our guns, often blindly. This can be especially harmful to investors when an investment isn’t going well. We are on high alert for this tendency, particularly because we write in public about our positions. We need to constantly force ourselves to take a fresh look at any stock that has performed poorly and ask if or where we might have been wrong, lest we fall prey to the commitment and consistency tendency.

Unity Bias

The Unity bias is a recent addition to Cialdini’s list that he added for the most recent version of his book. Once again, unsurprisingly, we are far more influenced by those we consider part of our “circle”. Opinions or suggestions made by those with whom we share an identify are likely to be taken seriously, even if there is no basis for us to take them seriously. When we share a family, religion, hometown, or even favorite sports team with someone we are very likely to have our judgement clouded compared to when interacting with those outside of our circle.

An important thing to remember is that each of these biases exist for a reason, and they are usually helpful. There are times, sometimes important ones, when one or all of these factors can work against us. It’s during these times when we are under the influence of others that we need to dig into the toolbox Cialdini gives us to try and recognize and counter when these innate biases are allowing us to be taken advantage of. The applications to investing and business couldn’t be stronger, and I know I’ll make sure each of my kids reads this book more than once.

Dan

The Demon of Unrest: A Saga of Hubris, Heartbreak, and Heroism at the Dawn of the Civil War by Erik Larson

The Demon Of Unrest tells the story of the five tense months between Lincoln’s election and the south’s attack on Fort Sumpter.

We all know what happened: Lincoln is elected, South Carolina secedes, Confederates fire on Fort Sumter, and the Civil War begins. Somehow, Lason manages to make it suspenseful. He weaves details garnered from letters, diary entries, and conversations to show the human side of the story. This is a story of bruised egos, misunderstandings, and defense of an honor code.

The way we learn it in school, the Civil War and attack on Fort Sumter seemed inevitable. Larson shows that to the people alive at the time, it was not a foregone conclusion. No one in 1861 would have predicted that 750,000 Americans would soon die. That should make us more humble about our forecasts.

One theme of the book is the south’s “honor code.” Each section of the book is introduced with an excerpt from the Code Duello, the rules governing how to duel. The south’s code emphasized personal and familial honor, often defended through dueling and violence, and was deeply intertwined with the institution of slavery.

Southern elites viewed any threat to slavery as an affront to their honor and way of life. Such an affront could only be resolved with violence. To the north, slavery was a political policy. The south’s honor code gave them a false sense of superiority and caused them to underestimate the North’s military and industrial might.

Lincoln makes relatively few appearances in the book. This is because he largely sat on his hands and remained silent until his inauguration. Historians have called this “masterly inactivity” and it can serve as a model for long-term investors. Unless there is something obvious to do, it is best to do nothing.

Outgoing President Buchanan serves as a foil to Lincoln. Buchanan procrastinated and continuously underestimated the severity of the situation. Lincoln remained motionless, making a plan, and waiting for the right time to act. Buchanan pretended that there wasn't a problem and hoped it’d go away on its own.

Major Robert Anderson, Sumter’s commander, is in an impossible situation for most of the book. He is sympathetic to the southern cause, but does not agree with their means, and remains loyal to the Union.

There were several mix-ups and mis-communications which led to bruised egos and the start of the war.

Anderson rarely receives clear orders from Washington and must make high impact decision on his own. One decision is to abandon his indefensible position on Sullivan’s Island for Fort Sumter, which was also under his command, but unoccupied.

Unbeknownst to Anderson, President Buchanan had given South Carolina assurances that Fort Sumter would remain empty. South Carolina felt duped and took it as an affront to its honor. They seized all unoccupied Union forts and laid siege to Sumter.

As Anderson’s supplies dwindled, he received little communication from Washington. Should he expect a resupply? Should he fight back and start a war? Should he abandon Union property to the south? When Buchanan attempted to resupply Sumter via an unarmed civilian ship, South Carolina fired on it and forced it to turn around.

After Lincoln's inauguration he immediately decided to resupply Union-held forts in seceded states. He knew that this would enrage the south, but failing to do so would effectively turn over Union property to the south and legitimize succession. Two of the key forts were Fort Pickens near Pensacola, Florida, and Fort Sumter in Charleston Harbor, South Carolina.

