Dun & Bradstreet’s (D&B) roots go back to 1841 when Lewis Tappan recognized the need for a centralized credit reporting system and formed The Mercantile Agency in NYC. The agency collected information from a network of correspondents and provided reliable and objective credit information to subscribers. 182 years later, D&B still does essentially the same thing which speaks to the businesses' resilience and quality. If that’s not replication mode I don’t know what is.

One fun fact — four U.S. presidents worked at Dun & Bradstreet. Abraham Lincoln, Ulysses S. Grant, Grover Cleveland and William McKinley were local credit reporters for D&B before they became presidents.

In 1859 The Mercantile Agency became R. G. Dun & Company and in 1933 it became Dun & Bradstreet. In the Go-Go years of the 1960s conglomerates were all the rage and D&B went on a shopping spree, notably acquiring Moody’s, R.H. Donnelley, Neilson, and Cognizant.

In 1996 D&B restructured and began spinning off its collection of businesses. By 2000 D&B was more or less in its current form.

After restructuring, D&B grew revenues slowly but steadily, with only a minor bobble in 2001-2002. Pre-tax earnings grew significantly faster because of the business’s inherent operating leverage.

The financial crisis hardly dented B&D’s revenue and earnings but the company never regained its growth afterwards. Revenue grew just 0.9% per year and pre-tax income declined. It was no disaster (buybacks and dividends produced a positive return for shareholders), but no great triumph either.

Enter Bill Foley

Foley is a legendary capital allocator who made his fortune in turnarounds. His first was title insurer Fidelity National Financial (which I wrote about in April 2022). He went on to work wonders at Fidelity National Information Services (FIS), and Black Knight (which Dan wrote about in January 2021). Privately, Foley has been involved in several more turnarounds. In 1998 the Wall Street Journal called him “a collector of ill-run restaurant chains” after he bought Hardee’s and Carl’s Jr. Could there be a higher complement?

B&D, an information services business, was squarely in the circle of competence Foley honed at FNF, FIS, and BKI. Foley felt the B&D’s lackluster earnings growth was due to under-management so in February 2019, he led an investor consortium to take the company private. The consortium consisted of Foley, Cannae Holdings, Black Knight, Thomas H Lee, and CC Capital. Thomas Lee was one of the early investors to pioneer LBOs in the 80s and his firm is among the oldest and largest private equity companies. CC Capital was founded by Chinh Chu who was formerly the head of private equity at Blackstone. That’s to say, this was not amateur hour. The consortium that still owns the majority of D&B are professionals with decades of success behind them.

What is D&B?

D&B has a leading market share in business-to-business credit reports. A VIC write-up from 2008 claimed the company had a “near monopoly” on this market with over 90% market share. I couldn’t find current data on this but would guess D&B continues to retain significantly more market share than competitors Experian and Equifax but probably less than 90% now.

D&B also provides insights to help businesses market themselves better, conduct Know Your Customer (KYC) due diligence, examine their supply chains, and understand their ESG footprint.

D&B’s primary asset is its Data Cloud which has information on over 500 million businesses across the world. D&B compiles its Data Cloud from approximately 28,000 sources, both public and proprietary. Recognizing the value of local expertise, D&B formed 13 World Wide Network (WWN) alliances which form an international ‘data supply chain’ and feed the Data Cloud with information from 256 countries and territories worldwide.

It’s one thing to collect data and another to organize it into a useful form. In 1963 D&B began assigning unique identifiers called D-U-N-S Numbers to all organizations in their data set. D-U-N-S Numbers have become a standard, like a social security number for a business or a corporate fingerprint, and are used by various government, commercial, and trade organizations.

The broad acceptance and use of D-U-N-S Numbers creates a flywheel-like effect that drives D&B’s data cloud. For example, before a company can legally bid on a government contract they must give the government their D-U-N-S Number. Similarly, before Target or Walmart will consider buying your products they’ll require your D-U-N-S Number so they can do a credit check on you. If you want your app on Apple’s app store Apple will make you provide a D-U-N-S Number.

