Timeshare businesses, for some historically valid reasons, have an “ick” factor to them. Until recently, what came to mind when I thought about timeshares were sleazy salesman duping unsuspecting customers into locking themselves into unaffordable and unusable long-term contracts for dingy condos. While some of those dynamics may still be true in the industry, it’s fair to say timeshare businesses have come a long ways.

Despite a poor reputation thanks to a history of scams and aggressive sales tactics, especially on the secondary market, the timeshare business is better than one might suspect. In fact, the scaled timeshare businesses have strong elements of recurring revenue, highly profitable financing operations, a capital efficient model, access to valuable rewards programs and exclusive relationships with the world’s largest hotel groups. They have proven resilient during tough economic periods, sit atop a consolidating industry, and are returning capital to shareholders.

Not too grossed out by the thought of timeshares? Read on for more details on one of the major players, Hilton Grand Vacations.

Do you have a “stranded” 401k from a past job that is neglected and unmanaged? These accounts are often an excellent fit for Eagle Point Capital’s long-term investment approach. Eagle Point manages separately managed accounts for retail investors. If you would like to invest with Eagle Point Capital or connect with us, please email info@eaglepointcap.com.

Industry

The large franchised hotel operators all used to own timeshare businesses (along with most of their real estate) but over the past decade all have elected to separate their businesses into asset-light franchisors, real estate holding companies, and timeshare businesses.

In 2011 Marriott spun off Marriott Vacations Worldwide (VAC), in 2016 Hilton spun off Hilton Grand Vacations, and in 2021 Wyndham spun off its timeshare business and named it Travel + Leisure. In 2018 Marriott Vacations purchased Hyatt’s timeshare business (Hyatt Vacation Club) and in recent years HGV gobbled up two of the largest independent timeshare operators, Diamond Resorts (2021) and Bluegreen vacations (recently announced, should close mid-2024). Disney Vacation Club is the only noteworthy timeshare business still wholly owned by a larger parent company (Walt Disney).

For the uninitiated, a timeshare company sells what they refer to as “vacation ownership interests”, or VOIs, which are basically the right to use a vacation property for a specified time period each year. VOIs can correspond to a single property at a set time each year or, more commonly, can be translated into points which can be exchanged for vacation stays at other properties (and at different times) within the timeshare operators network.

Hilton, Marriott, and Travel + Leisure serve different spectrums of the timeshare industry.

Marriott and Wyndham have pretty much stayed in their respective lanes while HGV’s two recent acquisitions have positioned it as the only timeshare company offering the full spectrum of price points. Whether this was a smart decision remains to be seen.

Assuming the Bluegreen acquisition goes through in 2024, HGV will become the largest timeshare operator by sales, earnings, and tour flow.

Business Model

HGV makes money in four ways and accordingly reports their business in four segments, which are:

Real Estate

Financing

Club & Resort

Rental & Ancillary

Real Estate

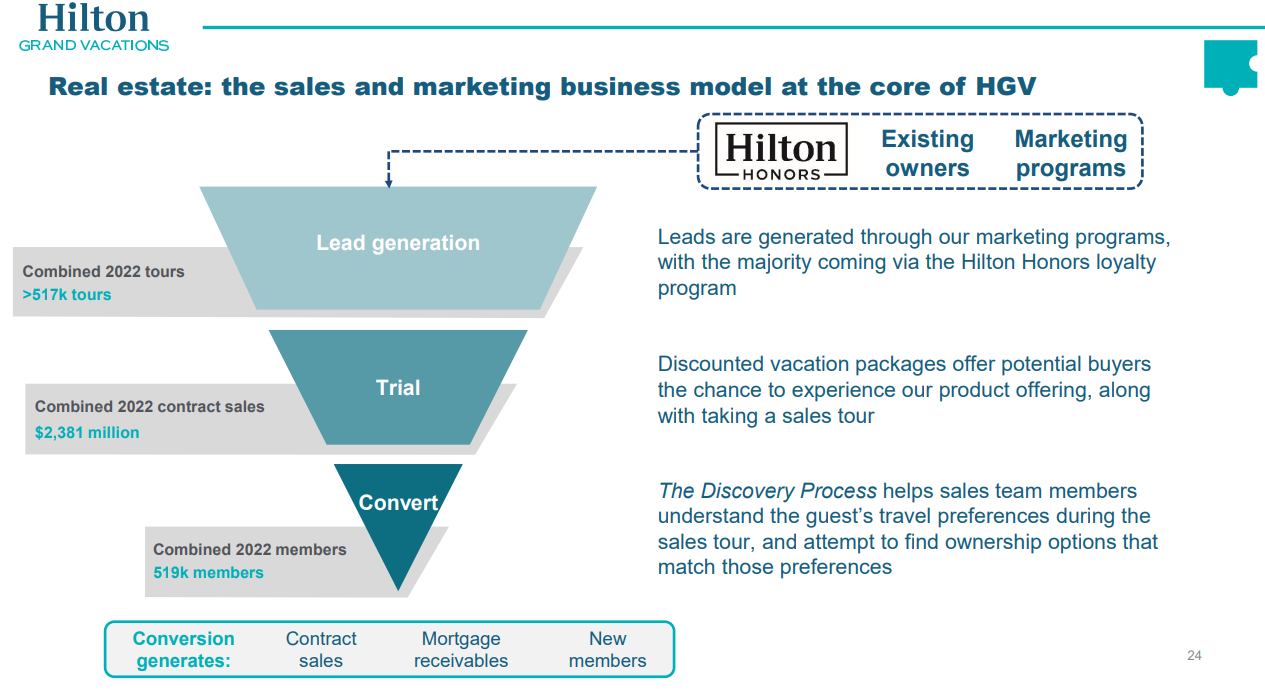

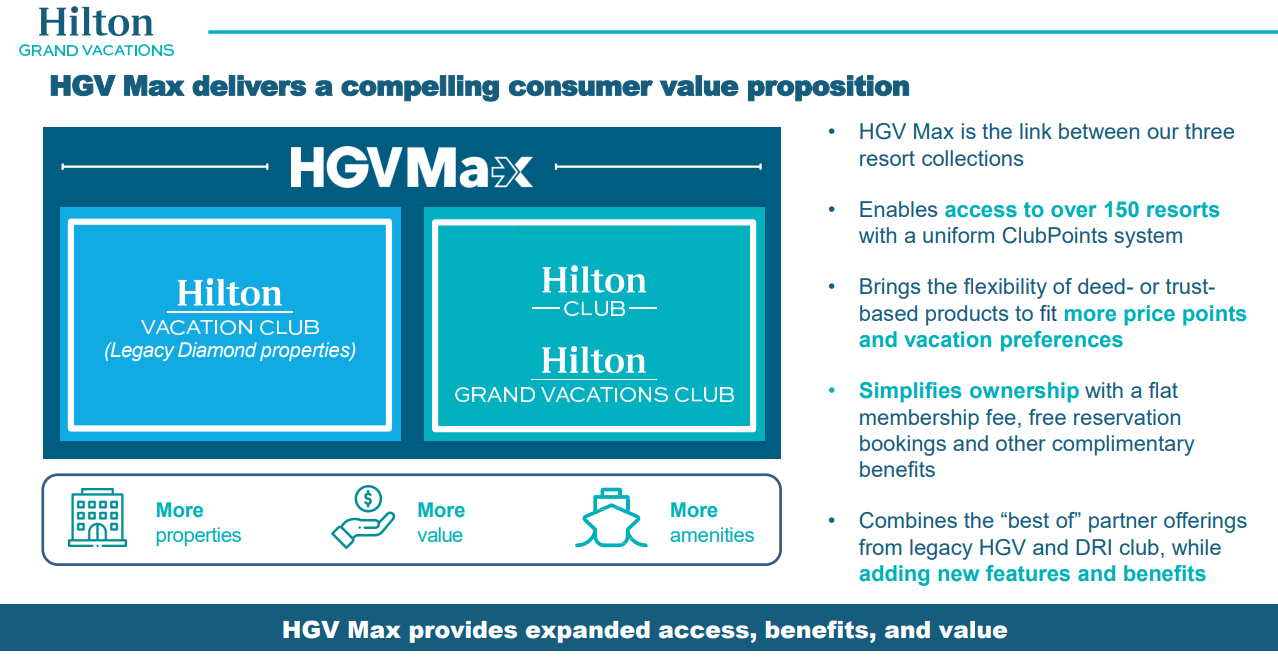

The Real Estate segment is the driver of the remaining three segments and is the heart of the operation. Real Estate revenue is generated by the sales of VOIs which generally correspond to a fee-simple, perpetual right to utilize a one week interval at an HGV resort each year. Importantly, VOIs do not correspond to any actual ownership in the physical property, just a right to use that property. When someone purchases a VOI they become part of HGV Max which gives them access to all of HGV’s resorts where they can exchange their points for stays at other properties.