Lincoln’s Secretary of State and his former political rival William Seward issued orders, somewhat independently, for the warship USS Powhatan to resupply Fort Pickens. Lincoln, meanwhile, ordered the same ship to resupply Fort Sumter. Seward did not fully accept his defeat in the election and expected Lincoln to act as his puppet. Lincoln did not.

When Lincoln informed the south that the Powhatan would resupply Sumter, General Beauregard gave Anderson an ultimatum to abandon the fort or be destroyed. Anderson declined and the fight started. In the confusion, the Powhatan never arrived and Anderson was forced to surrender under overwhelming fire.

This book shows how messy the real world can be. The cultures and values of the North and South were quite different, but neither seemed aware that they were different. Words and actions meant to de-escalate were therefore misconstrued as an escalation. Miscommunications and misunderstandings threw fuel on the fire. Southern pride and hubris blinded them to moral and economic realities and made war inevitable.

Matt

Fabric of Success: The Golden Threads Running Through the Tapestry of Every Great Business by James Emanuel

Fabric of Success was a book written recently by investor James Emanuel in which he seeks to understand the commonalities of history’s great businesses.

Emanuel does a great job using case studies to illuminate real examples of the “golden threads” that seem to be present in many great businesses. He pulls heavily from the current giants and their founders, most notably Jeff Bezos and Steve Jobs to try to unpack the qualitative aspects that made the businesses quantitatively great for an enduring period of time.

Having once worked at a large corporation I can especially relate to the importance of decentralized decision making and a lack of bureaucracy that seems to be present in many great enterprises. Buffett has harped on the criticality of limiting bureaucracy as it stifles innovation, slows down responses to competition, and results in a bloated cost structure. All of these things are bad for business and subsequently bad for shareholders, and Berkshire is famously ruthless at limiting corporate bloat.

A simple but powerful illustration of this principle, even at a behemoth like Amazon, is Bezos’ “two-pizza” rule:

“Bezos intuitively understood this dynamic and vowed to run Amazon with an emphasis on decentralisation and independent decision-making. He wanted small dynamic autonomous teams to be entrepreneurial and to get things done, not a management bureaucracy that would slow things down.

This is how the Amazon ‘two-pizza’ rule came into being. Having established that too many people involved in a process is counter productive, Bezos aimed to create teams that are no larger than can be fed by two pizzas. This also made meetings more productive by ensuring that there were not too many voices and opinions floating around.”

Bezos also famously banned PowerPoint presentations for project teams and instead insisted that the leaders of important meetings distilled the situation into a four page written memo. Instead of fumbling through dozens of slides and wasting everyone’s time, Bezos dedicated the first twenty minutes of every meeting to silent reading time. The memo would be distributed, everyone would read it, and then discussion began. As anyone who has attempted writing understands, it takes more care to ensure you understand your subject matter when you have to put it in writing, and Bezos has harnessed this idea to great success.

A lack of bureaucracy and decentralized decision making are just two of the 20+ important concepts that Emanuel outlines in his book.

Dan

Hillbilly Elegy: A Memoir of a Family and Culture in Crisis by J.D. Vance

I decided to read this book after the election with the hope of gaining some insight into J.D. Vance. Investors should put politics aside and try to understand the people setting policy.

This is Vance’s memoir of growing up as a “hillbilly” in southern Ohio and Kentucky. It describes an America few in the investment world see – poverty, addiction, violence, theft, and a culture which normalizes, or at least accepts, all of the above.

While the memoir paints a depressing and fatalistic view of the rust belt, Vance’s own rise, from the Marines, to Ohio State, Yale Law, the US Senate, and now Vice President, shows that there is hope.

Vance’s message seems to be that the American dream is dead in the rust belt, yet his own story proves that it is alive. Difficult? Sure. Uncommon? Absolutely. But possible nonetheless.

One of Vance’s messages is of self-reliance and self-determination. This is an important, if decaying, American value. Vance wrote:

“What separates the successful from the unsuccessful are the expectations that they had for their own lives. Yet the message of the right is increasingly: It’s not your fault that you’re a loser; it’s the government’s fault.”

And:

“Psychologists call it “learned helplessness” when a person believes, as I did during my youth, that the choices I made had no effect on the outcomes in my life.”

This reminds me of one of my favorite books, Jocko Willink’s Extreme Ownership. The message of that book is:

Accept responsibility for all outcomes, positive and negative;

Avoid blaming others or external circumstances for failures; and

Focus on how your actions, decisions, and mindset influence results.

