It’s no secret we love following capital-light franchisors. Especially ones that sell pizza and burgers. In the past we’ve written about Domino’s, Restaurant Brands International, Hilton, Wyndham, Wendy’s, and others.

Jack in the Box is a simple business that generates ample free cash flow and consistently buys back boatloads of stock. Over the past 15 years the company has retired almost 70% of its share count, putting its share buyback program up against nearly any public company. That alone is enough to keep it on our watch list. Add in the fact that it is a high return on equity franchisor that is nearing completion of its capital light transformation and currently working through (perhaps) temporary headwinds resulting in the lowest valuation since the financial crisis and things get even more intriguing. Still, the company is facing risks and a challenging consumer environment.

Do you have a “stranded” 401k from a past job that is neglected and unmanaged? These accounts are often an excellent fit for Eagle Point Capital’s long-term investment approach. Eagle Point manages separately manage accounts for retail investors. If you would like to invest with Eagle Point Capital or connect with us, please email info@eaglepointcap.com.

Overview

Jack in the Box is a west-coast focused quick serve restaurant (QSR) concept. They are known for their innovative and extensive menu where you can order anything (including breakfast for dinner or burgers for breakfast) all day and late into the night.

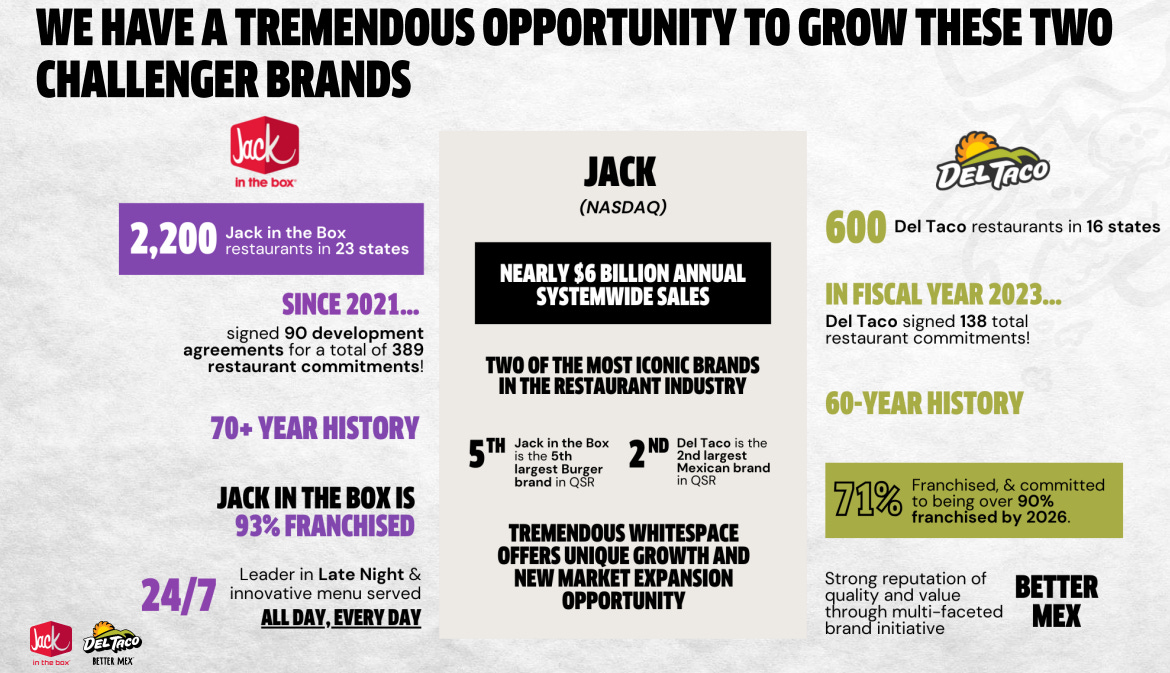

Jack in the Box was founded in 1951 as a handful of drive-up burger stands in southern California. Since then it has grown into a collection of 2,200 restaurants in 23 states. The company owned Qdoba for 15 years without much success. Qdoba is a fast casual Mexican restaurant and did not benefit from being owned by the same parent as Jack in the Box. The company ultimately sold Qdoba in 2018. Given the lack of success with Qdoba, I (and many others) was surprised when Jack in the Box announced in late 2021 that they had agreed to acquire Del Taco.

