In February 2009 John Malone’s Liberty Media rescued Sirius XM with a $530 million loan. Sirius and XM had just merged months before. During the 17 months it took to get FCC and DOJ approval, the economy tanked and new car sales plunged. Sirius XM traded as low as 5 cents per share and hired lawyers to prepare a bankruptcy filing.

The deal gave Liberty preferred shares convertible into 40% of Sirius XM. It also called for anti-takeover provisions which would last three years.

In 2012 those provisions expired and Liberty began buying more Sirius XM shares. In January 2013 they crossed the 50% ownership threshold. Liberty took over the company and installed its representatives into senior management roles and onto the board of directors. John Malone immediately implemented his signature levered buyback strategy at Sirius XM.

In April 2016 Liberty Media reorganized and recapitalized itself into three tracking stocks. One of those (LSXMA, LSMXB, and LSMXK) housed Liberty’s stake in Sirius XM. Since then Sirius XM has continued to repurchase shares, increasing Liberty’s ownership stake to 84%. In December 2023 Liberty said that their Sirius XM investment had returned over 5,000%.

The Liberty tracking stocks have traded at a significant discount to Sirius XM shares despite being virtually economic equivalents. Today that discount is 35%.

On October 27, 2023 Liberty announced plans to collapse the discount by spinning off its stake in Sirius XM. The transaction is slated to close in “early Q3.” Given the wide spread and short time-frame, buying LSXM may offer attractive returns.

Do you have a “stranded” 401k from a past job that is neglected and unmanaged? These accounts are often an excellent fit for Eagle Point Capital’s long-term investment approach. Eagle Point manages separately managed accounts for retail investors. If you would like to invest with Eagle Point Capital or connect with us, please email info@eaglepointcap.com.

What Is A Tracking Stock?

Tracking stocks are securities issued by a parent corporation to track the financial performance of a specific business unit or operating division within the larger organization. Tracking stock owners have a claim on the economics of a piece of the parent’s organization attributed to them.

In a sprawling and complex conglomerate like Liberty Media, tracking stocks allow investors to buy a targeted piece of the conglomerate. This could avoid a conglomerate discount since investors can choose the specific businesses they want to own while all of the businesses remain under the parent company’s ownership.

Tracking stocks also allow parent companies to align incentive compensation with a business unit's performance. Parent companies can also raise capital or engage in M&A for a specific business unit.

Liberty SiriusXM Group has three classes (LSXM -A, -B, and -K) that carry 1, 10, and 0 votes, respectively. The class C shares (-K) are marginally cheaper than the A shares. The B shares hardly trade.

What Does Sirius XM Own?

Sirius XM owns its namesake Sirius XM satellite radio business. Customers can listen to satellite radio using receivers built into most cars or by streaming through the Sirius XM app or website. Revenue mostly comes from subscription fees. The vast majority of Sirius XM’s revenue and value lies here.

Sirius XM also owns Pandora, which it paid $3.5 billion for in 2019. Pandora offers free (ad-supported) and paid personalized radio, as well as a paid on-demand subscription service (similar to Spotify). Most of Pandora’s revenue is from ads.

Sirius XM also own the podcasting company Stitcher, the Simplecast Creator Network, and an ad business. The ads business serves their own properties as well as third parties like SoundCloud and NBCUniversal.

The Transaction

Liberty Media will split off its shares of Sirius XM and related net liabilities. Net liabilities of $1.7 billion include 3.75% LSXMA convertible notes due 2028, 2.75% SIRI exchangeable bonds due 2049, a SIRI margin loan, and corporate cash.

In the split off LSXM shareholders will receive one share of New Sirius XM for each share of SIRI previously held at Liberty Media, adjusted for net liabilities. The pro forma exchange ratio is expected to be 8.4 based on balance sheet forecasts for June 30, 2024.

The SplitCo will immediately merge with Sirius XM. Existing Sirius XM shareholders will receive 1:1 shares of SplitCo, which will become New SiriusXM.

LSXM shareholders currently own 84% of Sirius XM and will own 81% after the transaction closes.