Vance did not escape his hometown’s cycle of poverty and addiction entirely on his own. He attributes much of his success to the stability his Grandma gave him as a child. Vance’s Mom struggled with addiction and was partnered to a revolving door of men. Vance would often escape the relative stability and normalcy of his Grandma’s house.

The takeaway for me was the power of family, loyalty, and unconditional love. Vance’s Grandma was not without flaws, as this book makes clear. But her devotion to Vance gave him just enough stability to overcome all of the other challenges he faced.

Matt

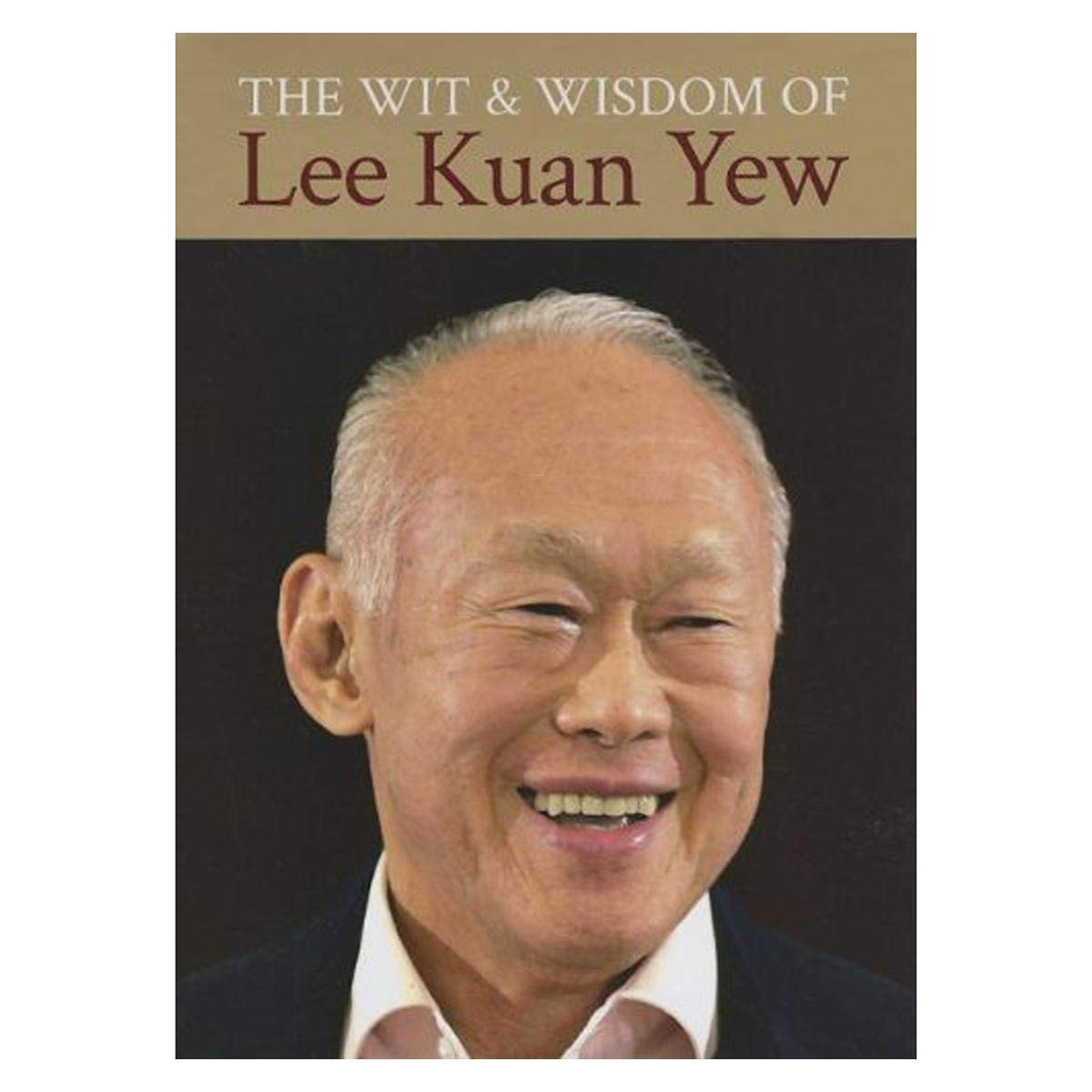

The Wit and Wisdom of Lee Kuan Yew

Lee Kuan Yew is the founding father of modern day Singapore. He brought the country out of poverty and foreign control in the 1950s and transformed the small nation into one of the world’s fastest success stories. This book is a little different that a traditional novel or biography; it’s a collection of quotes and passages from Lee Kuan Yew and is grouped by category.