They also source VOIs through “fee-for-service” agreements with third party developers. These agreements allow HGV to generate fees from the sale of VOIs and management of the properties without incurring the development costs of building the resort. The sale of VOIs are the lowest margin segment at around 30%, but are the engine for the much more profitable segments.

The average HGV timeshare costs somewhere around $22,000. The logic for those that purchase one – whether it’s sound or not is a different story – is you are purchasing a lifetime’s worth of vacations at nice resorts for ~$22K. As you’ll see shortly, that’s not exactly the whole story.

Financing

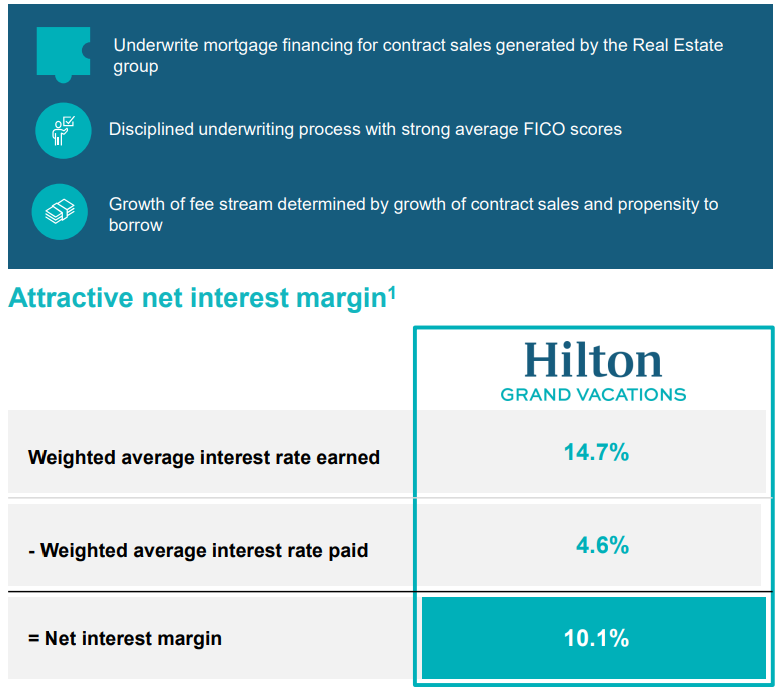

HGV operates a lucrative financing business. When HGV finances a VOI they generally require a 10% down payment and then charge around a 15% interest rate for a 10-year loan. The loans are often securitized and sold. The average loan balance is around $23,000, and a typical borrower has a good FICO score of around 736 and has a net worth of around $1 million.

HGV earns a spread on the interest rate it charges vs. the cost of the loan in addition to servicing fees. Currently HGV earns around a 10% net interest margin (it pays 4.6% interest and charges 14.7% to borrowers). This is a lumpy but profitable segment that earns ~60% margins.

Club and Resort

In my view, the Club and Resort segment is the highest quality piece of HGV. When someone buys a VOI, they don’t just pay the ~$22K and get to use the resorts in perpetuity. They also have to pay annual maintenance and club management fees. Prior to the sale of VOIs at a particular location, HGV enters into management agreements with the resort which cover activities such as day-to-day operations of the resorts, maintenance, financial reporting, and employee training and oversight. Even if the VOI owner never visits the hotel, they still have to pay the fees to avoid defaulting.

Management fees are cost-plus (so they are essentially inflation-proof) and members have to pay the annual fee at the beginning of the year, which provides tremendous visibility and predictability to this stream of cash. Unsurprisingly, management fees are highly profitable with 70% margins.

Rental and Ancillary

Any unsold VOIs are rented to boost utilization of HGV’s inventory as well as provide prospective VOI owners with a trial of potential properties. Ancillary revenue also includes food and beverage, retail, spa, and other guest offerings that occur at the resorts.

