Not often do we get the chance to watch Buffett consistently deploy meaningful capital into a situation in which anyone can also participate alongside Berkshire. Occidental Petroleum is a timely exception. Berkshire has been consistently purchasing stock in the company since early 2022 and now owns roughly 25% of the business, making it Berkshire’s sixth largest equity holding at around $13B.

Despite the fact that anyone can copy Buffett, and pay the same price he has paid for the stock – the stock price is within 10% of Berkshire’s initial purchase and they continue to buy at present prices – I find it curious that little is written about the business or the stock. I figured it was time to try to understand what he might be seeing. If you don’t want to read this whole article I think I could have summed it up by titling this post something like; Occidental Petroleum: value accruing to common shareholders.

Overview

Founded 114 years ago, Occidental Petroleum is an energy business with three main operating segments; oil and gas, chemical and midstream, and marketing.

The oil and gas segment explores for, develops, and produces oil, natural gas liquids (NGLs), and natural gas and has a heavy presence in the Permian basin. The chemical segment manufactures basic chemicals and vinyls such as caustic soda, chlorine and PVC. The midstream and marketing segment purchases, markets, gathers, and transports fossil fuels. Within the midstream and marketing segment is the nascent Occidental Low Carbon Venture business (OLCV) which is a recently formed and leading carbon sequestration venture.

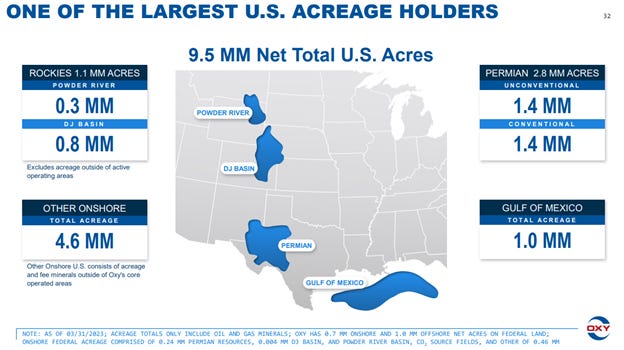

The main driver of the business is the oil and gas segment, which is in turn powered by a significant presence in key US geographies. The company owns over 9.5MM acres in the US of which about 8.5MM acres are onshore. Oxy has an international segment operating in Africa and the Middle East that account for around 20% of the oil and gas segment profits. In 2022 the oil and gas business (domestic and international) earned $12.8B, or about 82% of the company’s profits.

The chemical segment (OxyChem) earned $2.5B last year which represented about 17% of operating profits, and the midstream and marketing segment represented a nominal ~2% of profits.

I’m going to focus on the oil and gas business for the most part, but below is a historical look at OxyChem and its associated economic drivers. They’ve been minting money recently, but I wouldn’t count on that continuing at quite as high of a level through the cycle given current favorable commodity prices.

Anadarko Acquisition

In 2019 Occidental transformed the business with the controversial $55B (including assumed debt) acquisition of Anadarko. Occidental outbid Chevron with the help of a $10B preferred equity investment from Berkshire that helped seal the deal at the 11th hour.

Pre-acquisition Occidental operated in the Permian and internationally. The acquisition bolstered Occidental’s position in the Permian and added a significant presence in other U.S. segments and effectively reduced its dependence on international markets. Here is what Oxy’s footprint looks like in the U.S. today.

To say that this massive merger was ill-timed is an understatement. When oil prices tanked to -$37/barrel (I’m still trying to figure that one out) amidst the pandemic chaos, Occidental’s business was on the brink. The company took on a boatload of debt to get the deal done and with commodity prices depressed it was unclear whether or not the business could generate enough cash to service its debt (and Berkshire’s preferred equity) in the years ahead. Hence the stock collapsed from around $45 when the acquisition closed to less than $10 during 2020.

Yet, here we sit a few years later with the stock back at $60, the balance sheet repaired, and one of the more generous capital return programs around solidly underway. Is this result attributable to luck or managerial skill? As usual, the answer is some of each.

Clearly Occidental’s business is dependent on commodity prices and the risks that come with that (see 2020) which is something we generally shy away from given the lack of control over key inputs. The business is still intriguing, though, given its competitive position and, most importantly, capital allocation framework and incentive structures.