This gives businesses an immense incentive to ensure that D&B has their up-to-date credit information on file alongside their D-U-N-S Number. More to the point, businesses give D&B their data for free, because it is in their best interest. This dynamic ensures that D&B always has the most complete and up-to-date information on a given business, which makes it the most desirable database for someone like the government, Walmart, Target, or Apple to use for credit checks.

D&B analyzes all of the data it receives on a business to produce a proprietary Paydex score, which is like a FICO score for a business. A Paydex score indicates how promptly a business pays its suppliers and vendors and is widely relied on as an important measure of credit health for a business.

What Made D&B An Attractive LBO?

D&B wasn’t just in Foley’s circle of competence. It also had many of the characteristics that make an ideal LBO.

Stable recurring revenue.

Large, stable, diversified client base.

Ingrained in customer’s mission-critical workflows.

An affordable price relative to value received.

Capital light with minimal capital expenditures.

Natural operating leverage.

Stable Recurring Revenue

According to Value Line, D&B has only suffered an annual decline greater than 5% twice since 1997 (-7.7% in ‘01, -5.4% in ‘12). While revenue doesn’t grow particularly fast — 1.0% CAGR since 1997 — it doesn’t fluctuate much and is extremely predictable. The vast majority of D&B’s revenue is recurring. Part of Foley’s turnaround plan is to shift more customers onto multi-year subscriptions with pricing escalators that allow them to consume as much data as they want. Annual revenue retention has been 96% since 2019.

Large, stable, diversified client base

D&B’s largest clients are large, stable, blue-chip companies including approximately 90% of the businesses in the Fortune 500, approximately 80% of the Fortune 1000 and approximately 60% of the Global 500 during 2019.

Clients are diversified across size, industry and geography and feature minimal concentration. No client accounted for more than 5% of revenue, and D&B’s top 50 clients accounted for approximately 25% of revenue.

Ingrained in customer’s mission-critical workflows

D&B has held relationships with 20 of its top 25 clients by revenue for more than 20 years, which reflects how deeply embedded D&B is in their daily workflows and decisioning processes.

These are some of the questions clients use D&B to answer on the Finance & Risk Solutions side of the business:

Will this customer pay me on time?

How can I prioritize and automate my collections process?

How can I automate credit decisions across my portfolio?

How do I accelerate Know Your Customer ("KYC") / Anti-Money Laundering ("AML") due diligence while maintaining compliance with regulatory requirements?

How do I ensure my firm is properly using corporate linkage and beneficial ownership to ensure conflict checks are accurate?

How do I efficiently onboard third-parties using a risk-based assessment tool that offers monitoring?

How do I protect against the risk of supply chain interruptions and identify alternative suppliers?

Once a client creates a corporate bureaucracy using D&B’s data, D-U-N-S Number, and Paydex score to answer these questions, a D&B subscription becomes essential.

An affordable price relative to value received

Credit mistakes can be disastrous, and running a potential borrower through D&B’s data cloud is cheap insurance.

Capital light with minimal capital expenditures

D&B’s depreciation charge has averaged 4.8% of sales since 1997. D&B requires minimal PP&E or inventory since its primary asset is its Data Cloud and businesses voluntarily submit their data to D&B for free. Expenses are primarily related to salaries and IT expenses.

Natural operating leverage.

There is virtually no marginal cost to D&B serving an incremental data query from a new or existing customer, which means growth carries high incremental margins. Between 1997 and 2007 D&B only grew sales 1.7% but was able to grow earnings 9.4% because of operating leverage. When growth slowed after 2007 and management became slightly less disciplined, earnings stagnated. Management says current incremental margins are 60%.

D&B’s Challenges

These are all great qualities to have in a business, but D&B isn’t without its challenges.

Prior to Foley’s takeover, management’s strategy had been to raise prices and buy back stock. Though D&B requires minimal reinvestment, prior management is still underinvested in the company’s core cloud IT systems.

D&B’s growth slowed when Equifax and Experian, two of the big three consumer credit bureaus, decided to get into business credit scores. The financial crisis showed Equifax and Experian that consumer credit reports are more volatile than business-to-business credit reports and they saw the business side as an attractive diversifier.