Del Taco is a similarly scrappy challenger QSR brand with 600 locations in 16 states. There are many more similarities between Jack and Del Taco than there were between Jack and Qdoba – both are largely franchised, drive-through focused, true QSR concepts, and share similar geographic footprints. Still, I was and am wary of management executing effectively on a different Mexican food concept given the results at Qdoba.

The company operates a capital-light model with 93% of Jack in the Box stores franchised and 70% (and growing) of Del Taco’s operated by franchisees. The business has been working for several years to transition from a split operating model to a true capital light structure (a move I think makes a ton of sense).

Breaking out of the Box

In the years leading up to 2019, Jack in the Box had underinvested in technology and its brand image, was lagging behind competitors in franchisee profitability, had limited digital sales, and experienced deteriorating relationships with franchisees. From 2012-2020 same store sales were fledgling along at 2% per year, the company had negative net unit growth, a limited franchisee pipeline, and less than 1% of sales were originated via digital channels. To their credit, management still bought back a boat load of stock – about 8.5% of shares per year – thanks to the cash generative nature of the business even during a period of uninspiring financial performance.

After bringing in new management in 2020 the company appears to be on more stable footing. Over the past three years the company has reinvested in its digital capabilities and modernized the feel of its restaurant concepts. Same store sales have averaged 5% since 2020, digital sales are up 3x to 12% of revenue, and the company has positive net unit growth for the first time in a while.

Management feels now is the time to focus more on driving growth and unveiled new financial targets this January. By focusing on new markets, introducing a new look Jack in the Box concept, and investing in simplified marketing campaigns, the company is targeting higher average unit volumes (AUVs), 2.5% net new unit growth, and improved franchisee four-wall profitability.

Unfortunately, just as management was hoping to excite investors about Jack’s future, the business has run into a handful of new headwinds. Suffice it to say, no one is excited about the stock and its now about 50% below it’s 2023 high and trading for a very undemanding ~8.5x earnings.

Recent Headwinds

Jack in the Box is grappling with a handful of difficulties, some related to the broader economic environment and others more specific to Jack’s situation.

California Minimum Wage Increase

The most prominent concern in recent months has been California’s newly enacted minimum wage law. Starting April 1, the new law required that fast food employees are to be paid a minimum of $20 per hour. Investors were understandably concerned that the outrageously high minimum wage will have an outsized impact on Jack given almost half of their business is in California.

It seems plausible that the increased minimum wage in California will either a) shrink store-level margins and hurt franchisees and company-owned stores, b) result in franchisees prohibitively raising prices to offset the higher costs which will negatively impact traffic and overall revenue or c) some combination of both.

It’s very early, but it appears that some of those concerns may be misplaced and the company will muddle through. Management commented on the early results during the May earnings call (AB1228 is the name for the California minimum wage law):

“Speaking of AB1228, I'm proud of how our California franchisees joined together with our company leadership teams to execute strategic price increases, implement our margin savings plans, share best practices and test equipment and technology that can support labor savings in the future. Interestingly, our California restaurants at both brands have performed on par, and in some cases better than other regions across the country, particularly with our company-owned restaurants.”

The company is working with franchisees to eliminate labor by introducing new equipment and technology improvements in the restaurants, improve margins elsewhere when possible, and selectively raise prices.

So far, California stores have performed in-line or better than stores in other states. That said, it’s only been a few months and the jury is still out on how this will unfold.

It’s not as if Jack in the Box is the only restaurant contending with this problem. All QSRs (and employers in general) in California are battling the same wage inflation issue, and unless people just stop eating out altogether, it seems likely that demand will ultimately remain stable across different restaurant segments.

On the positive side, because Jack in the Box skews towards lower income consumers, their consumers will have (in general) received a raise, meaning it may be more likely they can stomach a higher check when eating out. Regardless, it’ll be interesting to watch the situation play out.