Why Is There Such A Wide Discount?

Tracking stocks are poorly understood and often beyond the investment mandate of investment managers and index funds. After the transaction closes SIRI will be eligible for inclusion in the S&P 500. It’s currently prohibited as a controlled company.

Although LSXM owns 84% of Sirius XM, Sirius XM shares are more liquid and heavily traded than any single share class of LSXM. This could mean that more price discovery is happening in SIRI than LSXM.

Another possible reason for the discount is skepticism over the deal closing. I don’t think this is likely. Here’s what Greg Maffei said about the approvals required:

“I'll touch on the approvals. I think we'll need HSR, which we think is relatively pro forma. We'll need [ SEC ] approval for the transfer of license, is also relatively pro forma. And then there will be no vote of the SIRI shareholders, but there will be a vote of the LSXM shareholders. So we'll need a proxy to get through the SEC, and that's probably the longest item to get done.”

He doesn’t sound worried.

Liberty shareholders stand to gain if the discount collapses, which is the purpose of the transaction. They have the incentive to close. There is no change in ownership so the FCC should not care. The only question is how long the SEC will take to approve the proxy. The size of SEC’s approvals backlog will determine when the deal closes. Some merger arb investors believe that Liberty’s “early Q3” target is conservative.

The Key Question

Will the merged company trade closer to SIRI’s price or LSXM’s price? Does LSXM trade at a discount to SIRI, or does SIRI trade at a premium to LSXM?

SIRI is more liquid and more widely owned, so I’d bet that SIRI represents the “true” price. Given that the purpose of this transaction is to eliminate the discount, management (John Malone et al) agrees. Incentives are incredibly important in special situations, and in this case Liberty’s incentives are to boost LSXM’s price towards SIRI’s. The Liberty board unanimously approved the transaction in December.

The spread between the two is so wide that the discount doesn’t need to be entirely close for this to be a successful investment. The spread provides a wide margin of safety if SIRI falls before losing money.

Even if LSMX represents the “true” price, there should not be a significant downside to buying LSXM here. That makes this a highly asymmetric investment opportunity. To understand that, it’s worth understanding Sirius XM’s fundamentals.

Valuation

One of the ways to de-risk this transaction is to get comfortable owning Sirius XM outright at the LSXM look-through price.

Sirius XM is a stable, recurring-revenue business that is highly free cash flow generative. Here’s how management describes their value proposition:

We have a very differentiated value proposition at SiriusXM with very unique content, a breadth of content, very human curated and hosted by artists as well as other talent. And then things like a unique sports proposition -- value proposition, right, where we have virtually every major league live play-by-play on SiriusXM, very hard to replicate that in video, for instance.

Sirius XM’s core customer is GenX or older, affluent, and grew up listening to the radio. The company is trying to reach younger customers who didn’t grow up listening to radio. They believe there’s demand for curated content (by a DJ or Pandora) and exclusive talk radio (Howard Stern, Conan), along with play-by-play sports coverage for every league. The want to position Sirius XM as a complement, not a replacement, to Spotify and similar audio streaming services.

The subscriber funnel is built atop long-term relationships with auto OEMs. Sirius XM is built into 80% of new vehicles and is in 55% of pre-owned vehicles currently sold. There are 150 million Sirius XM-enabled vehicles on the road.

A little over 30% of free trials convert into a paid subscription. A few years ago conversion from free to paid was a bit over 40%, ten points higher. Conversion has fallen as penetration of new cars increased and Sirius XM began reaching younger and less affluent customers.

Subscriber growth correlates with new car sales, which have recently been hamstrung by the chip shortage. It was robust pre-pandemic but has since plateaued.

Management expects to return to net subscriber growth:

So we're certainly expecting meaningful improvement in our subscriber net adds next year versus this year.