The combination of shrewd management, lucky bounces in commodity prices, and the aforementioned capital return program has brought the stock up by 6x since the depths of the pandemic. Let’s take a look at what got the business here and if it can sustain the progress in the years ahead.

Competitive Position

There are really only a few ways to evaluate the attractiveness of businesses whose economics are heavily influenced by commodity prices. Either you a) have to have a view on the direction of the price of the commodity over some time period and/or b) have an idea of the relative competitive position of a player in the industry.

Because I have no idea how to forecast oil, natural gas, or any other commodity prices, whenever I’m reading about a commodity business I try to focus on their relative competitive position.

Specifically, I’m looking for low cost producers. Whether it’s insurance (Progressive and GEICO), homebuilding (NVR), automotive (Toyota), oil and gas (Occidental) or any other commodity space, the low cost producer is generally going to deliver the most durable returns for shareholders through commodity cycles.

As Buffett explained in 2006 and 2007, you want to look for management teams focused on delivering low finding and production costs.

In 2006 he said:

"If you have an oil-producing company, you want a management that, over a five- or 10-year period, discovers and develops oil at lower-than-average unit cost. There's been a huge difference in performance in that among even the major companies, and I would pay the people that did that well. I would pay them very well, because they're creating wealth for me."

And reiterated the point in 2007:

"If oil goes from $30 to $60 a barrel, there's no reason in the world why oil executives should get paid more for what's going on. They didn't get it to $60 a barrel. If they have low finding costs, which is under their control, I would pay like crazy for that. A person who finds oil and develops reserves at $6 a barrel is worth a lot more than somebody that finds and develops them at $10 a barrel, assuming they're similar-quality reserves."

Accordingly, this is what long-term investors ought to focus on. In energy, a few good indicators of low cost of production are spend per barrel and well efficiency. As you’ve probably guessed, Occidental scores highly in both.

The business enjoys a leading position in the Permian in terms of well performance and is 20-30% better than average.

Spend per barrel - calculated as the sum of capital spending, general and administrative expenses, other operating and non-operating expenses and oil and gas lease operating costs divided by global oil, NGL and natural gas sales volumes – is another area I would want management rigorously focused on. Occidental not only measures spend per barrel annually but it drives the vast majority of the executive’s annual cash bonus.

Per the most recent proxy, 70% of cash bonus compensation was driven by achieving per barrel spending targets. Oxy has a target of $23.25 per barrel and came in just under that last year.

Just the fact that the company talks about spend per barrel targets (along with return on cash equity, also in the proxy), let alone compensates executives on achieving these targets, signals that the business is likely a low-cost producer.

Well efficiency and a rigorous focus on controlling spend ultimately manifest themselves in lower breakeven costs and a greater resiliency to lower commodity prices. Currently Occidental enjoys breakeven oil prices of around $40/barrel (per company filings and communications) which are among the best in the industry and meaningfully below the current ~$75/barrel oil prices.

The answers vary depending on who you ask, but it’s likely that average breakeven prices are closer to $54 for US Shale producers. Any way you slice it, Occidental is almost certainly among the lowest cost producers in the U.S.

Other Things Buffett Probably Likes

There are a few other less obvious but still important factors I think Buffett likes about the business compared to most other oil companies.

First is the domestically-focused asset base that resulted from the Anadarko acquisition. Being in the oil business is tough enough without having to layer in trying to get oil out of the ground in politically unstable environments like so many of the major oil companies have to deal with when drilling abroad. I suspect the added level of predictability thanks to the largely domestic-only exposure is a big plus.

Another interesting dynamic is that Oxy does not hedge commodity prices. I can’t recall reading about any other energy business that does not use significant hedging. Buffett often talks about why Berkshire doesn’t hedge currencies or commodities, among other things, and generally it’s because he doesn’t believe it can be done skillfully over long periods of time (by anyone). Most companies hedge to appease Wall Street and smooth results, but it ends up as a net-drag on results (like unneeded insurance). I suspect that from a cultural standpoint he likes that they refuse to do this, and instead take the commodity prices as they come, knowing they’ll likely be better off (even if it’s not as smooth of a ride) over a 10 year period without incurring the costs of hedging.

