Progressive: A Low Cost Producer

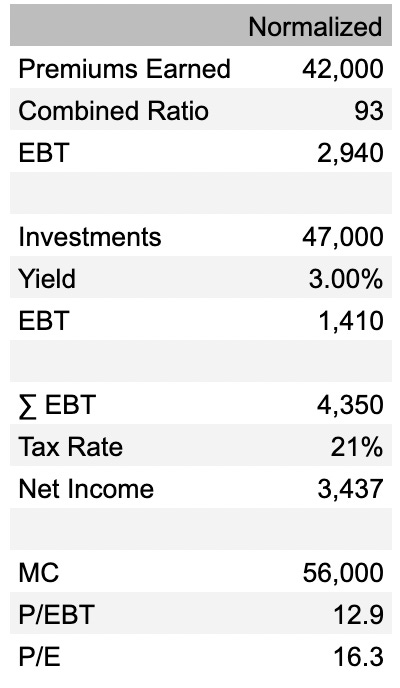

Progressive is the third largest auto insurer in the US. Jack Green and Joseph Lewis founded the company in 1937 in Mayfield Village, Ohio. In 1956 Peter Lewis, Joseph Lewis’s son, re-focused the company on insuring risky drivers with lots of accidents. The company aimed to minimize losses rather than expenses. To that end, it became an early mover in data collection and analysis.

In the late 1980’s, competition in Progressive’s niche intensified. The company responded by focusing on minimizing expenses rather than losses. This was the beginning of Progressive’s status as a low-cost producer.

Throughout its history, Progressive has lived up to its name with progressive thinking. In 1997, it became the first to sell insurance over the internet and the first to offer 24/7 claims reporting. It was also the first to quote drivers different rates based on the model of their car and credit rating. More recently, the company has leaned into telematics to measure braking, lane changes, and speed and further refine its underwriting.

These efforts have rewarded shareholders. Since its April 15, 1971 IPO, Progressive’s stock has compounded at 20.5% versus 9.9% for the S&P 500. 100 shares purchased at the IPO price for $1,800 would be worth over $19 million today.

Progressive’s stock has returned nearly 200,000% since 1980. Perhaps even more remarkable, the company has had only three CEOs over the last half century: Peter Lewis (1965-2000), Glenn Renwick (2001-2016), and Tricia Griffith (2016-Present).

Progressive’s structurally low costs and the large, fragmented U.S. auto insurance market suggest the company still has a long way to go. The company is squarely in replication mode and its future looks bright.

Industry

Auto insurance is required by law, which makes it an attractive, non-cyclical market. Consumers typically purchase auto insurance based on price, brand awareness, and an agent’s advice. Since policies are more or less the same everywhere, price is the biggest differentiator. Progressive’s low cost structure allows it to offer policies cheaper than almost anyone, giving it a major competitive advantage.