The publisher scoured speeches, interviews, and papers over several decades and selected quotes delivering wisdom about politics, family, education, relations with China, and just about everything else you can think of.

It’s no wonder Munger had a literal sculpture of Lee Kwan Yew in his home, and as Munger described in an interview:

“Lee Kuan Yew had the best record as a nation builder," Munger explained. "He had the probably the best grade record that ever existed in the history of the world. He took over a malarial swamp, with no army … And pretty soon, he turned that into this gloriously prosperous place.”

Furthermore, Munger added, “his method for doing it was so simple. He said, 'Figure out what works and do it.' Now it sounds like anybody would know that made sense. … he was a very smart man, and he had a lot of good ideas and he absolutely took over a malarial swamp and turned it into modern Singapore in his own lifetime. It was absolutely incredible.”

This book is a great primer on Yew’s overall philosophy towards life and politics and the views he held that helped make him so successful. I’m working through his actual autobiography now so more to come on the Singapore story.

Dan

The Best Of The Rest

Seth Godin: Understanding Pricing.

“The price paid will always be less than the value it creates for the purchaser. And the price is never more than the amount the purchaser can exchange.”

A brief history of Huy Fong Sriracha.

David Tran escaped Saigon in 1975 with 100 ounces of gold. He sold some in LA to begin production. Now his business is worth over a billion dollars.

NYT: The Sidewalk Fruit Vendor Who Sold a $6.2 Million Banana for 25 Cents.

A 74-year-old immigrant who works outside Sotheby’s shares a basement in the Bronx and works 12-hour shifts. He was stunned to hear what his banana went for at auction.

Auto Care On Air (Podcast): Brad Beckham, CEO, O'Reilly Auto Parts

Quartr: Chris Mayer on Dividends, Noise, and the Power of Reinvestment

Chris explains his thesis for his latest investment, Computer Modeling Group.

“The other big mistake is weighing way too heavily things that are happening now. It's funny, I keep an investment journal. And I keep good notes on companies I'm invested in. I comment on the quarterly reports and such. And looking back on these notes is always enlightening. Because I an can clearly see how so little of the details mattered. The concerns of the day dissolve into nothingness over a period of years. And yet they seemed so important at the time.”

WSJ: Stores Adapt to an Online World

The potential for an amazing deal attracts even millionaires who could otherwise afford to pay market rate for luxury items. TJX’s middle-and lower-income customers shop there because it is affordable and a form of entertainment.

Bloomberg: This Is What the World’s First All-EV Car Market Looks Like

Cars in Norway have been gradually getting older as people hold on to conventional models, even if they’re not buying new ones. The average age of a gasoline-powered car has risen to 19 years from 16 in 2020. It’s a similar story for diesels, according to OFV, the national road federation.

Sales of second-hand conventional models have decreased this year, signaling that people are keeping them. Even so, the numbers are declining, with 1 million fewer gasoline cars on the road in Norway compared with 20 years ago. And they’re being used much less, covering a quarter of the miles and consuming 70% less fuel.

Related: WSJ: Our Cars Have Never Been Older

Bloomberg: Worried About Stocks? $1 Trillion in Buybacks Will Help

The S&P 500’s buyback yield peaked at 4.7% in 2007 and has trended lower ever since, landing at 2% last year.

Over the long run, stock returns come from mainly two sources: distribution of profits, traditionally in the form of dividends, and earnings growth. The S&P 500 and its predecessor index generated a total return of 9.3% a year since 1871. Of that, 4.6% came from dividends and 4.1% from earnings growth, while change in valuation contributed just 0.6%. (Changes in valuation grab a lot of attention and can have a big impact on total return in the short and medium term, but they’re mostly noise over the long term.)

Flyover Stocks: A Common Misconception About Buffett

Buffett is more interested in generating returns from fundamental growth (dividends and earnings) than speculative returns (change in multiple).

Bloomberg: We’re Burning More Coal Than Ever Thanks To China

Bloomberg: Amazon Delays RTO Mandate for Thousands of Workers Due to Space

There’s now a shortage of the high-quality space typically leased by tech companies.