Rewards System

The most interesting part of HGV’s business model is the rewards system. I can’t understand why someone would be interested in plunking down $20K and committing to a perpetual $900 management fee for the right to use one condo with an inflexible schedule every year. However, the ability to exchange points and redeem them across a couple hundred resorts is a much more interesting proposition. I’m not suggesting that I’m running out to sign up for a timeshare tour, but I can at least understand the intrigue of plugging in to the Hilton rewards network.

Additionally, the rewards network has the potential to increase the value of HGV’s recent acquisitions of Diamond and Bluegreen, leaving the combined companies in a far more profitable position a few years from now (more on that later).

Business Drivers

Sales of VOIs are obviously the catalyst that drives financing, management fees, and ancillary revenue streams, and as such are the best indicator of the direction of the business. HGV tracks net owner growth (NOG) which in itself is driven by tour flour. Another important metric to keep an eye on is value per guest (VPG) which is an indicator of pricing dynamics.

Since 2015 (first year data is broken out by the company), tour flow has grown at 8.7% annually. From 2015-2019, which strips out the pandemic and distortions from major acquisitions, tour flow grew at 7% per year. I think low-to-mid-single-digit tour flow growth is a reasonable expectation over the course of several years.

VPG has grown at 3% per year overall since 2015, but was largely flat from 2015-2019, which makes sense given the benign inflationary environment during that period. I would imagine VPG might roughly track inflation over long periods of time.

If these assumptions are in the ballpark, I’d expect revenue to compound at a mid-single-digit rate barring any other major acquisitions. This is nothing heroic, but timeshares aren’t a high growth business, and as we’ll see, not a lot of growth needs to materialize for significant value to be created.

Capital Allocation

Management’s capital allocation policy is what originally interested me in studying HGV more closely. Over the last year or so, management has been open about its interest in buying back significant stock. They’ve communicated the intention to repurchase around 9% of the current market cap annually, which would be a world-class buyback program if executed effectively.

In addition to share repurchases, HGV has conducted two large acquisitions in recent years (Diamond Resorts, which was owned by Apollo, and Bluegreen). I have more mixed feelings about these. On the one hand, I understand the rationale. Plugging a standalone timeshare business into the HGV rewards program, refreshing the sales process, and combining back office functions should create major synergies both on the revenue and cost side. HGV successfully executed on the Diamond integration and by all accounts has met or exceeded all synergy targets, which were significant to begin with.

On the other hand, large acquisitions are complicated, have a poor base rate of success, and suck up capital that otherwise could have been returned via even more repurchases or special dividends.

Net-net, I understand the acquisitions especially in light of the fact that there are few large remaining independent timeshare operators so when they hit the market you only have one chance to add the inventory into the fold.

Cyclicality

I assumed timeshare businesses would be massively cyclical and subject to wild swings based on small changes in the economy. However, I’m not sure that’s the case.

The timeshare market certainly had a downturn during the 2008/9 financial crisis. Surprisingly (as disclosed in the 2016 spinoff document), HGV actually grew contract sales through that period of time. Additionally, because of the capital efficient nature of the business, HGV should not have any trouble weathering a modest economic downturn even if they are not able to outright grow through the next recession.

It’s just one data point, and I’ve not uncovered many good case studies of how timeshares in their current structure perform during recessions, but HGV’s performance during the GFC is a powerful data point.

Another interesting aspect of the business is its ability to re-acquire inventory for pennies on the dollar in the event of a default. The WSJ outlined Marriott Vacation’s likely resilience in an article last summer (the title of the article, “Don’t Buy a Timeshare - Buy a Timeshare Seller” really encapsulates my attitude):

“A surprising amount of what it sells is “recycled” from existing customers at extremely favorable rates. Every year, Marriott spends $80 million to $90 million on weeks or points that it then resells for about $1 billion, according to Geller.

That doesn’t include people who defaulted on loans originated by Marriott—a separate profit center for the company. It periodically sells packages of loans to investors and then buys back defaulted notes at par, effectively paying about 55 cents or 60 cents on the dollar for their vacation purchases.”

HGV has outlined a similar dynamic within its business, and specifically called out Diamond’s efficient inventory recycling process.