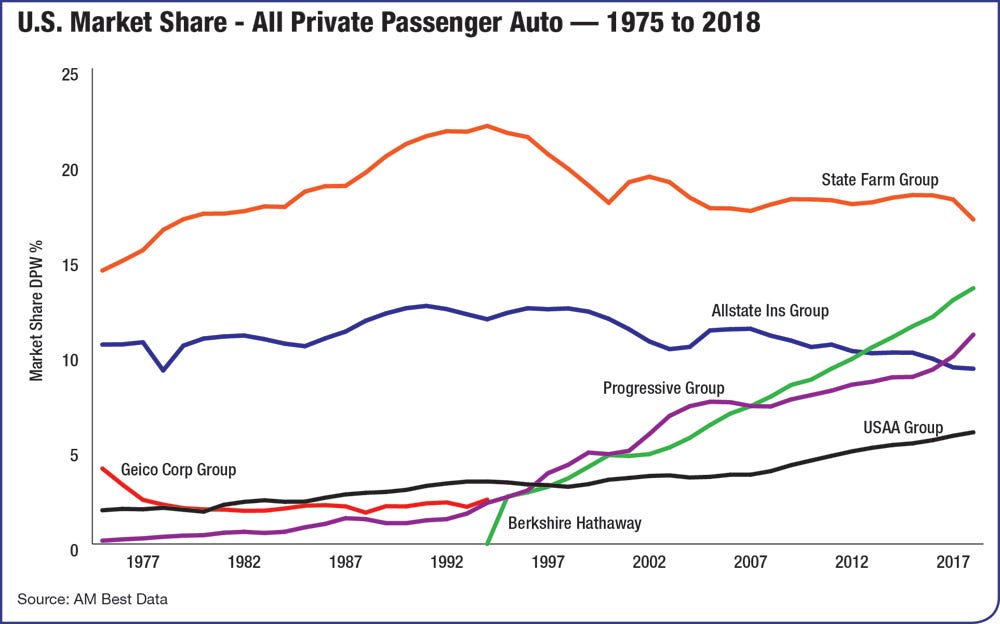

The American auto insurance market is mature and only likely to grow at an inflation-like rate over time. However, the market is fragmented, with the largest player (State Farm) having less than 17% share. Progressive and GEICO, the industry’s two low-cost operators, have consistently gained share over the years and are likely to continue doing so.

How Insurers Make Money

Insurance companies make money in two ways: underwriting and investing. Since insurance policies are paid up front, insurers can invest the premiums until they pay out a claim. If they collect more premiums than they pay out in claims, they’ve earned an underwriting profit.

Profit = Earned Premiums + Investment income – Incurred Losses – Underwriting Expenses

The auto insurance industry as a whole loses money on underwriting. They rely on investing to turn a profit. Progressive is one of the exceptions. Since 2010, it has averaged a 7.5% underwriting profit with no losses. Only GEICO has a similar track record of underwriting profits.

An insurer’s combined ratio is the complement of its underwriting margin. It’s also the sum of the loss ratio and expense ratio. The loss ratio is driven purely by underwriting, while the expense ratio is driven by the company’s overhead.

Loss Ratio = Total Incurred Losses / Total Collected Insurance Premiums

Expense Ratio = Percentage of premiums used to pay all the costs of acquiring, writing, and servicing insurance and reinsurance.

Progressive aims for a 96 combined ratio (i.e. 4% underwriting margin) while growing as fast as possible. Historically, they’ve earned more than intended on underwriting, averaging a 93 combined ratio.

At first, this might appear unapologetically good. However, the reality is more nuanced. The higher Progressive’s combined ratio, the cheaper its policies are to consumers. Since price is the most important factor when a consumer buys auto insurance, low prices drive growth. This means that large underwriting profits come at the expense of faster growth. Insurance is an unusual industry in that rapid growth is usually bad — it suggests the insurer has mis-priced their risk. Progressive thinks a 96 combined ratio strikes the right balance between the profitability and growth. In their own words: "It creates a good balance between attractive margins and competitive rates for customers."

Low Cost Producer

In a commodity business like auto insurance, the operator with the lowest costs usually wins. They can price below their competitors’ breakeven and still earn a profit. Progressive has a cost structure that’s lower than all of its competitors but GEICO.

Expense Ratio

An auto insurer’s sales channels have the largest effect on their expense ratio. GEICO has a low expense ratio because 100% of its business is written directly over the phone and internet. GEICO has no agents to pay a commission or salary.

Allstate has a higher expense ratio because it relies 100% on captive (in-house) agents to write its policies. They need salaries, commissions, health care, office space, etc.

Progressive lies in the middle. They write 42% of premiums directly and 58% through independent agents. Most insurers pay independent agents a 15-20% commission. Progressive only pays 10%.

This minimizes costs but can create a conflict of interest for the independent agent. If the agent can sell a different policy that’s only slightly more expensive, they can earn a 50% pay raise (15% commission vs 10%). As a result, Progressive has lower retention (i.e. higher churn) through its independent agents than other insurers do.