Finally, Oxy has a mix of slow and fast decline wells. Part of the limited exposure they have abroad are operations in Oman, where they have slow decline wells that produce oil steadily. By contrast, in the Permian their production can be throttled up or down to take advantage of good oil prices or avoid selling oil at bad prices. This allows the business to grow production without commensurate growth in costs because the wells are already there.

It’s vitally important to operate with efficiency in a commodity industry, but perhaps equally as important (and of more intrigue to me) is effective capital allocation. It’s here where things get really interesting.

Capital Allocation

We look for management teams that clearly communicate their plans to allocate capital. Additionally, we want to easily see how the capital allocation plans will benefit common equity holders. Occidental lays this out as well as just about any company.

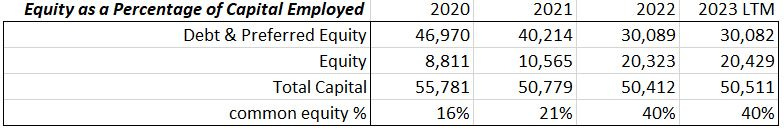

Coming out of the Anadarko acquisition the company was laden with debt – close to $50B including Berkshire’s preferred equity - putting equity holders in a precarious situation.

In determining the value of a company, debt holders stand first in line followed by preferred equity holders, with common equity holders at the back of the line. Assuming a company’s overall value (total debt + total equity value, or enterprise value) is relatively fixed at any given time, the more debt a company owes, the less value that’s left for equity holders. Accordingly, every dollar of debt or preferred equity that is reduced is effectively a dollar of value transferred to common equity holders.

Thanks to the rebound in oil prices since 2020 and Occidental’s ability to operate efficiently and generate significant cash, meaningful value has accrued to equity holders. CEO Vicki Hollub communicated in early 2022 that as soon as the company achieved its target leverage levels, they would start aggressively returning capital to shareholders via a growing dividend and substantial share repurchases. Over the past few years Occidental has repaid over $15B of debt and preferred equity, and that value has transferred to shareholders.

As you can see below, even though the overall capital employed hasn’t changed a whole lot since 2020, the value of the equity as a percentage of the overall capital has nearly tripled.

It’s been even more dramatic when you look at common equity as a percentage of Enterprise Value. Occidental management calls this “enterprise value rebalancing”, and tracks it annually in the below graphic.

It is no secret what the company plans to do with its cash going forward, here is a recurring slide to remind investors how cash will be allocated.

To reinforce the point, here are a few quotes from Vicki Hollub from the company’s last two earnings calls:

From the Q4 call in February:

“Our vastly improved financial position, even compared to 1 year ago, enables us to begin allocating a greater proportion of excess free cash flow to our shareholders in 2023.”

From the Q1 call in May:

“For example, last year, we -- out of the $17.5 billion of cash that we had available to those 3 buckets, the debt reduction, share repurchases and capital programs, 57% went to debt reduction, 17% to share repurchases, and 26% to our capital programs. If we had a similar situation with that kind of cash, 40% would go to capital programs, but 55% would go to share repurchases, and potentially up to 5% for debt reduction. So this is something that we're very committed to is not to let our capital grow to a point where it's not a -- we're not able to buyback shares at the level that we really need to do.”

Analysts have a hard time believing Occidental will remain committed to returning capital to shareholders and will instead pivot to pouring more cash into capex and follow the old saying – “drill baby drill” as oil prices stay at attractive levels. Hollub is adamant this is not the case, and reiterated the focus on returning cash via repurchases even after considering ongoing capex.

“I want everybody to understand that, looking forward, our capital program for our oil and gas development, chemicals, midstream, the corporation's capital is going to be invested in a way that, that fits with the priorities that we've established, one of which, and as important as any of the others, is investing in ourselves. That is the repurchase of shares. That's a big part of our cash flow priorities. And I want to make sure that people don't think that we're going to, in the future, have capital spending so much that we can't accomplish that.”

Ok, you get the point – management is manically focused on both communicating the plans for allocating capital and emphasizing the continuing transfer of value to shareholders. Buffett appears sold that this will continue, and over the past few years they’ve kept their word. It’s crucial to note, though, this newfound capital discipline has yet to be tested through a full commodity cycle. How is it likely to turn out if they continue to keep their promise?