An event of outsized defaults would certainly present near-term challenges for HGV, but it also allows the business to acquire inventory at dirt-cheap prices and recycle the units during the upturn, potentially generating outsized returns.

Forward Returns and Valuation

Management is targeting around $100M of synergies after Bluegreen is integrated, and I don’t have reason to doubt the figure given their track record of integration with Diamond.

After the integration, if management achieves its plan, the combined company could generate ~$1.3B of EBITDA. The walk is straightforward and does not account for any growth between now and when the businesses are fully integrated.

Additionally, management targets a 55-65% free cash flow conversion in a steady state. This gets you to ~$770M of FCF in a few years, meaning the stock is trading at less than 6x normalized FCF. Someone is wrong here; management or the market.

The biggest question mark for me is how realistic the free cash flow conversion number is.

Given the nature of the business, the GAAP financials vs. cash dynamics can be a little divergent. For example, HGV presells VOIs when they are developing a new resort. They receive the cash and fees from the VOIs but cannot recognize the earnings on the units sold until the resort comes “online”. When the resort goes live, they’ll recognize outsized earnings for that period but, since they’ve already received the cash for some of the VOIs, operating cash flow will lag reported earnings for that period. In essence, cash flow is smoother than reported earnings.

Additionally, the pandemic (which halted tour flow in 2020) and two large acquisitions over the past three years have muddied the financial waters significantly, making it that much harder to judge normalized free cash flow.

Looking back at Marriott Vacations Worldwide over the past decade partially allays some of those concerns.

With only one large acquisition in 2018/2019 to contend with, and a longer period of “normal” conditions as a public company, Marriott Vacations has demonstrated the ability to convert EBITDA to free cash flow at ~67% on average, albeit in a lumpy fashion.

HGV has also demonstrated the ability to deliver. In 2022 HGV generated ~$560M of FCF, or 54% of EBITDA, at the low-end of the eventual targeted range. The question is, can they sustain this level of performance?

I see two potential outcomes. If the company executes the integration of Bluegreen as they’ve communicated, HGV will generate significant free cash flow. This will allow a rapid delevering and major buybacks at current prices. Investors will not need to rely on a valuation re-rating due to the high free cash flow and buyback yield.

Let’s say the company generates the aforementioned ~$770 million of free cash flow, that would correspond to a mid-teens free cash flow yield plus any growth on top of that. Shareholders would likely either benefit from earning the free cash flow yield as long as the depressed valuation persists or enjoy a rapid re-rating to a more normal ~15x multiple. In either case, shareholder’s would be looking at high-teens or better annual returns for 5+ years (it could come all at once in the event of a re-rating).

On the other hand, if the market is right about the current valuation, that probably means some combination occurs of management failing to effectively integrate Bluegreen or the business proves to be no-growth and highly cyclical. At ~14x GAAP earnings the stock still doesn’t look expensive, but under these circumstances maybe investors only realize a middling return. Fortunately, HGV generates significant free cash flow in its current form and returns most of it to shareholders. As long as this dynamic persists it should provide a reasonable downside protection for long-term investors.

I need to do a little more work on the financing side of the business as well as how likely long-term organic growth might prove to be, but the business is certainly an intriguing blend of quality and valuation with just enough of an “ick” factor to scare off investors and create a potential mispricing.

Do you have a “stranded” 401k from a past job that is neglected and unmanaged? These accounts are often an excellent fit for Eagle Point Capital’s long-term investment approach. Eagle Point manages separately managed accounts for retail investors. If you would like to invest with Eagle Point Capital or connect with us, please email info@eaglepointcap.com.

Disclosure: The author, Eagle Point Capital, or their affiliates may own the securities discussed. This blog is for informational purposes only. Nothing should be construed as investment advice. Please read our Terms and Conditions for further details.

interesting, thx

Really enjoyed the write-up. Thanks for unpacking the business. A few of questions:

1. How do you think about the debt situation and are they raising more debt to fund the upcoming acquisition?

2. How do you get comfort with the rates they charge on their loans and whether that is sustainable? Is that a packaging thing where people don't really think to shop around? Surely extending one's mortgage would be preferable?

3. You hinted at it a few times but didn't explicitly say whether you would purchase timeshare for yourself? Is this truly a win-win for the customer and the provider or is it just clever packaging to get the customer to pay more?

Thanks