If a direct sales channel is the cheapest, why doesn’t everyone do it?

It comes down to incentives. Companies with captive agents like Allstate would see rebellions in their ranks if they started undercutting their own agents prices, cutting them out, and dealing directly with customers.

There are only three auto insurers with sizable direct sales channels: GEICO, USAA, and Progressive. USAA and GEICO have sold 100% direct from day one. Progressive was able to introduce a direct offering despite its independent agents because:

They already paid below-average commissions, which dis-incentivized agents from selling their policies unless Progressive was their only option.

Progressive writes a lot of policies to high-risk drivers who have few other options.

Progressive provides its independent agents best-in-class technology to make doing business with them is seamless. The company’s competitors don’t have the scale to invest in tech like Progressive.

In other words, Progressive was able to build a direct sales channel because its independent agents had no choice but to continue doing business with it. That’s not true of State Farm or Allstate.

Today the direct sales channel is highly consolidated with just three companies carrying more than 75% of the share. GEICO leads with about 45%, while Progressive and USAA have about 20% each. USAA only writes insurance for military members, which limits their potential growth. GEICO is therefore Progressive’s most important competitor.

Insurers with direct sales channels are well positioned to benefit from the pandemic’s shift towards e-commerce. Over time, Progressive’s sales mix will continue shifting towards its direct business. This should cause Progressive’s expense ratio to converge with GEICO’s. However, GEICO will always remain ahead since it already has a 100% direct sales mix. As the low cost leaders, these two companies will continue to take share and should eventually become the #1 and #2 insurers by market share. Progressive and GEICO together get 50% of first-time buyers business.

Scale

Scale is another factor affecting expense ratios. Insurers that write more premiums can spread the cost of software and advertising across a larger base. The chart below shows that Progressive spends the most on advertising among the major auto insurers. GEICO isn’t pictured since its parent company, Berkshire Hathaway, doesn’t explicitly disclose GEICO’s advertising expenditure. Estimates suggest GEICO spends slightly more than Progressive, however. State Farm has write more premiums than Progressive and GEICO, but (presumably) spends less on advertising because it relies on expensive captive agents to sell policies.

Loss Ratio

An insurer’s loss ratio makes up the other half of its combined ratio. Historically, GEICO has operated with a lower expense ratio and higher loss ratio than Progressive. GEICO’s goal is to achieve “costless” float (i.e. 100 combined ratio) that Warren Buffett can invest. GEICO invests more aggressively than Progressive, with a large allocation to Buffett’s stock picks. GEICO can afford to invest more aggressively because Berkshire Hathaway is so over capitalized and backed by operating cash flows from assets like the BNSF railroad and Mid-American Energy.

Progressive invests more conservatively, primarily in investment-grade bonds along with some equity indexes. Today Progressive’s portfolio is 91.5% fixed income and 8.5% equities. Progressive writes more premium relative to its capital than most insurers, including GEICO, which would magnify their loss of capital if they had an underwriting loss. Progressive leaves room for error by targeting a 96 combined ratio vs GEICO’s 100.

The two key variables affecting pricing are forecasts of accident frequency and severity. The chart below shows that severity has been trending higher while frequency has been trending lower. Excluding 2020, where a lack of miles driven contributed to a huge drop in frequency, frequency is relatively flat (down 5% vs 2009). Accident frequency declined regularly until about 2011, when the rise of smart phones and distracted driving lead to increases.

In 2008 Progressive began using telematics to help price their risk. Drivers can elect to use Progressive’s Snapshot device to measure their driving habits in exchange for a discount. Over the intervening years, Progressive has collected tens of billions of miles of driving data, which it uses to segment its customers and price risk more granularly. GEICO was slow to adopt telematics and has lost some share to Progressive as a result. In 2019, GEICO threw in the towel and started their own telematics program.

Leverage

In addition to deciding how to price insurance, insurers need to decide how much insurance they can write. Progressive aims to write $2 of premiums for every dollar of their capital. Debt averages 25-30% of capital, which means premiums to equity average 2.7x. Most insurers write closer to 1-1.5x their capital.

