Esquire Financial is a niche lender that primarily serves as a banking partner to legal firms while also providing payment processing services.

Generating attractive returns in banking generally requires low cost deposits, intelligent lending and risk management, and an efficient operating structure. Esquire appears to demonstrate each of these in spades, largely because of a laser focus on its core market, high insider ownership, and a digitally-focused operating model.

Analyzing large money-center banks can be nearly impossible (at least for me) given the complexity and breadth of their business activities and balance sheet. It’s often hard to spot risks and an investment requires major faith in leadership and lending culture. Its why, when reading about banks, I much prefer to explore smaller, simpler lenders like Esquire where I can at least have a chance to get my head around the business the way a private owner might do.

Do you have a “stranded” 401k from a past job that is neglected and unmanaged? These accounts are often an excellent fit for Eagle Point Capital’s long-term investment approach. Eagle Point manages separately manage accounts for retail investors. If you would like to invest with Eagle Point Capital or connect with us, please email info@eaglepointcap.com.

Business Model

Founded in 2006 and IPO-ing in 2017, Esquire is a relatively new bank with an interesting core market. While technically a full service bank, Esquire focuses on providing law firms with various sources of credit, which they refer to as “litigation financing”. A little more than half the loans they make are litigation loans and, more interestingly, almost 90% of their deposits are nearly cost-free. We’ll talk about why this is so advantageous in a minute. First, an overview of the loan book.

Lending Activities

Commercial Litigation-Related Loans

When a law firm enters into an agreement to represent a client in litigation on a contingency basis, there will usually be minimal or no revenue from the client for two years or more as the case plays out. When the client wins a case there will be a large payment or settlement, a portion of which is used by the client to pay for the legal services accrued over the life of the case. This is obviously not ideal from a cash flow perspective for the law firm, as they need to pay attorney’s and incur significant costs while the case plays out.

So, instead of burn through cash at the law firm while the case unfolds, they turn to Esquire who extends a “case cost line of credit”. Esquire provides a loan that the law firm uses to finance the case and then the loan is paid back from settlement proceeds, if any. If the law firm loses the case, they still have to repay the loan out of the firm’s cash flows.

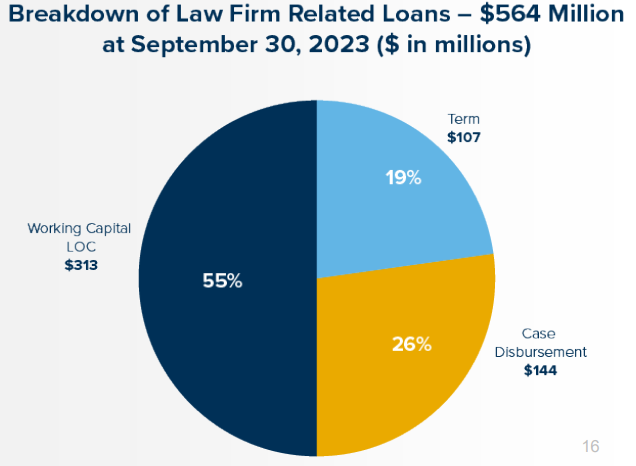

Case cost lines of credit represent about 28% of the litigation-related loan book. In addition, Esquire provides general working capital lines of credit to law firms (55% of litigation-related loans) which are similar to case cost lines of credit but they are not tied to individual contingency cases. They also provide standard term loans to law firms (13% of litigation-related loans) and a small amount of bridge financing for already settled cases.

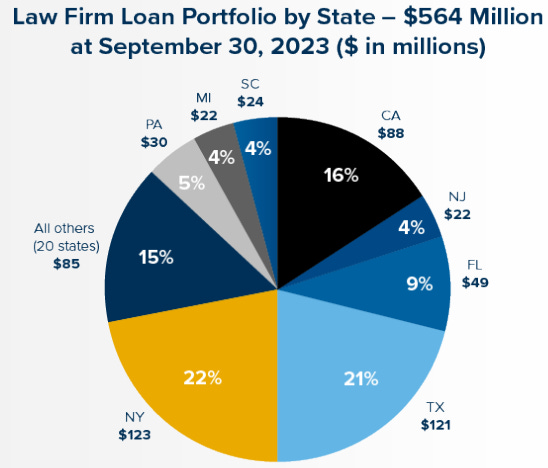

The litigation lending segment serves law firms across the country and a very diverse base of cases. Esquire has decades of experience underwriting and financing litigation activities and has had tremendous success in the space for years.

Consumer Loans

The other ~45% of loans Esquire makes are plain vanilla real estate loans that are unrelated to the legal industry. The majority of these loans are located in the New York metropolitan area, which makes sense as the firm is headquartered (and operates its sole branch) in Jericho, New York.

The real estate loan book is split between multifamily loans secured by apartment and mixed-use properties (28%), Commercial Real Estate primarily secured by mixed-use, warehouse, and hospitality properties (10%), and 1-4 family loans secured by investment properties (3% of loans).

Given the unsecured and specialized nature of the litigation segment, Esquire earns attractive returns on these loans with an average yield of 9.5%. Loan to value (LTV) ratios are just 15% in this segment and the average loan is only drawn 50% against the overall commitment. Additionally, Esquire requires personal guarantees from the principals at the law firms.

While I find the litigation-related loans interesting and like the unique focus on a niche market, it’s the deposit side of the business where things get really interesting.

Deposits

Esquire enjoys incredibly low cost deposit thanks to its exposure to the litigation industry. Why? It’s simple, Esquire doesn’t have to pay interest on most of its deposits. 88% of Esquire’s deposits are demand deposits or escrow funds on which Esquire pays no interest.