Historically D&B enjoyed strong barriers to entry because they’d been collecting data so long and had everything organized by D-U-N-S Number. Starting from scratch and replicating D&B’s database would have been colossally expensive before the internet. D&B also benefited from the flywheel effect where businesses voluntarily submitted their information. Businesses presumably would not submit their inflation to a new upstart.

However, the internet arrived and Equifax and Experian were motivated. While it is unclear exactly how much share they have taken from D&B, it’s likely sizable. Equifax and Experian undercut D&B’s prices to take share, which limited D&B’s ability to use price to grow, its primary strategy in the pre-Foley era.

D&B says that they use a mix of proprietary and public data. It’s unclear what their proprietary data is or whether competitors can replicate it. It’s clear that the internet has made it easier to find information about all sorts of things, including small businesses. When D&B started it had to go door to door to get data in some cases. Now technology makes it much easier to collect data.

D&B isn’t obsolete yet though. If nothing else, D&B saves its clients time by aggregating all of the data for them. However, convenience is D&B’s only value proposition then its product has been so thoroughly commoditized that the business is unlikely to produce attractive returns.

One question that has come up recently is the rise of AI. While the hype around AI today smells a lot like the hype around blockchain from just a few years ago (often hyped by the exact same people), it’s worth considering. D&B thinks AI offers more opportunity than risk. AI creates a huge thirst for data, which D&B sells. Moreover, D&B can (and does) deploy AI itself. D&B has proprietary data, so AI trained on public data will never be as good as D&B’s AI training on proprietary and public data.

However, D&B did not have a great track record of managing technological change. When the cloud emerged as a viable IT technology after 2007 D&B underinvested in it and its IT system. Clients complained that some of D&B’s data was inaccurate and was poorly structured when delivered. Accuracy and ease of use are what D&B’s reputation and pricing power rest on. When these were called into question while viable competitors emerged, growth slowed.

Last but not least, prior management played accounting games which undermined the trust of the investment community. For example, management excluded severance costs and restructuring charges from adjusted financials. However, they took a restructuring charge every single year and, despite tens of millions of severance charges every year, headcount never declined.

Even worse, management counted acquisitions as core revenue but didn’t count divestitures. That means that if they sold $20M in revenues and acquired $20M in revenues they’d report $20M of sales growth even though actual revenues were flat.

Buffett says to buy a business a ham sandwich can run because someday one will. D&B’s ham sandwich moment has come and gone with the business intact.

Foley’s Playbook

Foley first threw out virtually the entire prior board and management team and put his own team in. They let one third of employees go.

Foley put Anthony Jabbour, a longtime deputy, in charge. Jabour was COO at FIS for 14 years before becoming CEO of Black Knight. He recently transitioned to Executive Chairman of Black Knight, which is in the process of being sold.

There is plenty of skin in the game at D&B, as the table below shows. Jabour personally owns $80 million of stock or 1.8% of the company. Management as a whole owns $441 million of stock or 10% of the company. Foley’s consortium of investors owns another 30% of the company worth $1.3 billion. Canae and THL recently added to their stake in D&B by swapping their stake in Optimal Blue for BKI’s stake in D&B.