Progressive can get away with higher underwriting leverage because they rarely exceed a 100 combined ratio. The industry as a whole doesn’t usually underwrite that well and doesn’t want to magnify underwriting losses with leverage. Progressive has only exceeded a 100 combined ratio twice in recent history: 1991 and 2000. In both instances, they lost 5% on underwriting, which would have cost them 10% of their capital at 2x leverage and 14% of equity assuming 30% of their capital was debt.

Progressive’s leverage means that unprofitable underwriting is the key risk facing the company. For example, a 112 combined ratio, 2x leverage, and 30% debt-to-capital would erase 30% of the company’s equity. Fortunately, Progressive has a multi-decade history of profitable underwriting. Using history as a guide, Progressive is only likely to lose money on underwriting once every ten to twenty years. And those losses will be at least partially offset by income from their conservative investment portfolio.

Capital Allocation

Since its 1971 IPO, Progressive has consistently paid dividends and repurchased shares, all the while growing and gaining market share.

In 2007, Progressive implemented a variable dividend policy. Rather than pay a steadily quarterly sum, regardless of business results, Progressive uses a formula to relate its business performance to its divided. This is highly rationale, but rarely done.

Progressive also repurchases shares in order to offset dilution from its equity-based compensation programs and return any under-leveraged capital to shareholders. Since 1971, the company has spent $9.2 billion repurchasing shares, at an average cost of $7.63 per share (the stock trades for $95 today).

Over the last ten years, Progressive has paid out about 40% of profits and retained and reinvested the remaining 60%. Since 2005 shares outstanding have shrunk 2.5% per year and the stock’s yielded an average of 1.6% for a total shareholder yield of about 4%.

Forward Returns

If Progressive earns its target 96 combined ratio and leverages itself 2.7x to its equity it should earn a 10.8% ROE from underwriting. It’s investment portfolio yields about 2-3%, which brings its expected ROE to 13-14%.

If Progressive were to continue reinvesting 60% of its profits at 14%, it’d grow 8.4% per year. Adding a 4% yield for dividends and buybacks brings expected total returns to 12%. Incidentally, this is the same expected return Francois Rochon of Giverny Capital told Value Investor Insight he expects.

Most likely, Progressive will do even better. Though the company aims for a 96 combined ratio, its averaged 93 over the last decade. A repeat would bring its ROE to 22% (=7*2.7+3) and forward returns to 17% (=0.6*22+4). If interest rates rise, Progressive’s returns will go even higher. In 2018 when interest rates rose Progressive’s investment income rose 46%.

Progressive also has upside if they can improve their retention (i.e. reduce churn). They’re trying to do this by bundling home and auto insurance. Today Progressive’s small homeowner’s insurance line loses money, but likely makes up for it with improved auto insurance retention. As the program grows, retention should increase. As the program matures, it ought to at least earn a 100 combined ratio.