Demand deposits are basically just checking accounts that the same law firms that utilize Esquire’s litigation lending use to run their business on a day-to-day basis. A portion of the demand deposit accounts are also from payment processing customers (more on that below) and have the same characteristics (i.e. almost no cost) as the law firm demand deposit accounts. Escrow accounts are funds held in a trust that are used to pay claimant settlements over time, and are essentially an interest-free loan to Esquire in the interim.

Demand deposit accounts and escrow funds also tend to be extremely sticky. Because Esquire is the lender to law firms, they are also highly likely to serve as the every day bank, and companies are loath to move their checking account to a different bank given the headache and risks involved. Escrow accounts for paying claimant settlements are by definition long-lived.

As a result, Esquire’s cost of deposits was just 0.15% at the end of 2022 and 0.69% in the latest quarter, despite interest rates and costs of deposits rising dramatically for peers. The attractive yield on the loan portfolio combined with stable, low-cost deposits result in industry-leading 6%+ net interest margins (NIM). This far exceeds what a typical bank earns and is about double the national average per bankregdata.com, which is shown below.

This is not a recent phenomenon, either. The company has enjoyed superior NIMs across a variety of fed funds rates.

Payment Processing

In addition to these traditional banking activities, Esquire has a payment-processing division that accounts for around 26% of revenue. Esquire serves as an acquiring bank and clears credit and debit transactions on behalf of merchants. Basically, Esquire serves as a mediator between issuer banks and card networks to help facilitate payments and also (I believe) maintains the merchant accounts to deposit money when cardholder’s banks pay for settled transactions.

This is a fine business in itself, and provides some buffer to fluctuating interest rates (most of Esquire’s loans are floating-rate) but it is a much more competitive space than the niche litigation-lending segment. Nonetheless, the company has been working to grow this side of the business as a source of non-interest income and in 2022 processed $28B of payments across 76,000 merchants.

Fundamentals

Because of the unique deposit and lending nature, Esquire has enjoyed solid returns on equity as its business has scaled. Loans and deposits have grown at more than 20% annually since 2015 thanks to a focus on dominating its niche customer segment.

Additionally, due to a lean operating structure (48% efficiency ratio) and a branchless (except for its headquarters) digital-first model, return on equity has exceeded 20% in recent years.

A good proxy for intrinsic value growth or underlying earnings power for a financial institution is the change in tangible book value per share. Since going public, Esquire has compounded tangible book value per share at about 13% annually.

All of these growth metrics are impressive, and have resulted in solid performance for the stock; which has compounded at 16.6% per year for the past five years before dividends, which add another percent or so. Paradoxically, I think the strong growth brings about the biggest risk.

Risks

Unlike a retailer or other businesses that deal in the physical world, banks can be subject to hidden risks – just ask Silicon Valley Bank or First Republic Bank (I suppose the risks weren’t exactly hidden to everyone, but they sure were for most people). One of the biggest risks for a financial institution is that it grows too quickly by extending risky loans or dealing in esoteric financial products with hidden risks. Despite its rapid expansion, it doesn’t appears Esquire has relaxed its lending standards in the name of growth.

Historically, the company has had very low charge-offs, non-performing loans, and allowance for credit losses (all indicators of loan quality). Since 2015, there have only been two years with reportable non-performing loans and charge-offs have never exceeded 1.29%.

These numbers are almost suspiciously low, but it isn’t out of the question that Esquire simply sticks to its lane and doesn’t reach for extra return via risky loans because its business model is profitable enough. Still, there’s always a risk of hidden surprises lurking on the balance sheet of a bank and is something investors need to consider. I could also imagine a scenario whereby it runs out of leading high-quality law firms to finance and starts going down the quality spectrum to more suspect law firms, which could adversely impact the loan quality.

Particularly with smaller lenders like this, a major factor in assessing credit risk is insider’s skin in the game. Fortunately, Esquire’s insiders own over 20% of the company, which is certainly a good indicator when it comes to taking undue risks. It doesn’t mean risks won’t materialize, but it does mean management is dealing with their own money alongside shareholders.

Finally, the bank is well capitalized with a CET1 ratio of 12.2% (adjusted down from 14%+ to account for losses on available for sale and held to maturity investments). This is well in excess of regulatory minimums and in-line or higher with the extremely well capitalized mega banks like JP Morgan and Wells Fargo.

I think the other risk is that Esquire runs out of room to expand in its litigation lending niche which has proved to be so attractive. This is a much smaller risk, since it’s largely one of reinvestment, and I would hope management would return capital to shareholders rather than “de-worsify”, but who knows. Major forays into new lending segments or unrelated businesses would be a yellow flag to me.

Takeaway

By all accounts, Esquire appears to be a high-quality bank with a profitable and growing niche augmented by a fast-growing payment processing business. The stock trades for an undemanding valuation of around 10x earnings, has compounded intrinsic value by a low/mid-teens rate for many years, is run by management with skin in the game, earns above average returns on equity, and appears to have a reasonable runway to replicate its success. Its niche market of serving law firms, while small compared to the overall banking industry, is by no means tapped out.

On the other hand, it’s a small bank that could be subject to hidden risks or run into a growth cliff. Time will tell, but it’s certainly an interesting one to study.

Do you have a “stranded” 401k from a past job that is neglected and unmanaged? These accounts are often an excellent fit for Eagle Point Capital’s long-term investment approach. Eagle Point manages separately manage accounts for retail investors. If you would like to invest with Eagle Point Capital or connect with us, please email info@eaglepointcap.com.

Disclosure: The author, Eagle Point Capital, or their affiliates may own the securities discussed. This blog is for informational purposes only. Nothing should be construed as investment advice. Please read our Terms and Conditions for further details.

great article, would've been nice if there was a valuation section. definitely adding ESQ on my watchlist.

Check out Burford capital $BUR. It’s not a bank but is into litigation financing.