Struggling Low-End Consumer

Retailers across the board from Target to Dollar General to AutoZone have commented during recent earnings calls that low-end consumers are feeling pinched. After years of far above trend inflation it appears that consumers are pulling back on discretionary purchases and leaning towards lower priced items. This hurts both volumes and skews sales to less profitable categories (such as value meals) and has cast a pall over much of the QSR sector in recent months.

While the pressure on these consumers is real, I don’t regard this as any sort of existential or permanent threat to QSRs. Americans love to eat out, and after an adjustment period I would anticipate consumer spending patterns reverting to normal. This could take six months or a few years, but I’d be shocked if the current customer spending patterns persist indefinitely.

Price War Concerns

Jack in the Box is not the only restaurant being impacted by consumers pulling back. In an effort to stimulate demand, McDonald’s recently announced a $5 meal deal that will last for about a month starting in late June. It appears this also has investors and analysts on edge about a potential value meal price war across the industry.

The $5 meal option gets a lot of questions on every restaurant’s earnings call and lays bare the competitive nature of the QSR industry. While clearly it’s tougher to maintain an advantageous competitive position in the QSR space than some other industries – it requires continuous menu innovation, advertising, and thoughtful value offerings – the major QSR players manage to consistently earn high returns on equity and generate tremendous free cash flow. I don’t see McDonald’s limited time $5 meal deal changing any of that over the long run.

Other Worries

The hype around GLP-1s late last summer had a significant impact on a number of QSR stocks. Restaurant Brands International, Domino’s, McDonald’s, and others all experienced 15-20% pullbacks from last summer into the fall coinciding with the peak news cycle around GLP-1s and their potential to curb American’s unhealthy eating habits. Jack in the Box was not spared and it still appears there is lingering concerns regarding GLP-1s and the potential impact on the fast food industry.

I don’t have any unique insights into the long-term impact of weight lost pills on American’s eating out habits, but again I tend to lean towards thinking we will collectively continue to eat fast food well into the future. Most families treat eating out (even at fast food restaurants) as a small “luxury” and are not eating there every day. Even if we consume less calories overall, the reward for taking the family out to eat once in a while seems likely to continue even if there comes a time the whole nation is taking magic diet pills. I’d be more concerned if I was a grocer, though something tells me they’ll muscle through any impacts from GLP-1s just fine as well.

Finally, Jack in the Box is lapping strong same store sales growth last year resulting in uninspiring current year organic growth. Same store sales at both Jack in the Box and Del Taco were down ~2% to start the year but are recently trending towards flat to modest growth. Investors seem to frequently project episodic negative same store sales growth in perpetuity and unduly punish retailers for the natural ebb and flow of same store sales. To be fair, Jack’s lackluster historical same store sales growth (pre-2020) probably hasn’t done much to help the stock during the latest period of sluggish revenue growth.

Fundamentals

Capital-light franchisors economics are driven by the underlying trends in system wide sales. System wide sales are driven by same store sales and net unit growth.

You can’t assess a retailer’s comparable store sales without understanding inflation trends, as restaurants generally attempt to pass on inflationary costs in commodities and labor via higher prices. Retailers that can at least pass on inflation are in a reasonable competitive position. Over the last decade Jack in the Box has averaged roughly 3.4% annual same store sales growth, which is modestly better than the 2.7% average inflation over the same period.

Net unit growth (NUG) has been less impressive. As noted, until recently, unit growth had been slightly negative for many years. This year unit growth should be modestly positive, and management is aiming for 2.5% NUG over the longer term. They believe there is an overlap in franchisees that currently own Jack in the Box’s that would also like to open Del Tacos, and are moving into new geographies for the first time in many years.

Capital allocation is the other important business driver given the amount of free cash flow that Jack’s business generates. This is my favorite aspect of the company, as management has historically leaned in to share repurchases to the tune of 7%+ per year. Again because of the capital light nature of the business model Jack in the Box operates with negative equity and earns attractive returns on capital. Jack in the Box is not the worlds best business, but given it’s business model and capital allocation, it’s at least above average.

Unfortunately, like so many other QSRs, the balance sheet is highly levered. While I love a good share buyback program, the company has pursued a levered-buyback approach over the last decade and allocated more than 100% of free cash flow to share repurchases and funded the gap with debt.