Valuation

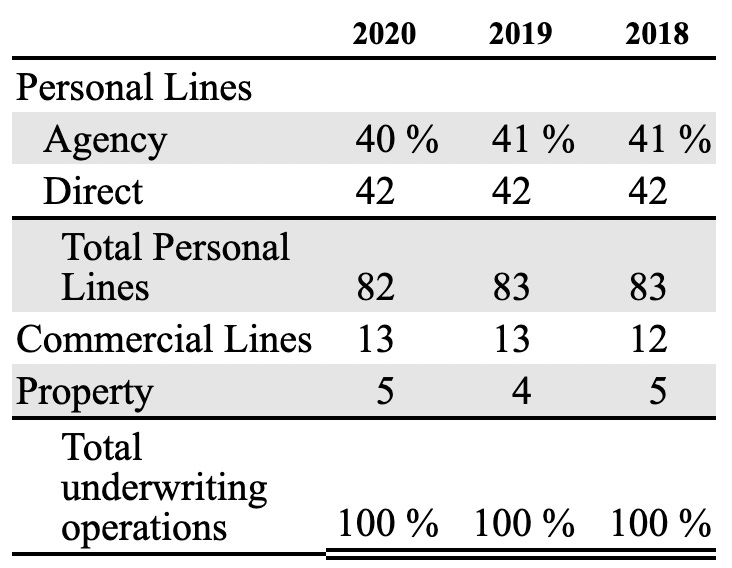

Progressive’s currently trades for 16x its normalized earnings power. The key assumptions are a 93 combined ratio and 3% investment yield (current is 2.4%).

Notably, my estimate of Progressive’s normalized earnings power comes in below its actual 2019 and 2020 results. 2020 was particularly profitable for Progressive because accident frequency and churn were so low. In 2019, Progressive earned a 91 combined ratio, versus the 93 I assumed.

Historically, Progressive has traded between 12-18x earnings. At 16x, it’s currently right in the middle. Here the stock looks like a wonderful business at a fair price. Had investors merely paid a fair price for Progressive at any time in its past, they were richly rewarded.

Risks

There are the key risks to realizing these forward returns.

First, their customer acquisition cost could rise. Progressive has been able to grow rapidly because they’ve enjoyed exceptional returns on their advertising. It’s possible, however, that they eventually reach a point where the low hanging fruit has been picked.

On the other hand, Progressive is an entrenched low-cost producer who can beat almost anyone’s rates while remaining profitable. At the end of the day, prices speak for themselves in auto insurance, which is why Progressive has a multi-decade track record of growing its market share.

Second, a series of underwriting errors could erode Progressive’s capital and require it to raise dilutive equity at unattractive prices. Warren Buffett recounts how underwriting errors nearly killed GEICO in the early 1970s:

Between 1936 and 1975, GEICO grew from a standing start to a 4% market share, becoming the country’s fourth largest auto insurer. During most of this period, the company was superbly managed, achieving both excellent volume gains and high profits. It looked unstoppable. But after my friend and hero Lorimer Davidson retired as CEO in 1970, his successors soon made a huge mistake by under-reserving for losses. This produced faulty cost information, which in turn produced inadequate pricing. By 1976, GEICO was on the brink of failure.

Progressive has as much data and processing power as anyone in the auto insurance industry, so a failure to underwrite properly would likely require a cultural breakdown. That’s unlikely given the company’s steady management (only 3 CEOs since the 1950s) and cost-consciousness. In fact, Progressive’s entrenched culture is probably its greatest assets. Over very long periods of time, culture drives stock market outperformance.

Third, a significant drop in accident frequency could reduce premiums per policy. In theory, we may someday see a world where 100% of cars are self-driving and never crash. I suspect we’re unlikely to see that in our lifetime. If trains and planes aren’t even full self driving, we have a ways to go before cars are. In the interim, increases in accident severity (due to more complex sensors and lighter materials) have more than offset decreases in frequency.

Summary

If you look at Progressive, the auto insurance company, they've gained market share in the last 20 years and they're as strong, their model is as strong today as it was 20 years ago. There's many technology companies you can't say that at all. How durable is the competitive advantage is a key question you have to ask when you invest in any security.

Progressive is an entrenched low-cost producer in the American auto insurance industry. It’s hard-to-replicate direct sales channel gives it a cost advantage over larger rivals like State Farm and Allstate. The company has a multi-decade history of profitable underwriting, conservative investing, and market share gains. The company is in replication mode with a long runway ahead of it. Progressive looks capable of producing low to mid teens total shareholders returns for the foreseeable future. The stock trades in-line with its historical valuation, and at a discount to the broad market.

If you would like to invest with Eagle Point Capital or connect with us, please email info@eaglepointcap.com. Thank you for reading!

Disclosure: The author, Eagle Point Capital, or their affiliates may own the securities discussed. This blog is for informational purposes only. Nothing should be construed as investment advice. Please read our Terms and Conditions for further details.