I bet you’ve been dying to know who supplies the fire retardant that is dropped out of airplanes over wild fires. Good news because you’re about to find out.

Background

Perimeter Solutions is the monopoly provider of fire retardant that is used to fight wild fires in the western U.S. and around the world.

Perimeter was taken public in late 2021 by EverArc holdings, a publicly listed acquisition company (like a SPAC but with fully committed capital). EverArc is spearheaded by the legendary Nick Howley, the less-legendary-but-very-talented William Thorndike, in addition to Buffett’s former protégé Tracy Britt Cool.

A side note on the directors:

Nick Howley has one of the best investment records of any CEO of all time having returned around 30% annually (including dividends) for several decades since taking over Transdigm in the 1990s. For a complete history of Transdigm, I highly recommend listening to the 50x podcast about the business. Since going public in 2006 investors have made 26x their money before taking into account the considerable special dividend distributions collected along the way. Matt wrote a great piece about the business a few years ago.

William Thorndike quite literally wrote one of the definitive books on capital allocation called The Outsiders, which we reference frequently.

Tracy Britt Cool worked as Buffett’s right-hand woman for a decade before going out on her own to attempt to replicate the Berkshire playbook on a smaller scale.

Thorndike and Howley are good friends and formed the acquisition company to hunt for a business that they thought could replicate the Transdigm playbook to some degree. After some searching they found a business that fits what they were looking for; Perimeter Solutions.

Combine an all-star board with a niche monopoly business and things get interesting very quickly with Perimeter Solutions.

Business Overview

Perimeter Solutions is managed in two segments; fire safety and oil additives. The fire safety segment is the driver of the business and is split between fire retardant, firefighting foams, and custom equipment and services. The oil additives segment is a high quality but no-growth product line that sells niche oil additives that result in better engine function and longer engine life. In this post I’ll focus on the fire safety segment which is 85%+ of the company’s earnings, and drives its intrinsic value.

Fire Safety

Fire retardant is the red powder dropped from planes to help slow the spread of wild fires. Retardant is dropped ahead of forest fires and chemically alters vegetation to make it less flammable. This gives ground crews a chance to catch up with and extinguish forest fires.

The fire retardant brand PHOS-CHEK® was developed by Monsanto in the 1960s and through a series of acquisitions and spinoffs, Perimeter Solutions was ultimately formed when ICL carved the company out to private equity ownership in 2018. EverArc purchased the business from SK Capital Partners in 2021.

What has emerged is the dominant player in fire suppression chemicals.

In addition to fire retardant the company sells specialty class A, class B, and class A/B firefighting foams which are used to fight structural fires, flammable/combustible liquids fires, and a combination thereof, respectively. The much smaller foam business is high quality but subject to a bit more competition than the retardant segment.

Competitive Position

The best way to analyze Perimeter’s competitive position is through the lens of the attributes Howley & co. were looking for when they launched EverArc. Specifically, the team was hunting for a business that met the following five characteristics:

1. Recurring and predictable revenue streams;

2. Long-term secular growth tailwinds;

3. Products that account for a critical but small portion of larger value streams;

4. Significant free cash flow generation and high returns on tangible capital;

5. Potential for opportunistic consolidation.

Perimeter scores highly on all marks.

Recurring and Predictable Revenue Streams

The fire retardant business is incredibly entrenched. For starters, Perimeter Solutions is virtually the only player that supplies retardant to governmental firefighting agencies. There just aren’t other competing products out there that work as well and are likely to unseat Perimeter. It’s not for lack of trying, though. As the CEO put it on last years’ earnings call:

Let me now touch briefly on our market position. Hardly a day has passed over the last 15 years without someone trying to qualify and sell a competing retardant product. Some have attempted to compete quietly while others have done so quite loudly. What has remained consistent is that no one other than Perimeter has sold a commercially significant amount of retardant and not one of our historical would-be competitors is active in the market today. We are sure that other aspiring entrants will come and go in the future. And while we always take potential competitors very seriously, we are as confident as ever in our long-term market position.

This quote was just a longer way of saying that Perimeter Solutions enjoys a monopoly that has stood the test of time.

The switching costs are immense in this business for a couple of reasons. First, regardless of the type of business, the government is not quick to switch suppliers once they have one qualified and have a history of success. When it comes to matters that involve loss of life and property, such as fighting wildfires, the switching costs are amplified by many multiples. The risk/reward for the government for switching from a known, and effective, product, to a new supplier just to save a few bucks is just not something that is going to happen in all likelihood.

Next, Perimeter is deeply engrained into the firefighting supply chain. In addition to manufacturing the retardant, Perimeter sells the equipment used in and the logistics of storing, transporting, and loading the retardant at a moment’s notice. When fires break out and retardant is needed, Perimeter springs into action in conjunction with firefighting crews to get the product where it needs to be and loaded onto air tankers. This is a complicated process and has a high cost of failure. Switching fire retardant suppliers would also entail ripping Perimeter out of the supply chain, something that strikes me as exceedingly unlikely.