Forward Returns

As with every business and stock, Occidental’s forward returns will be driven by growth, yield, and change in valuation multiple. Given the aforementioned capital return program, shareholder yield is likely to be the driver of returns from here.

I have no idea what the price of oil will be this year, or next year, or in five years. I do know that the world has an insatiable appetite for oil and other natural resources, far beyond demand driven by gas-powered automobiles. Over the long term, I tend to think we’ll use just about every drop of oil we can pump, so I don’t really subscribe to the theory that we’ll be living in an oil-free world any time soon, but hey maybe I’m wrong.

How much Occidental earns in any given year will depend in large part on the price of oil that year. Here are the current sensitivities to changes in oil prices.

Oil averaged around $94/barrel during fiscal 2022 compared to $68 during fiscal 2021. Oxy generated $12.3B and $7.5B of free cash flow in each year, respectively. Management returned almost exactly 100% of free cash flow each year to shareholders, and I expect that trend to continue.

This isn’t very technical, but let’s just say oil oscillates between 2021 and 2022 prices for the foreseeable future (seems reasonable?). This would likely lead to around $9B-$10B of average annual free cash flow. Obviously results will be driven by a combination of changes in volumes and changes in the price of oil, but I’m just looking for reasonable directional assumptions.

Occidental’s market cap is around $54B and with an investment grade balance sheet and no significant near-term maturities, it’s likely most of that cash finds its way back to shareholders directly. I’m no mathematician, but $9B compared to $54B is north of a 15% free cash flow yield, a reasonable starting point for forward returns. Let’s say these earnings assumptions are off by half – it’s still not a disaster.

Circling back to Berkshire’s investment thesis. As much as prognosticators want to believe Buffett’s oil investments mean he has a near-term view of oil, I highly doubt it. Once again, it’s not because I’m speculating, it’s because it’s what Buffett has said before. In 2007 he reminded people that if he had a view about a commodity price he’d just buy the commodity directly:

“If we were in an oil stock, it's because we think it offers a lot of value at this price, but it does not mean that we think the price of oil is going up. If we thought oil was going up, we could buy oil futures, which we actually did once.”

Instead of a tactical bet on where oil goes in the near term, here’s my guess as to what Buffett is thinking:

Occidental is a low cost producer with assets well positioned in a (relatively) politically stable environment. They’re generating a boatload of cash in a “normal” commodity environment, that cash is finding it’s way back to shareholders, and the stock trades for like 6.5x earnings. If this situation persists, today’s prices are going to look like a real bargain. If oil goes to $30 for a prolonged period, it won’t be a great outcome for a few years, and if oil stays where it is or goes higher, it’s likely to be an excellent outcome. I don’t think it has to be much more complicated than that, and evaluating the asymmetry takes no real mathematical rigor.

Buffett likes and trusts Vicki Hollub, and believes she’ll continue to be a good steward of shareholder capital. Then again, maybe she’ll bet the company on another massive acquisition, like in 2019. I think that is unlikely to happen, especially given Berkshire’s ownership position, but who knows.

Occidental is not the best business in the world. It is, however, a decent business if you believe oil is going to be needed for decades to come. It has a world class capital return program, both in terms of magnitude and clarity. Management is guided by a rational incentive structure and acts with shareholders in mind.

Obviously the market disagrees with most of these thoughts at present given the current valuation, so it’ll be interesting to watch it unfold over the years.

Do you have a “stranded” 401k from a past job that is neglected and unmanaged? These accounts are often an excellent fit for Eagle Point Capital’s long-term investment approach. Please contact us to learn more about opening a separately managed account with EPC.

Disclosure: The author, Eagle Point Capital, or their affiliates may own the securities discussed. This blog is for informational purposes only. Nothing should be construed as investment advice. Please read our Terms and Conditions for further details.

Oxy is going to reinvigorate shale by producing net zero oil in the Permian using CCUS technology, whose inputs by the way are chemicals from its chemicals business. That's what Munger was referring to in the 2023 annual meeting when he said: "If anybody can figure out another magic trick, that’s all we need is another magic trick."

It also leads the carbon sequestration market if I am not wrong? It is quite a small space, but loads of growth optionality on top