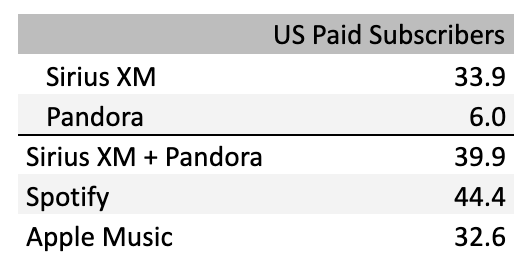

Sirius XM’s subscriber count is similar to Spotify and Apple Music on a paid US-only basis. Since Sirius XM only operates in North America, this is the most apples-to-apples comparison. Sirius XM technically has some Canadian subscribers but I don’t think that takes away from the point that Sirius XM is a sizable business.

Sure, Spotify and Apple Music have hundreds of millions more of free subscribers. But Spotify loses money on those (and in aggregate). Sirius XM is highly free cash flow generative. Spotify may have more growth potential, but growing while losing money never made sense to me, and neither does Spotify’s valuation.

Churn is remarkably low and has continued to dwindle. It speaks to the value proposition of Sirius XM’s content. Management expects monthly churn to remain below 1.8%.

Sirius XM’s churn implies a five year customer relationship, which is probably close to how often the typical subscriber gets a new car (subscribers tend to be affluent). The biggest reason Sirius XM loses subscribers is because they sell their car. That requires Sirius XM to reacquire the subscriber in their new vehicle, which they usually do.

Sirius XM typically raises prices every other year and has historically priced above inflation. That hasn’t been the case lately. The company took a price increase in late 2021 and again in early 2023 and doesn’t expect to adjust prices again until 2025. Future price increases will probably run ahead of inflation to catch up. The business sports 50% gross margins, 23% operating margins, and a 30% ROIC.

The pro forma merged company trades for $12.3 billion (based on LSXMK’s price) and 3.9x leverage. Analysts expect it to earn $1.2 billion of free cash flow this year. That implies a 10% free cash flow yield for LSMX and 7% for SIRI.

Why’s the FCF yield so high? Sales have fallen modestly since the pandemic and the company has a lot of debt. Shrinking sales and lots of leverage isn’t a good combination. Capex is elevated, further reducing free cash flow.

There are also questions about the terminal value of satellite radio. Increasing penetration of cell service reduces the value of satellite coverage. Younger generations when never experienced radio may no tbe interested in Sirius XM. The company’s move into streaming, exclusive content (Howard Stern, Conan), and customized recommendations (Pandora) are meant to address this.

Investors buying LSXM here are paying a no-growth multiple for a no-growth stock. Bottom-line growth may perk up in the next couple of years even if the top-line doesn’t. Management expects free cash flow to improve considerably over the next five years, especially after 2024. There’s a chance that the top and bottom lines grow if the company’s historical pricing power and subscriber growth resume.

In 2023 Sirius XM became a full cash taxpayer and stepped up satellite capex in-line with its 15 year refresh rate. Satellite capex will remain elevated in 2024. Afterward it will decline and reach “nearly zero” by 2028. I’m always a little wary of capital-heavy companies that say capex is almost over. A new capex cycle always seems to start shockingly soon after the last one ends.

Non-satellite capex is also elevated. In late 2023 Sirius XM released its next generation technology platform. They plan to migrate streaming XM radio, satellite automotive XM radio, and Pandora onto the same platform. This will give them new data to improve recommendations. Helping new XM Radio customers find content improves paid conversions.

As Sirius XM merges their tech stack, operating costs will decline. This should be evident by the end of 2024. Increased marketing around the company’s new $9.99 per month streaming-only offer will negate some of the savings. This offer is designed to complement other audio streaming services and boost growth, especially among younger customers.

Capital allocation has historically focused on buybacks. Since their buyback program began in December 2012 they’ve repurchased $18.8 billion of shares at an average price of $4.51 per share. Share count fell by 37%, a 4.5% annual CAGR. Sirius XM also pays out about 30% of earnings as a dividend which amounts to a 2% yield.