It’s pretty clear the quality of revenue is very high here.

Long-term secular tailwinds

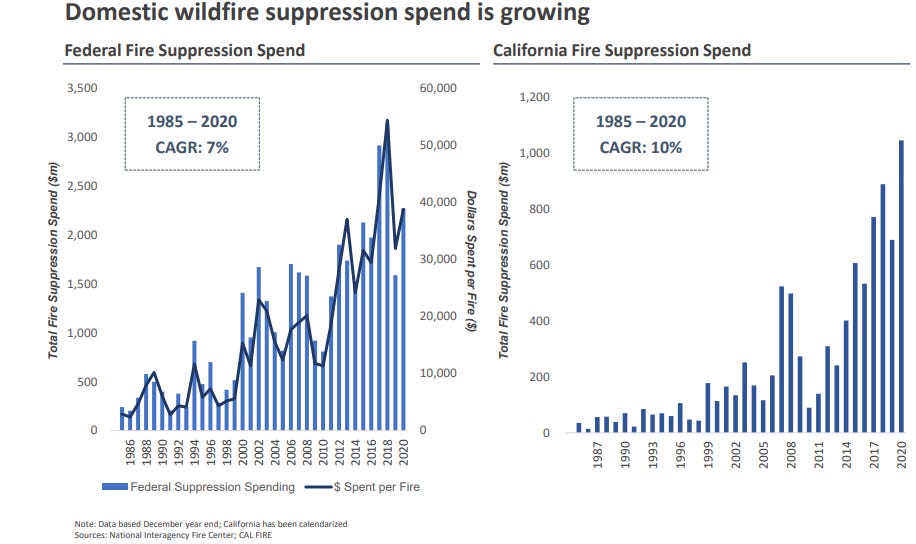

Federal fire suppression spend and California fire suppression spend (Perimeter’s top customers) have compounded at 7% and 10% annually since 1985. Since 2010, fire retardant volume has compounded at roughly 10% annually. There are three reasons for these secular trends.

First, more acres burned per year and longer fire seasons are driving increased demand for fire suppression products. Since the 1980s both of these factors have caused a steady increase in wildfire damage over rolling five year periods (any one year can be pretty random).

Next, there is an increasing overlap between wildlands and urban areas. As people increasingly encroach on the edge of forests, the wildfires need to be fought more vigorously as they cannot just burn themselves out as would be the case when fires start in the middle of nowhere with no structures in sight.

Finally, there has been a dramatic increase in firefighting airtanker capacity. For years, the bottleneck in fire retardant usage was caused by lack of aircraft capacity to carry and drop the retardant rather than lack of product availability or demand. Since 2010 aircraft capacity has increased significantly; a trend that is expected to continue.

Small into Big

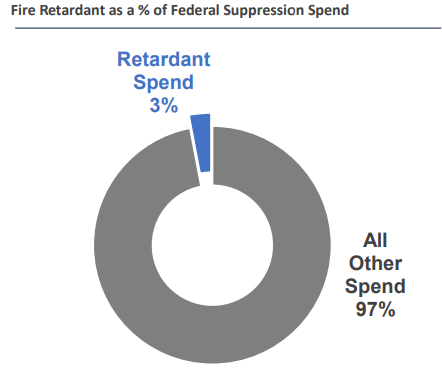

Transdigm famously acquired aircraft parts that were a small sliver of the overall spend of an aircraft but critical nonetheless. This conferred major pricing power. Fire retardant comprises a low-single-digit percentage of fire suppression spend, but is a critical component of firefighting.

This leaves a lot of room for price increases and allows the company to fly under the radar with regards to pricing power. The company describes their pricing strategy as “Value Based Pricing”. This is just a euphemism for raising prices on a product that delivers a lot of value compared to the overall cost. I expect the board to push this angle hard.

Historically the business has increased prices in the mid-single-digit range annually (well ahead of historical inflation). In today’s high inflation environment, the company is passing price along without issue. From the August earnings call:

We're experiencing significant raw material inflation in 2022. As expected, we're successfully passing on this inflation through contractual mechanisms in place across the vast majority of our Fire Safety business.

Free cash flow generation and returns on tangible capital

The business generates around $60M of free cash flow on roughly $110M of tangible capital (fixed assets and net working capital) for a 50%+ return on tangible capital. The business is highly cash generative with capital expenditures comprising just 2% of revenue.

Opportunistic Consolidation

Perimeter has a long history of bolt-on acquisitions in the fire safety segment, and the board is likely to continue hunting for complementary businesses that demonstrate the above four characteristics.

Growth and Returns

Howley and Thorndike have noted that they aim to deliver “private equity returns in the public market” with Perimeter Solutions, which they define as high-teens annual returns.