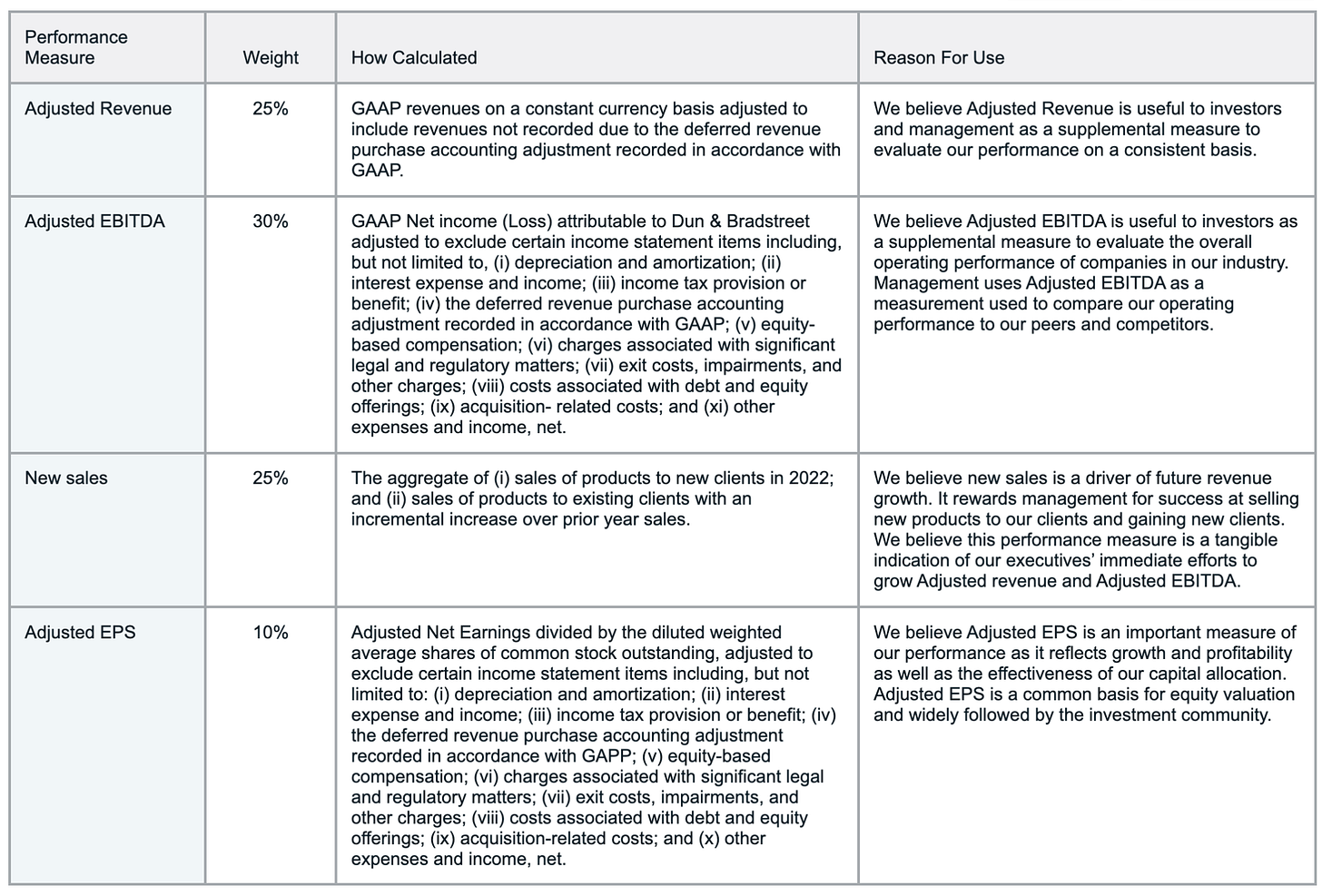

Base salaries for management are low. Jabbour only gets $250k but can earn significant bonuses if the company performs. Incentive comp is tied to revenue, EBITDA, new sales, and EPS. There’s also a separate incentive for cost savings. This isn’t the greatest incentive plan I’ve ever seen but makes sense given the capital light nature of the business and Foley’s focus for the turnaround.

While high insider ownership and skin in the game is undoubtedly good, it can create a short-term overhang if the PE funds in the investor consortium decide to sell. Eventually they’ll want liquidity. Right now the stock is down 60% from its IPO price, so they’ll want to see that change within a few years so they can exit.

Management stands to earn a substantial payment for a change in control which could indicate how Foley and the investment consortium expect to exit. There are a few businesses that might want to own D&B such as Experian, Equifax, TransUnion, Intercontinental Exchange, Moody’s, or S&P Global.

Foley’s strategy for the turnaround is first to cut costs and improve the company’s tech. The ailing tech needed basic things like modern APIs so that it is easy for clients to integrate with D&B’s Data Cloud.

Foley also reorganized the sales team around customer types so that pricing can be customized to how sticky a customer relationship is. D&B changed the sales team’s incentives to push clients into multi-year subscriptions with pricing escalators. These should drive lasting organic growth of a few percent per year.