Leverage has gone from 1.8x to more than 5x since 2014 and is now in excess of what I would consider prudent. I don’t think the business is at risk given the cash generative nature and the stability and predictability of fast food chains, but it also leaves much less room for error. At the very least, the business will not be able to consistently return more than 100% of free cash flow to shareholders as has been the case in the recent past.

The good news is, shareholders may receive a more attractive yield today even with less than 100% of free cash flow being returned given the depressed valuation.

Valuation and Forward Returns

If management hits their targets Jack in the Box will generate mid-single digit revenue growth on average for many years. Same store sales should come in at 2-4% and the company is targeting 2.5% NUG for 4-6.5% system wide sales growth. This growth largely flows right through to Jack in the Box as they generate a royalty on franchisee sales.

To produce a “fair” 10% return (after accounting for the ~5% organic growth Jack in the Box is targeting) the stock should trade for around a ~5% earnings yield, or 20x earnings. This is right in line with its historical 19x multiple and would be in the ballpark (though still at slight discount) to other scaled publicly traded franchisors such as McDonald’s, Restaurant Brands International, Wendy’s, and others. However, at just ~8.5x earnings, Jack in the Box trades nowhere near that range.

The current valuation implies that management will not achieve its growth targets because of the various headwinds mentioned above, and the business will in fact shrink over a sustained period of time, and/or shareholders will not receive a level of shareholder yield remotely comparable to the past decade. This may prove correct, but seems unlikely.

Let’s say that the company “only” returns 75% of earnings to shareholders via dividends and repurchases. At today’s prices, it’s still a ~9% shareholder yield. If the business grows at even a low single digit clip shareholders would be looking at double-digit returns. If the stock re-rates to a valuation more in-line with its historical (and fair) range, the stock returns would be far higher than that.

Though it probably seems like the distant past, less than a year ago before the sudden concerns over GLP-1s, California minimum wage laws, and pressure on low end consumers, the stock traded for around 17x earnings. Even re-rating to an undemanding 15x earnings over the next five years would add more than 10% annually to returns.

Jack in the Box reminds me of other times that temporary headwinds have resulted in otherwise high-quality businesses selling for no-growth multiples. The public market tends to occasionally extrapolate recent results into eternity. Sometimes this proves correct, but often times it does not.

If management can deliver even modest growth and navigate the current consumer and competitive environment without imploding, it’s likely shareholders will do well from present prices. On the other hand, the company has a checkered history in terms of acquisitions and generating consistent growth, is facing challenging industry conditions, and is highly levered. Either way, a simple, high-quality business with a world class buyback program selling for sub-9x earnings is worth paying attention to.

Do you have a “stranded” 401k from a past job that is neglected and unmanaged? These accounts are often an excellent fit for Eagle Point Capital’s long-term investment approach. Eagle Point manages separately manage accounts for retail investors. If you would like to invest with Eagle Point Capital or connect with us, please email info@eaglepointcap.com.

Disclosure: The author, Eagle Point Capital, or their affiliates may own the securities discussed. This blog is for informational purposes only. Nothing should be construed as investment advice. Please read our Terms and Conditions for further details.

Great write up. I am completely put off by the debt here though. 1.71 B debt to 104m trailing fcf. The future of the company, there ability to return cash to shareholders is going to be very dependent on interest rates.

My pretty uninformed 2 cents, based mostly off the contents of this post: A dangerous build-up of debt funding unreasonable share repurchases and large acquisitions with minimal strategic value ($15m in synergies is not sufficient for a $600m acquisition) screams financial mismanagement, empire-building, and overall poor leadership.

My experience with reasonably cheap looking companies with heavy debt loads has not been positive. In my eyes, this is not cheap enough to justify the risk as a cigar butt, and the brands and finances are not strong enough to justify it being a quality pick (a 5 year payback period is not good).

I like to pick investments where I'm likely to do very well, whether the market recognises I'm right anytime soon or not. I don't think that's the case here. The underlying business is not fast-growing, the book value is negative, the balance sheet risk is substantial. If the market wants to keep it <10x earnings for the next decade, your return will be fairly dismal.