As noted above, the fire suppressant market is driven by a few main variables, each easily trackable over time. I was surprised to see the historical growth of such a niche market, yet it doesn’t seem likely to slow down anytime soon.

The algorithm to delivering those returns looks something like this:

Volume for retardant should grow at high-single to low-double-digit percentages each year. This would be consistent with the long-term trend of government spending. Pricing provides an additional tailwind to revenue and when combined with volume growth (and flat revenue in the additives business) overall revenue growth should be around 10-12% on average. This would be consistent with historical performance.

Per management, margins should expand 100-200 bps annually for the foreseeable future thanks to the fixed cost nature of manufacturing retardant and the effect of increasing prices (which is revenue growth that requires $0 of spend).

Taken together you have 7-9% volume growth, 4-6% pricing growth, and 1-2% margin expansion for 12-17% compounding over long periods of time before considering any capital return benefit, which is sure to come.

The business has a long international runway as well. Acres burned per year are increasing around the world and countries like Australia, Chile, and Greece are just beginning to adopt Perimeter’s fire retardants. Additionally, the company is seeing green shoots in its nascent prevention and protection product portfolio. Management believes this could represent another material growth opportunity.

It is important to remember that annual results can be lumpy and a bit random as fire seasons will ebb and flow. The overall trend of more acres burned, longer fire seasons, an increasing urban/wildland interface, and an emphasis on increased airtanker capacity are all very likely to contribute to long-term growth.

Director Haitham Khouri confirmed this growth algorithm and forward returns expectations last November:

We expect Perimeter to grow consolidated revenue approximately 10% and to grow consolidated adjusted EBITDA in the mid-teens prior to any significant capital allocation or capital structure actions. Note that these outcomes are generally in line with the company's historical performance.

And we shouldn’t ignore the upside from capital allocation considering who is running the show. Perimeter already instituted a $100M buyback authorization to opportunistically repurchase shares. They briefly began buying back shares when the stock dipped into the $8 range this June, an opportunity that proved short-lived. Special dividends, share repurchases, and opportunistic acquisitions are surely in the playbook for years ahead and should be accretive by at least ~3% per share at present prices. I would be more confident than most businesses that capital allocation creates significant value given the track record of Howley, Thorndike, and Cool.

Valuation

Perimeter is a little pricey at present (and very pricey on headline financials). GAAP financials don’t reflect economic reality thanks to large noncash amortization charges relating to historical customer lists, so I value the business on a free cash flow basis (like pretty much every business we study).

Perimeter generated around $60M in free cash flow last year and at the current market cap of $1.87B it trades for a 3% free cash flow yield. While ~30x earnings is expensive, the stock is down about 20% from where Thorndike and Howley took it public, and the quality and durability of the business deserve a premium valuation.

If the business can execute and deliver high-teens per share returns for the next decade or more, as the management team and board intend to, today’s prices will look like a steal in hindsight. Even if the multiple compresses from 30x down to 20-25x returns would still be in the mid-teens annually over a decade and investors would earn multiples of their invested capital. I would still prefer a margin of safety to protect against the unknown, but it’s an interesting business to keep an eye on.

The stock is small and underfollowed, which could lead to significant volatility and an opportunity to acquire shares at bargain prices during a slow fire season or other periods of temporary headwinds that will undoubtedly arise.

If you would like to invest with Eagle Point Capital or connect with us, please email info@eaglepointcap.com. Thank you for reading!

Disclosure: The author, Eagle Point Capital, or their affiliates may own the securities discussed. This blog is for informational purposes only. Nothing should be construed as investment advice. Please read our Terms and Conditions for further details.

Do you think the crazy compensation for Howley and co. truly makes them aligned with investors? As I heard someone else put it, it feels like a "heads, I win big, tails, I still win" type of thing. They get over 2 million shares p/year regardless of performance and then something like 18% of share price increase each year computed using the original share count of ~150 million shares (and this bonus will be in effect every year for basically ten years) -- and it's not subject to a high water mark, to put it in hedge fund terms. It seems like an insane amount of compensation for people who aren't even full time managing the business (they're on the board). Last year their comp. was easily over 100 million. They could be completely awol and still do quite well for themselves. Anyway, I know none of that has to do directly with the business operations but it's still something that keeps me up at night a little with this one which I've owned since it was the EverArc "spac".

Seeking clarification on a prior comment here - the way I read the agreement is that there is in effect a high water mark ("over the highest"). Am I reading this wrong? (Not that they are clearly taking more than a pound of flesh here ...)

"Thereafter, the Variable Annual Advisory Amount will only become payable if the Payment Price during any subsequent Payment Year is greater than the highest Payment Price in any preceding Payment Year in which an amount was paid in respect of this Agreement. Such Variable Annual Advisory Amount will be equal in value to eighteen percent (18%) of the increase in the Payment Price over the highest Payment Price in any preceding Payment Year multiplied by the Founder Advisory Agreement Calculation Number."