Next, Foley wants to enhance relationships with existing customers by cross selling and up-selling. D&B’s largest customers use 8 or 9 products on average but the typical customer only uses 2 on average.If D&B can get customers to rely on D&B for more than one service the relationship will become much more sticky and D&B will gain pricing power.

Foley also wants to expand the client base. D&B has been working with several clients for decades but their direct competitors are not clients at all. Since D&B has already demonstrated value to one competitor it should be able to sell the same value to the other competitors.

Last, D&B has done a handful of acquisitions. The idea is to add capabilities that can be bundled with existing services or upsold or cross sold to increase revenue and decrease churn. D&B has 90% of the Fortune 500 as customers and they’re already using 8-9 products each, so there’s a ripe opportunity to add more services to these relationships.

None of the tricks in Foley’s bag are particularly innovative. They merely require effort and execution. The only reason Foley can pull these levers is because the company had been under-managed prior. D&B should have been doing these things all along.

Forward Returns

In 2019 when Foley bought D&B the company had flat sales growth and 94% revenue retention. Today, three years after IPO, the company is growing at 3% and revenue retention has improved to 96%. 50% of revenues are under multi-year contracts, up from 20% which brings recurring revenues to 95%.

So far D&B’s priority has been to reignite growth and that’s required catch up capex in excess of depreciation. Management expects capex will settle in around 6-7% of sales, which is still ahead of depreciation by $50 million. This implies free cash flow conversion of 80%.

Near term capital allocation will be focused on debt pay down. D&B has already delivered significantly to 4x EBITDA but wants to be in the 3-3.5 range. The company’s stable revenues allow for significant leverage.

Besides debt pay down D&B is prioritizing investing in the business and paying a dividend. Eventually buybacks will be on the table. Under prior management D&B was an aggressive repurchaser and shrank its share count by 4% per year between 1997 and 2017.

When D&B IPO’d management guided for 0-3% revenue growth. Now that they’ve hit that target they’re raising the bar for the next several years to 5-7%. Management says 90% of clients are already growing 5% per year because of contractual pricing escalators. D&B has 60% contribution margins so earnings should grow at a high single digit or low double digit rate if management succeeds. D&B’s 2% dividend yield brings forward returns a little higher.

Today the business trades for approximately 10x earnings. However, earnings are messy, muddled by significant non-cash and non-economic amortization from purchase accounting, Covid headwinds in 2020 and 2021, pension adjustments, and commission charges. In time these will fade and the business’s core earnings power should shine through on a GAAP basis. For now the stock screens poorly, which must be at least one reason the stock has gotten so cheap.

If D&B does continue to grow and delever, it’s likely to see some multiple expansion as well. A 10x multiple implies no growth. Going from 10x earnings to 15x earnings over five years would add another 8% to annual returns.

All told, let’s say D&B grows sales 4% and earrings 6%, pays a 2% dividend yield, and goes from 10 to 15x PE over five years. That’s a 16% return, and would be well below what management is guiding for. The high end of management’s guidance puts forward returns over 20% (including multiple expansion). Eventually buybacks will also add to forward returns.

Although Buffett warns that “turnarounds rarely turn”, under Bill Foley they usually do. D&B seems to have made the leap from no growth to low single digit growth. If sustained, the stock looks cheap on that basis alone. If management can continue to accelerate growth, then the stock looks like a steal here.

Do you have a “stranded” 401k from a past job that is neglected and unmanaged? These accounts are often an excellent fit for Eagle Point Capital’s long-term investment approach. Please contact us to learn more about opening a separately managed account with EPC.

Disclosure: The author, Eagle Point Capital, or their affiliates may own the securities discussed. This blog is for informational purposes only. Nothing should be construed as investment advice. Please read our Terms and Conditions for further details.

Thanks for the great and thorough analysis! I have done some work on DNB as well. The one thing I haven't yet got my head around, is that how they're going to reduce the big pile of debt? Personally I think it's a drag on the valuation and also not good for shareholders in the long run. The interest expenses consume much of the opeational cash flow. Any thoughts on how they could perform the pay down of the debt... just many years of waiting?