The company has historically run with leverage of 3-3.5x EV/EBITDA. That will jump to just shy of 4x when the transaction closes. Post close, management will maintain the dividend, complete their capex program, and use remaining cash flow to deleverage. Buybacks will remain on the table if there’s a good opportunity, but will be de-emphasized. Deleveraging should be complete by year-end 2025, which accounts for some buybacks. Deleveraging will finish a little earlier without any buybacks.

Risks

If you buy LSXMK and don’t short SIRI, you have two exposures. One to the spread and the other to the underlying business. SIRI has a 0.95 beta so if the market tanks then LSXM and SIRI could fall in sympathy. The worst case is that the spread closes while both stock trend down.

If that happens, it will probably be best to hold SIRI (post conversion) until valuations normalize back to their present 7-10% FCF yield. This scenario is partially mitigated by the spread’s width. SIRI needs to fall more than 35% before buying LSXMK is unprofitable.

Most likely, the spread will close somewhere in the middle. That’s what has happened since the spread (SIRI/LSXMK-1) peaked on 12/14. LSXMK has gained 5% while SIRI has declined 16%.

A Barron’s article on December 13th took a stab a explaining the unusually large spread. At publication the spread was over 60%. Since then it’s steadily decreased to 35%.

Sirius XM shares could be trading for more than they are worth, artificially supported by a low float, high short interest, and difficulty in borrowing the shares. One investor told Barron’s he tried to borrow Sirius XM stock Tuesday morning and was offered a rate of about 50%, while borrow rates for most stocks are closer to zero.

That can make it tough to buy Liberty SiriusXM and sell short Sirius XM, which would position investors to benefit if the spread narrows as the deal moves closer to being completed. Indeed, Sirius XM was the subject of a short squeeze in the summer when its stock price briefly spiked to $8 a share.

A second factor is that it will take some time for the deal to close, with the companies projecting that it will happen in the third quarter of 2024.

The article goes on to list increasingly creative bear cases such as:

“Sirius XM holders could sue to stop the deal, arguing that it is too friendly to Liberty Media.”

“The Internal Revenue Service may not take a favorable view on the proposed tax-free nature of the transaction from Liberty’s perspective.”

“Once the Sirius XM stock is distributed to Liberty SiriusXM tracker investors, the float in Sirius XM, now around 16%, will surge. That could depress the stock.”

These are valid concerns that investors will need to handicap themselves. Given that the wide spread provides a margin of safety on the downside, the trade seems asymmetrically skewed to the upside.

This situation rhymes with the case studies Joel Greenblatt describes in his book You Can Be A Stock Market Genius. Reading his case studies make then seem clear and obvious, but that’s hindsight bias. Is LSXMK going to look as obvious in six months? Time will tell.

Further Reading

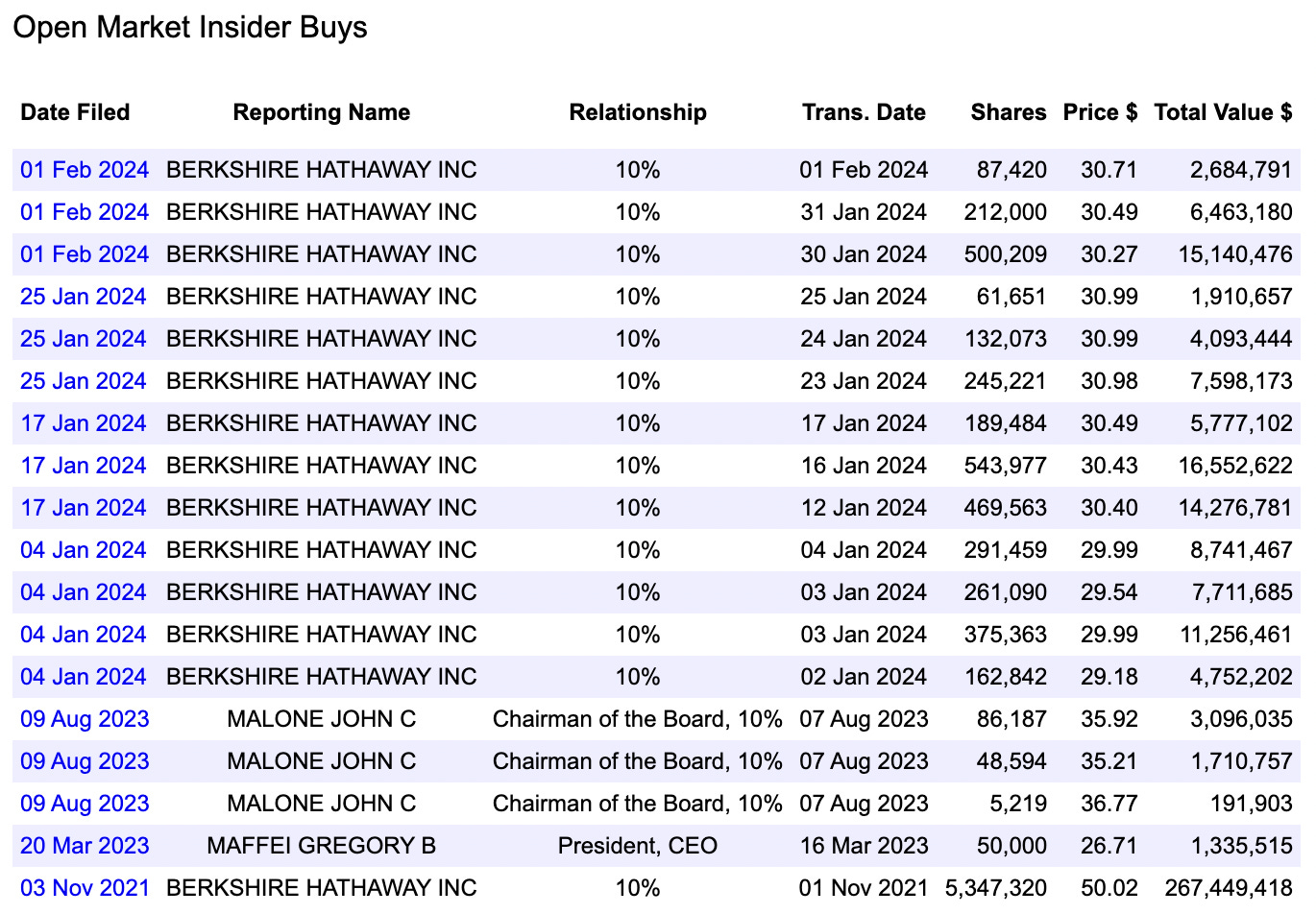

The excellent Clark Street Value blog posted about this opportunity a few weeks ago. His analysis combined with Berkshire’s purchases caused me to investigate it further.

Berkshire owns over $2 billion of Liberty SiriusXM, more than 20%. In Q4 Berkshire more than tripled its investment in SIRI. It’s likely Ted Weschler’s position (though possibly Todd Comb’s).

Given that Berkshire has owned LSXMK and SIRI for years, its clear that they like the business, valuation, and capital allocation. Their recent LSXMK purchases suggest that Berkshire expects this transaction to create value.

Seth Klarman’s Baupost Group owns a large stake as well. Baupost has 14.4% of its public equities portfolio invested in LSXMA and LSXMK which makes it their second largest position. Baupost has owned LSXMK for a while so they’re probably invested for reasons beyond the discount closing.

Do you have a “stranded” 401k from a past job that is neglected and unmanaged? These accounts are often an excellent fit for Eagle Point Capital’s long-term investment approach. Eagle Point manages separately managed accounts for retail investors. If you would like to invest with Eagle Point Capital or connect with us, please email info@eaglepointcap.com.

Disclosure: The author, Eagle Point Capital, or their affiliates may own the securities discussed. This blog is for informational purposes only. Nothing should be construed as investment advice. Please read our Terms and Conditions for further details.

Really great overview of the situation.

Great article, how do you see the deal right now? Siri dropped a lot and lot of short interest with a limited free float. I am wondering if the shorters have to cover before merger or if they are long Liberty tracking shares will the short be offset after merging with Siri?